Kansas Specialty Services Contact - Self-Employed

Description

How to fill out Specialty Services Contact - Self-Employed?

Are you currently in a scenario where you require documents for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms provides a vast collection of form templates, such as the Kansas Specialty Services Contact - Self-Employed, designed to meet state and federal requirements.

Once you find the right form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Kansas Specialty Services Contact - Self-Employed template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/region.

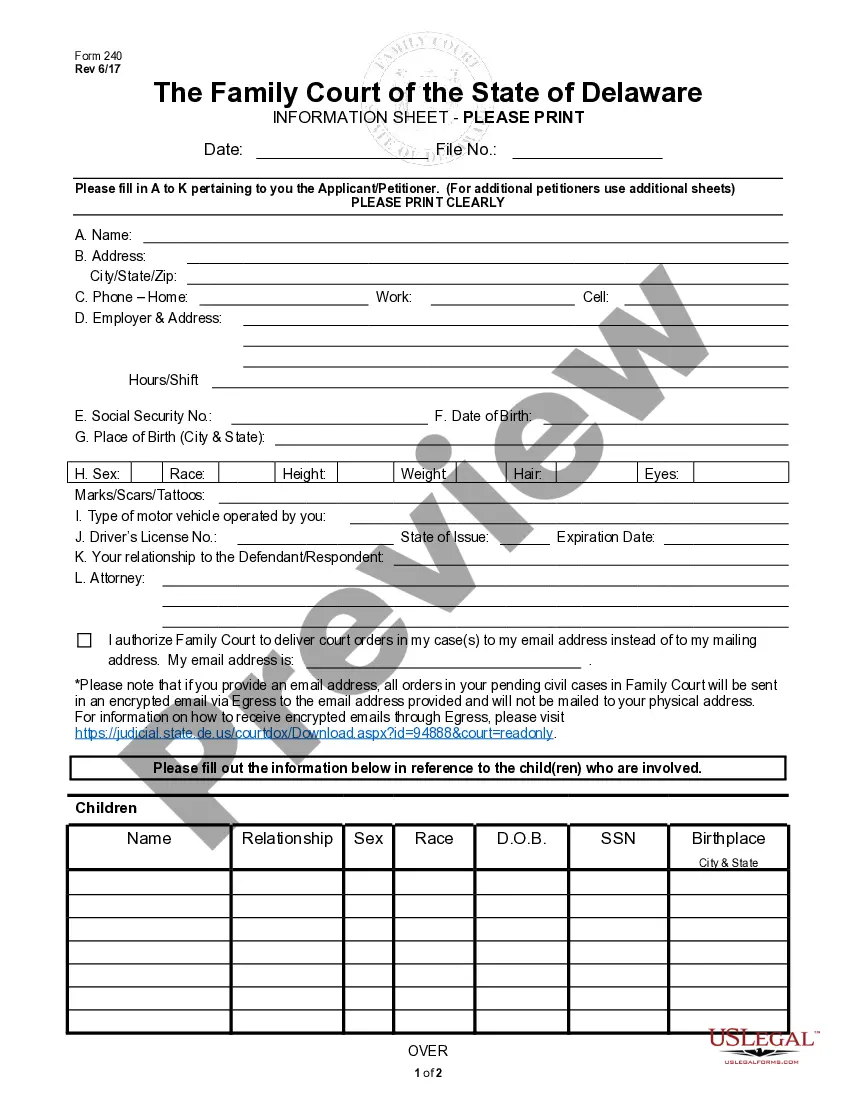

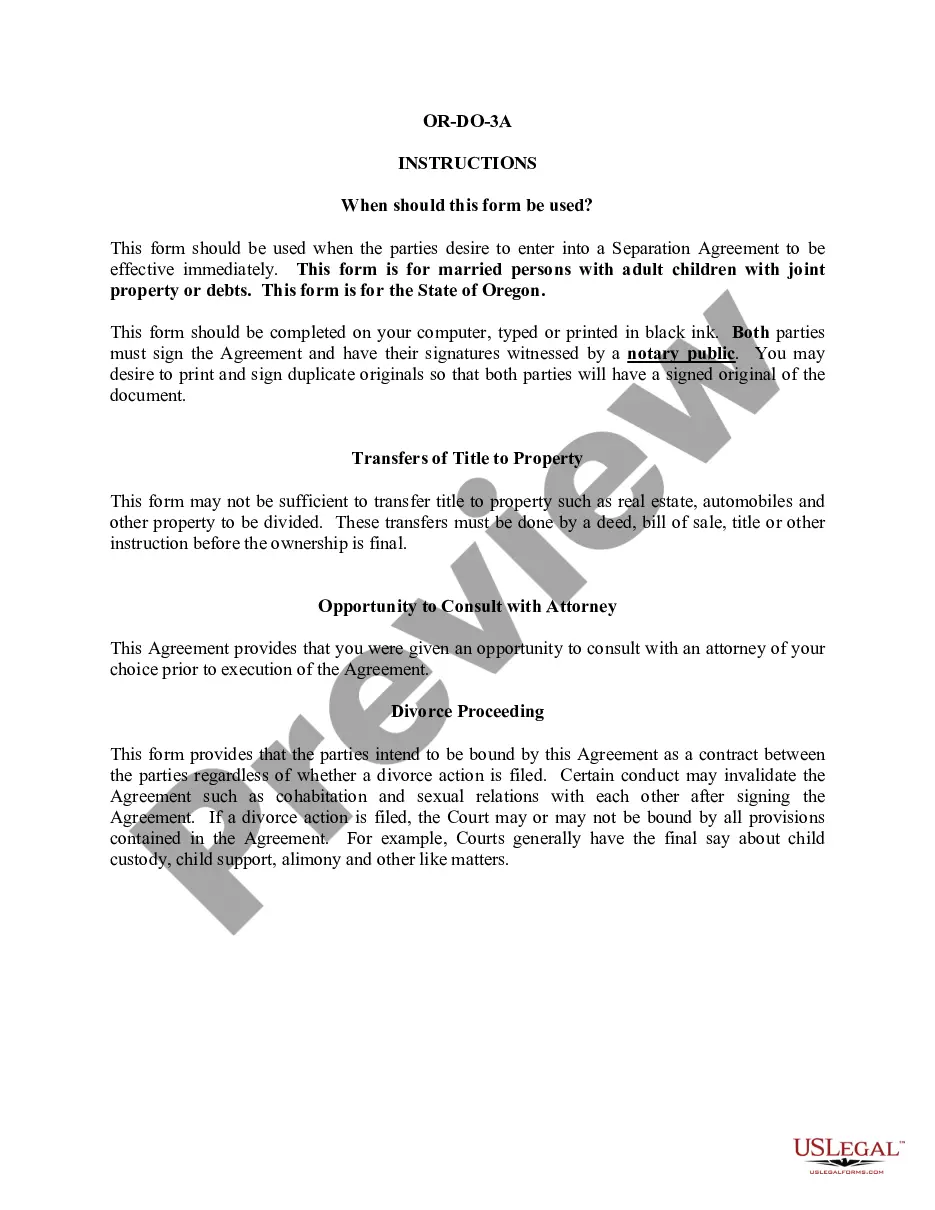

- Use the Preview option to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search section to find the form that meets your needs.

Form popularity

FAQ

Yes, Kansas does require the filing of 1099 forms under certain conditions, particularly when you have made payments to contractors or freelancers exceeding $600 in a tax year. It is essential to ensure that these forms are submitted accurately and on time to avoid penalties. Using a service like USLegalForms can simplify the process, ensuring your compliance with Kansas regulations. If you need clarity or assistance, contacting Kansas Specialty Services Contact - Self-Employed is advisable.

To file a KW3 in Kansas, you first need to gather your income information and any other relevant data specific to your business. You can complete the KW3 form through the Kansas Department of Revenue's website or by using a reliable platform like USLegalForms that provides guided assistance for self-employed individuals. Once you fill out the form, submit it to the appropriate tax office. For a seamless experience, consider reaching out to Kansas Specialty Services Contact - Self-Employed for any specific inquiries.

You can get your own EIN number by completing the online application on the IRS website. During the application process, you'll provide your business structure and relevant information. For a smoother experience, consider using Kansas Specialty Services Contact - Self-Employed, as they can guide you through the steps and ensure that your application is submitted correctly.

To apply for a Kansas tax ID number, you can fill out the Kansas Business Tax Application available online. Ensure that you have all necessary information ready, including your business details and federal EIN. Leveraging Kansas Specialty Services Contact - Self-Employed can simplify this process and help you understand the specific requirements unique to your business.

You must report self-employment income to the IRS using Schedule C (Form 1040) when filing your annual tax return. This form allows you to detail your earnings and expenses related to your business. It's essential for self-employed individuals to keep accurate records, as Kansas Specialty Services Contact - Self-Employed can help you stay organized and informed about your tax obligations.

To get a Kansas EIN number, visit the IRS website and complete the online EIN application. The process is straightforward, and it only takes a few minutes. By utilizing Kansas Specialty Services Contact - Self-Employed, you can ensure that your application is accurate and that you meet all state and federal requirements.

Yes, you can obtain an EIN (Employer Identification Number) immediately by applying online through the IRS website. This is a convenient option, especially for those leveraging Kansas Specialty Services Contact - Self-Employed. Once you complete the online application, you'll receive your EIN instantly, which allows you to start your business activities right away.

In Kansas, you do not need to formally register a sole proprietorship if you are using your legal name as the business name. However, if you intend to operate under a different name, you must file a 'Doing Business As' (DBA) form with the county. Additionally, it is essential to obtain any required local licenses or permits. Kansas Specialty Services Contact - Self-Employed can assist you in understanding the registration process.

Choosing between an LLC and a sole proprietorship depends on your business needs. A sole proprietorship is simpler and often requires less paperwork, while an LLC offers liability protection for your personal assets. If you are self-employed, evaluating your risks and financial goals is crucial. For personalized advice, you can reach out to Kansas Specialty Services Contact - Self-Employed.

To reach a live person at Kansas Unemployment, you can call their dedicated phone line during business hours. Be prepared to provide your information for quicker assistance. If you encounter any challenges, consider using the Kansas Specialty Services Contact - Self-Employed to find additional support resources. They can guide you through the process of getting the help you need.