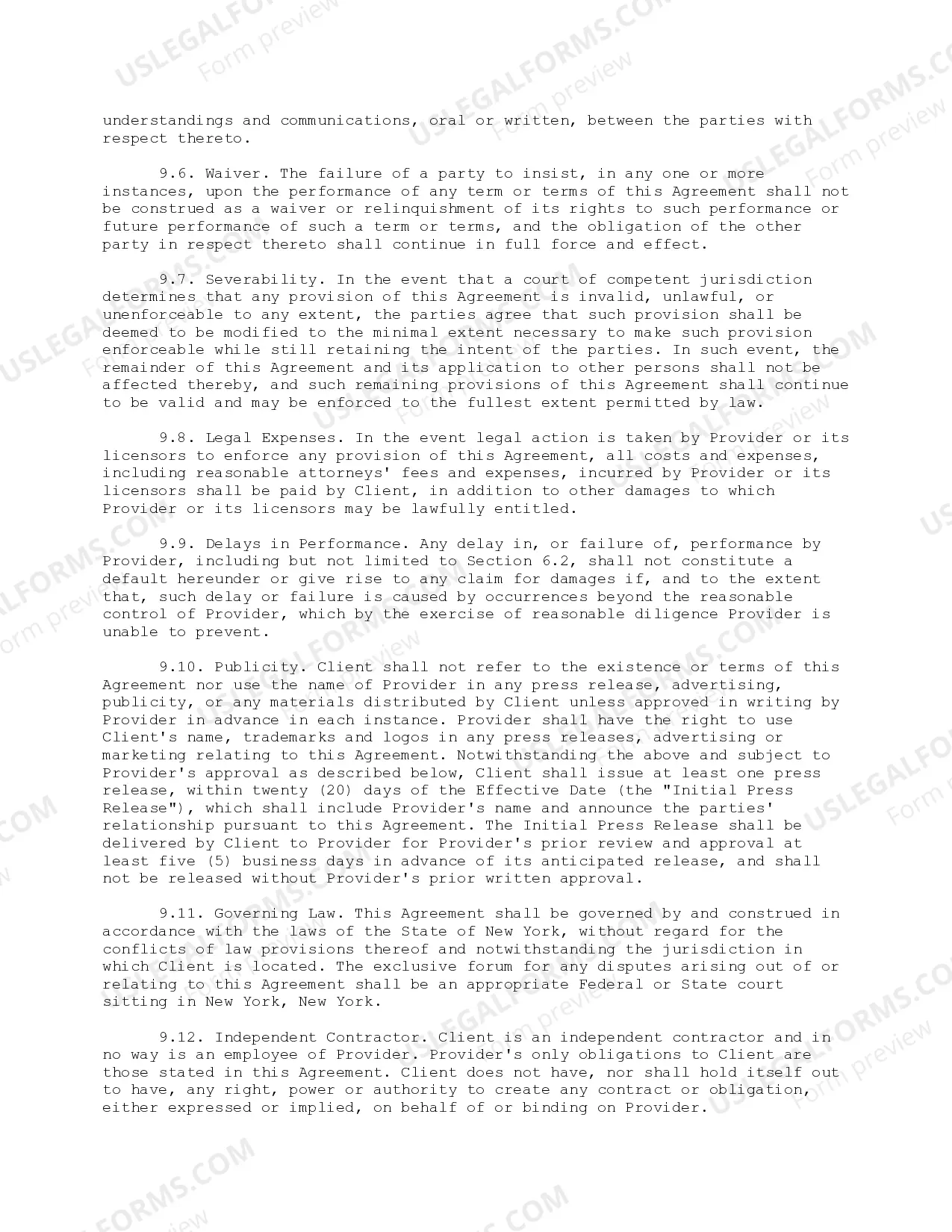

This form is used by a web search services provider and company or individual to set forth the terms and conditions under which the search services provider will provide services to another company or individual.

Kansas Search Engine Services Agreement

Description

How to fill out Search Engine Services Agreement?

It is possible to devote hrs on-line attempting to find the lawful document format that meets the federal and state requirements you want. US Legal Forms offers a large number of lawful types which are analyzed by professionals. You can easily down load or print the Kansas Search Engine Services Agreement from your service.

If you have a US Legal Forms accounts, it is possible to log in and click on the Down load button. Next, it is possible to complete, revise, print, or indicator the Kansas Search Engine Services Agreement. Each and every lawful document format you get is your own property for a long time. To get an additional backup of any obtained form, check out the My Forms tab and click on the related button.

If you are using the US Legal Forms web site initially, follow the straightforward guidelines listed below:

- Very first, be sure that you have chosen the proper document format for that county/metropolis of your choosing. Look at the form explanation to ensure you have picked out the appropriate form. If readily available, take advantage of the Preview button to look throughout the document format at the same time.

- In order to discover an additional variation from the form, take advantage of the Research area to get the format that fits your needs and requirements.

- Once you have identified the format you need, click on Acquire now to continue.

- Find the prices program you need, key in your credentials, and register for your account on US Legal Forms.

- Total the financial transaction. You may use your bank card or PayPal accounts to pay for the lawful form.

- Find the structure from the document and down load it in your product.

- Make modifications in your document if necessary. It is possible to complete, revise and indicator and print Kansas Search Engine Services Agreement.

Down load and print a large number of document web templates using the US Legal Forms web site, which provides the most important assortment of lawful types. Use skilled and status-distinct web templates to handle your business or individual demands.

Form popularity

FAQ

Filing the formation paperwork to start your Kansas LLC will cost $165 ($160 online). You'll also need to pay $55 ($50 online) every year to file your Kansas Annual Report.

To start a corporation in Kansas, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. The articles cost $90 to file ($89 online). Once filed with the state, this document formally creates your Kansas corporation.

Advantage#1: The benefits of Incorporation or LLC formation Federal taxation: If you register a new company in Kansas as an S corporation then the corporation or firm will not pay any income tax. ... Independent life: When you register a new business in Kansas as an S Corporation, it will enjoy an independent life.

(785) 296-4500 The Kansas Treasury Offset Program (KTOP) does not have detailed information regarding debts and will only be able to provide callers with the contact name and phone number of the creditor agency to which their debt is owed, as well as the debt amount.

To form a Kansas corporation, you must file articles of incorporation with the Secretary of State and pay a filing fee. As soon as you file the articles, the corporation exists as a legal entity. The articles of incorporation may contain many provisions, but they must contain the following: Name of the corporation.

OUR KANSAS INCORPORATION SERVICES ServiceFeeKansas Formation Service$1001 Year Resident Agent Service$49State Filing Fees$89Total$238

The process of adding a member to a Kansas LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

The Kansas Treasury Offset Program (KTOP) collects delinquent accounts receivable by matching State of Kansas debt against federal non-tax payments.