Kansas Employee Retirement Agreement

Description

How to fill out Employee Retirement Agreement?

Finding the right lawful papers design could be a have a problem. Naturally, there are plenty of themes available on the Internet, but how would you obtain the lawful form you will need? Make use of the US Legal Forms website. The services delivers a huge number of themes, including the Kansas Employee Retirement Agreement, that can be used for business and personal demands. All of the varieties are examined by specialists and meet up with federal and state needs.

Should you be previously authorized, log in to your accounts and click on the Download option to obtain the Kansas Employee Retirement Agreement. Make use of accounts to check through the lawful varieties you may have ordered previously. Go to the My Forms tab of your respective accounts and obtain an additional backup of your papers you will need.

Should you be a whole new consumer of US Legal Forms, here are straightforward guidelines for you to stick to:

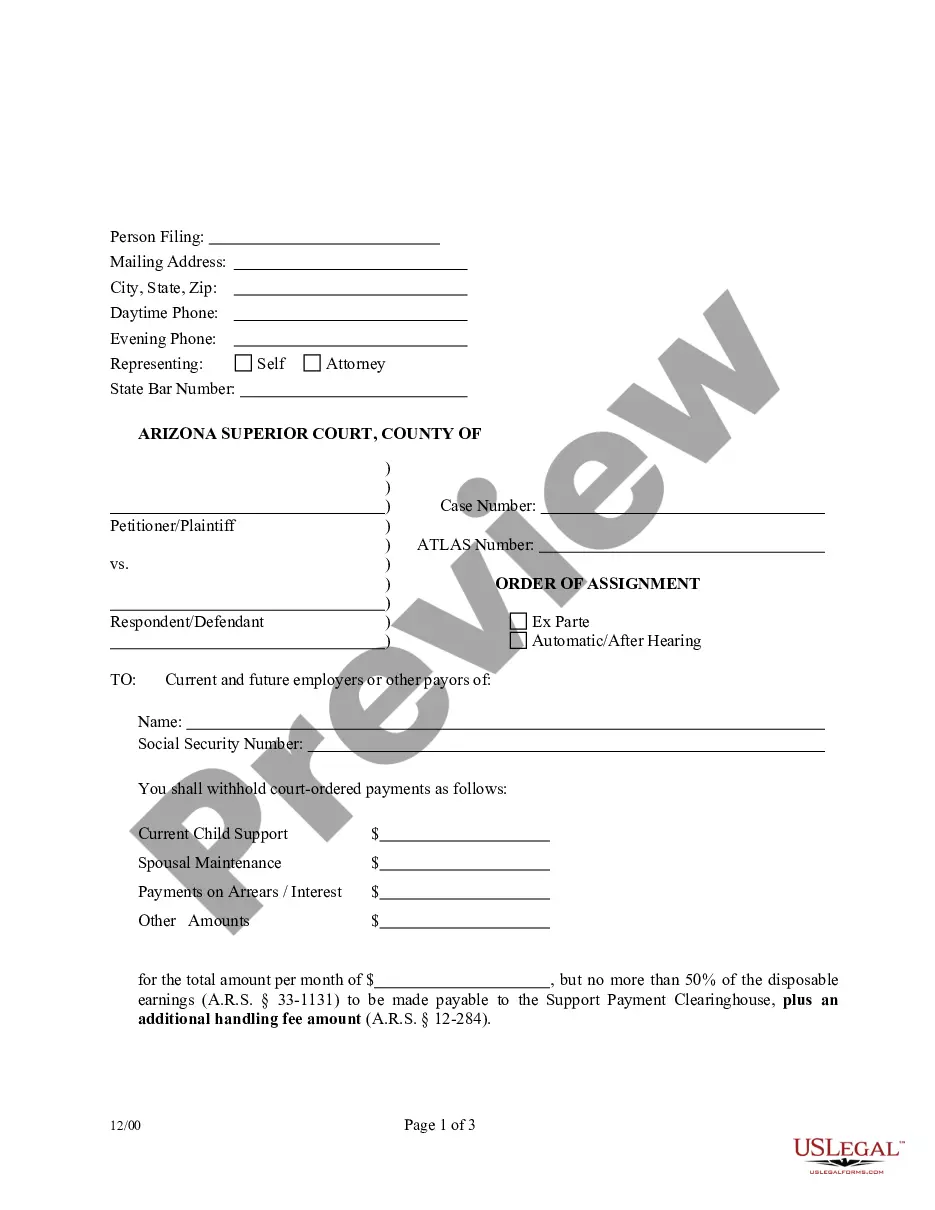

- First, be sure you have selected the appropriate form for your personal town/region. You are able to check out the form making use of the Preview option and study the form description to guarantee this is the right one for you.

- In the event the form fails to meet up with your needs, utilize the Seach field to get the appropriate form.

- When you are sure that the form is proper, go through the Acquire now option to obtain the form.

- Pick the costs strategy you want and type in the necessary information and facts. Create your accounts and pay for an order making use of your PayPal accounts or credit card.

- Pick the document format and obtain the lawful papers design to your gadget.

- Total, revise and produce and indication the obtained Kansas Employee Retirement Agreement.

US Legal Forms is definitely the greatest catalogue of lawful varieties that you can find a variety of papers themes. Make use of the company to obtain professionally-manufactured papers that stick to express needs.

Form popularity

FAQ

The average KPERS member retires at age 62 with 20 years of service. At age 62 with a final salary of $40,000, he will receive full KPERS benefits and a reduced benefit for early retirement from Social Security.

Life Insurance, Disability & Death Benefits. KPERS isn't just for retirement. Your income is automatically protected by life insurance, disability benefits and death benefits. It's here if you need it.

The 85-point rule is only one of the three ways you can qualify for retirement. You can retire at age 55 with 10 years of service, even without 85 points. There is a 0.6% reduction for each month you are between age 55 and age 60, and a 0.2% reduction for each month you are between age 60 and age 62.

You will return as a KPERS 3 member. You can apply to withdraw your contributions any time 31 days after you end employment. If you withdraw, you will give up all Retirement System rights, benefits and service credit.

You'll Need More Than KPERS KPERS and Social Security won't be enough for a secure retirement. You need to do your part to "fill the gap" by saving on your own. One of the easiest ways to save is through an employer plan, like a 457(b) or 403(b). Many employers offer KPERS 457.

Keep your money in KPERS and apply for retirement when you become eligible. Your account will continue to earn interest in the meantime, and you can withdraw any time if you change your mind.

KPERS 1 (Correctional A & B) To be eligible, you must work in a Group A or B position for at least three years immediately before retirement.

KPERS members vest their benefit with five years of service.