Kansas Leasehold Interest Workform

Description

How to fill out Leasehold Interest Workform?

Are you in a situation where you need documentation for either business or personal activities almost all the time.

There are numerous legitimate document templates accessible online, but locating versions you can depend on is challenging.

US Legal Forms provides thousands of template documents, such as the Kansas Leasehold Interest Form, that are designed to comply with state and federal regulations.

Access all the document templates you have purchased from the My documents list.

You can obtain another copy of the Kansas Leasehold Interest Form at any point, if necessary. Just click on the desired template to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Kansas Leasehold Interest Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Search for the template you need and ensure it is for the correct city or region.

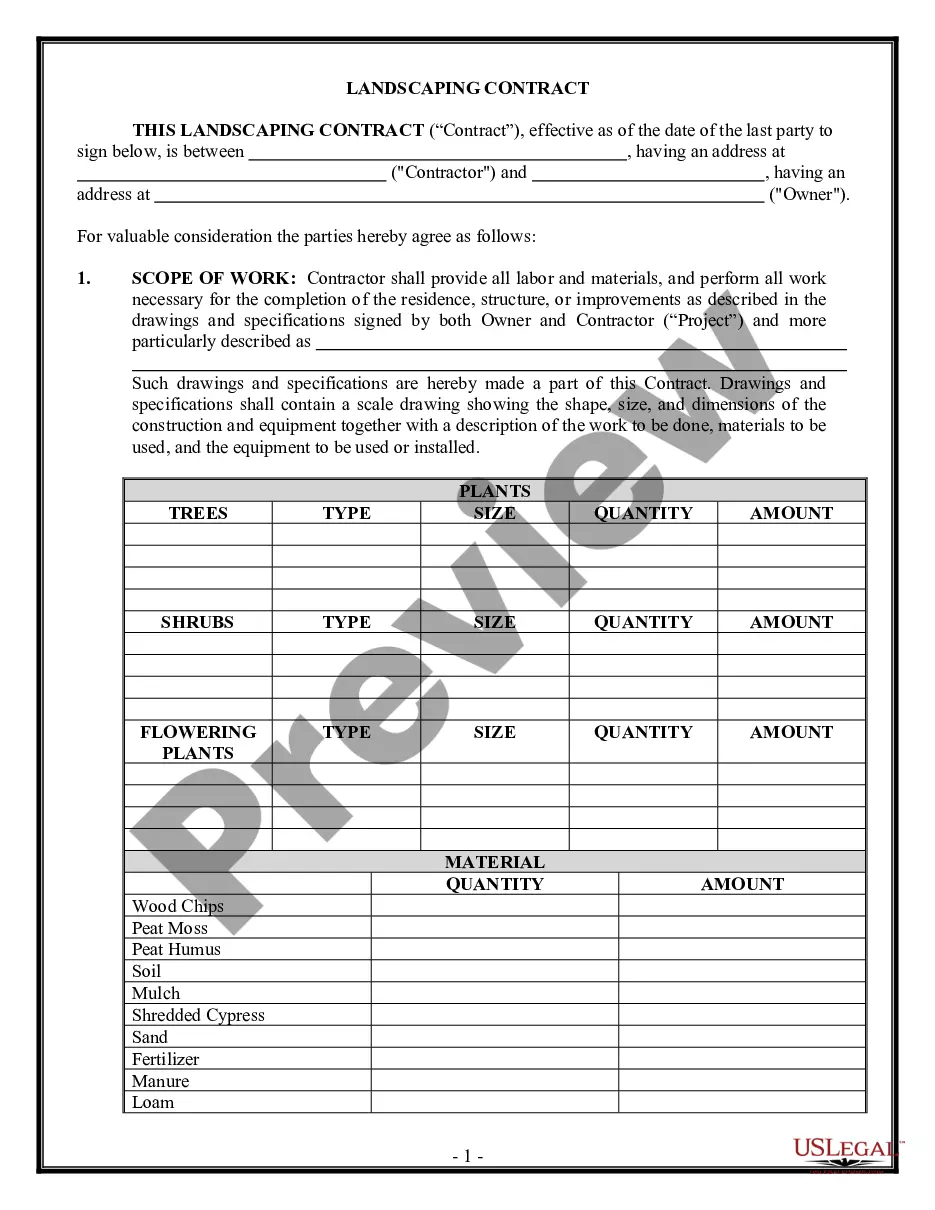

- Utilize the Review button to evaluate the document.

- Check the description to ensure you have selected the correct template.

- If the document is not what you are looking for, use the Search field to find the template that suits your needs and requirements.

- Once you find the correct template, click Buy now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa/Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

A common rule of thumb for valuing mineral rights is to evaluate potential earnings from oil or gas production as well as current market conditions. Mineral rights typically range from $5,000 to $10,000 per acre, but values can differ. To ensure an accurate assessment, consider using the Kansas Leasehold Interest Workform to facilitate your evaluation process.

In Kansas, the tax extension form allows taxpayers to request additional time to file their income tax returns. You can find this form on the Kansas Department of Revenue website. Utilizing the Kansas Leasehold Interest Workform can help you organize your financial documents more effectively ahead of tax season.

Mineral rights in Kansas can vary significantly in value based on location, production potential, and market demand. Generally speaking, properties in active drilling areas tend to command higher prices. For accurate valuation, consider using the Kansas Leasehold Interest Workform, which provides a comprehensive framework for determining worth.

To find out how much your mineral rights are worth, start by consulting with a qualified mineral rights appraiser who understands the Kansas market. You can also review recent sales data and production records for similar mineral rights. The Kansas Leasehold Interest Workform can assist you in organizing this information effectively.

The Kansas Surface Owner Notification Act requires companies to notify landowners before entering their property for mineral exploration or extraction. This act safeguards landowners' rights and ensures they receive timely information about activities impacting their land. Utilizing resources like the Kansas Leasehold Interest Workform can help you understand your rights and responsibilities under this act.

To value mineral rights in Kansas, start by reviewing recent sales of comparable mineral rights in your area. Gather data on the production history of wells nearby, as this will heavily influence value. Consider using the Kansas Leasehold Interest Workform to provide a structured approach for assessing your mineral rights.

To qualify for the Kansas SVR property tax refund, you must meet specific criteria. Primarily, you should be a resident of Kansas who is either 65 years or older, or permanently disabled. Additionally, you must have an eligible property, which may include those with a Kansas Leasehold Interest Workform that applies. By understanding these requirements, you can ensure that you complete the refund process accurately and maximize your benefits.

You can terminate your farm lease in Kansas at the end of the lease term, usually outlined in your lease agreement. Additionally, if both parties agree to terminate early, you can do so. Keep in mind that a Kansas Leasehold Interest Workform can provide clear termination clauses to help avoid misunderstandings and protect both parties involved.

Yes, Kansas is a joint tenancy state. This means that when property is owned jointly, each tenant has an equal share of the property and the right of survivorship. If one owner dies, their interest automatically transfers to the surviving owner. For more explicit arrangements, consider using a Kansas Leasehold Interest Workform to outline joint tenancy agreements clearly.

To file a Kansas annual report, you typically need to complete the report form and submit it to the Secretary of State's office. Make sure to include any leasehold interest details, as they may impact your business’s financial summary. Using the Kansas Leasehold Interest Workform can streamline this process and ensure you provide all necessary information for accurate reporting.