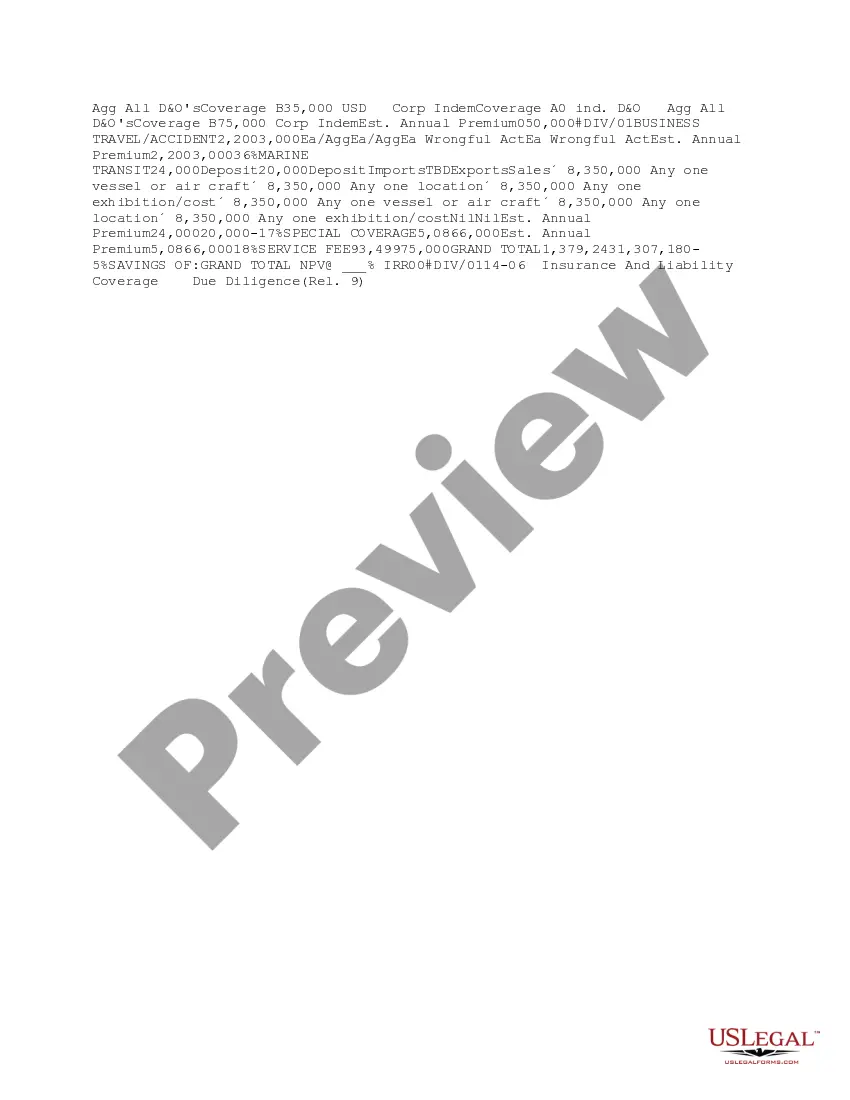

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

Kansas Risk Evaluation Specialist Matrix

Description

How to fill out Risk Evaluation Specialist Matrix?

If you desire to complete, acquire, or print legal form templates, utilize US Legal Forms, the largest selection of legal documents available online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal use are organized by categories and claims or by keywords and phrases.

Every legal document template you purchase is yours forever. You have access to each form you saved in your account. Click the My documents section and choose a form to print or download again.

Stay competitive and acquire, print, and obtain the Kansas Risk Evaluation Specialist Matrix using US Legal Forms. There are millions of professional and state-specific documents you can use for your business or personal requirements.

- Utilize US Legal Forms to locate the Kansas Risk Evaluation Specialist Matrix with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then select the Obtain option to access the Kansas Risk Evaluation Specialist Matrix.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for the correct jurisdiction.

- Step 2. Use the Review option to check the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other types of the legal form design.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Kansas Risk Evaluation Specialist Matrix.

Form popularity

FAQ

As seen in this figure the likelihood of a bad event goes down starting at one for the lowest and goes to six at the utmost for the rare event. The six categories of probabilities of the event are two for the occasional, three for seldom, four for unlikely and five for remote.

Most companies use the following five categories to determine the likelihood of a risk event: Highly Likely. Risks in the highly likely category are almost certain to occur. Likely. A likely risk has a 61-90 percent chance of occurring. Possible. Unlikely. Highly Unlikely.

The risk assessment matrix works by presenting various risks as a chart, color-coded by severity: high risks in red, moderate risks in yellow, and low risks in green. Every risk matrix also has two axes: one that measures likelihood, and another that measures impact.

Critical risk also expresses the likelihood of severe injuries, potential damages, and financial loss. Minor indicates that little attention is required as the risk has a low probability of occurring....Risk Impact (Risk Severity)Minor (Blue)Moderate (Green)Major (Orange)Critical (Red)

How do you calculate risk in a risk matrix?Step 1: Identify the risks related to your project.Step 2: Define and determine risk criteria for your project.Step 3: Analyze the risks you've identified.Step 4: Prioritize the risks and make an action plan.

To calculate a Quantative Risk Rating, begin by allocating a number to the Likelihood of the risk arising and Severity of Injury and then multiply the Likelihood by the Severity to arrive at the Rating.

The Health and Safety Executive's Five steps to risk assessment.Step 1: Identify the hazards.Step 2: Decide who might be harmed and how.Step 3: Evaluate the risks and decide on precautions.Step 4: Record your findings and implement them.Step 5: Review your risk assessment and update if. necessary.

4x4 Risk MatrixThe matrix works by selecting the appropriate consequences from across the bottom, and then cross referencing against the row containing the likelihood, to read off the estimated risk rating. Likelihood (Probability) 4. Likely or frequent (likely to occur, to be expected) 3.

As previously stated, a risk matrix will visually tell you the levels of risk that your organisation is facing. They are often used during the risk assessment process to help you decide which risk management strategy will be best to deal with them as well as which risks need prioritising.

Because a 5x5 risk matrix is just a way of calculating risk with 5 categories for likelihood, and 5 categories severity. Each risk box in the matrix represents the combination of a particular level of likelihood and consequence, and can be assigned either a numerical or descriptive risk value (the risk estimate).