Kansas Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

How to fill out Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

Are you currently in a situation the place you will need paperwork for possibly organization or personal functions just about every day? There are tons of legitimate record templates available on the Internet, but discovering types you can trust isn`t easy. US Legal Forms gives a huge number of type templates, like the Kansas Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, which can be published to fulfill federal and state requirements.

In case you are previously knowledgeable about US Legal Forms internet site and also have an account, just log in. After that, you may download the Kansas Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds format.

Should you not come with an bank account and need to begin to use US Legal Forms, adopt these measures:

- Find the type you require and ensure it is for that appropriate town/area.

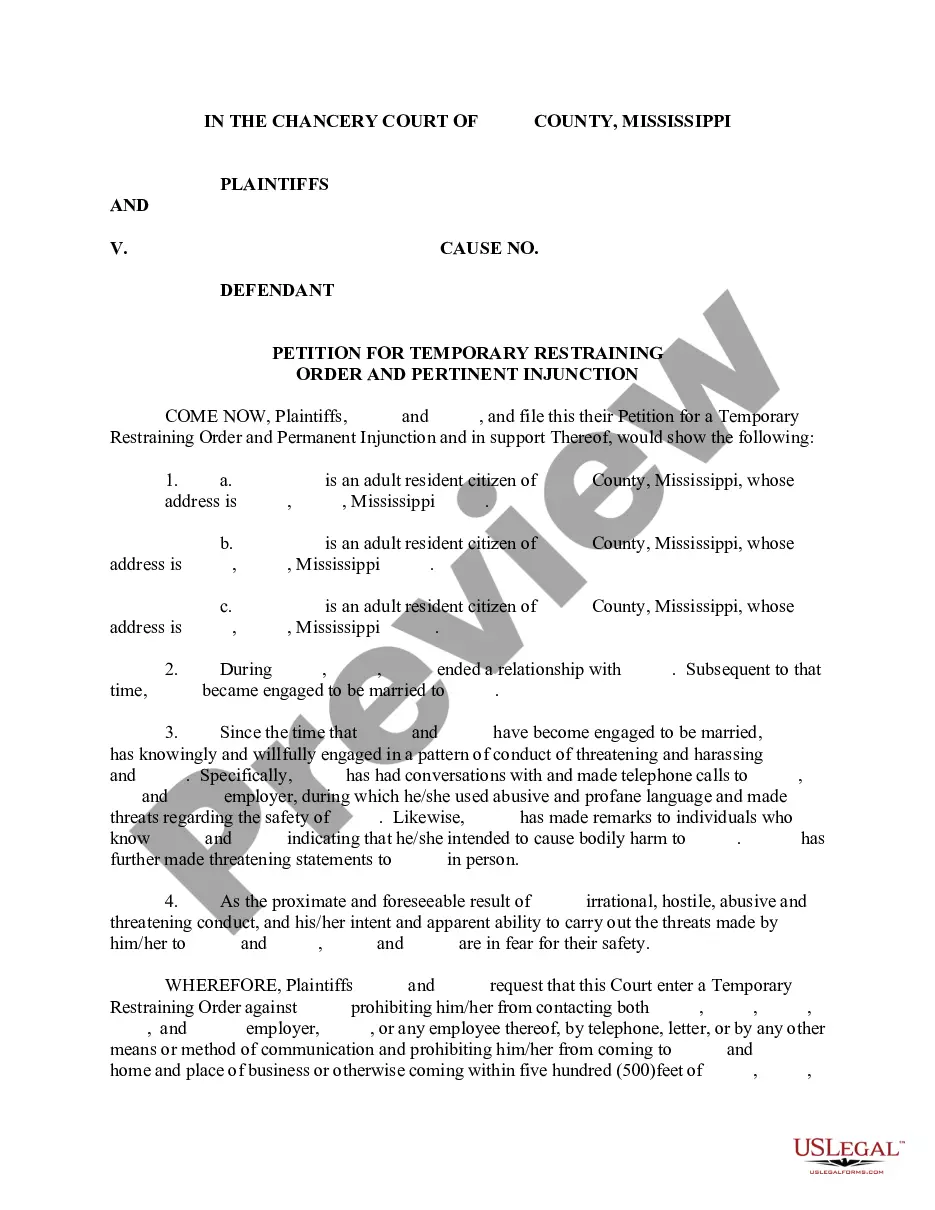

- Make use of the Review key to review the shape.

- See the description to actually have selected the right type.

- When the type isn`t what you are looking for, use the Lookup discipline to discover the type that suits you and requirements.

- Once you find the appropriate type, just click Purchase now.

- Select the costs program you want, submit the specified details to generate your bank account, and pay for the order making use of your PayPal or charge card.

- Select a practical file formatting and download your backup.

Get all the record templates you have purchased in the My Forms menus. You may get a more backup of Kansas Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds whenever, if possible. Just go through the essential type to download or printing the record format.

Use US Legal Forms, one of the most extensive variety of legitimate kinds, to save time as well as avoid mistakes. The support gives professionally made legitimate record templates that you can use for an array of functions. Produce an account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

The regulatory agencies primarily responsible for supervising the internal operations of commercial banks and administering the state and federal banking laws applicable to commercial banks in the United States include the Federal Reserve System, the Office of the Comptroller of the Currency (OCC), the FDIC and the ...

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

How can I file a complaint with the Federal Reserve Board (FRB)? If your problem concerns a state-chartered bank that is a member of the Federal Reserve System, contact the Federal Reserve Consumer Help unit. You may also contact the relevant state attorneys general or state banking department.

If you have a complaint or need assistance regarding a financial institution or transaction, you can submit a Consumer Assistance Form to our agency. Our Consumer Affairs department will review the form and supporting documentation and open a case.

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.

The complaint process begins when you submit a complaint to a Federal Reserve Consumer Help (FRCH) representative either online or by mail, fax, or phone. Upon receiving your complaint, a FRCH representative determines the appropriate federal regulator to address your complaint.

Where can I complain if I have a problem with my Bank? You can raise your grievance on the Digital Complaint Management System (CMS) Portal: .