Kansas Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

Are you currently inside a placement the place you need papers for either enterprise or specific purposes virtually every time? There are plenty of legal document layouts available online, but discovering versions you can rely is not effortless. US Legal Forms delivers a large number of type layouts, like the Kansas Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan, which are created to satisfy federal and state specifications.

If you are previously acquainted with US Legal Forms site and get a merchant account, basically log in. Afterward, you can obtain the Kansas Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan web template.

Unless you offer an profile and need to begin to use US Legal Forms, follow these steps:

- Find the type you require and ensure it is for the appropriate city/state.

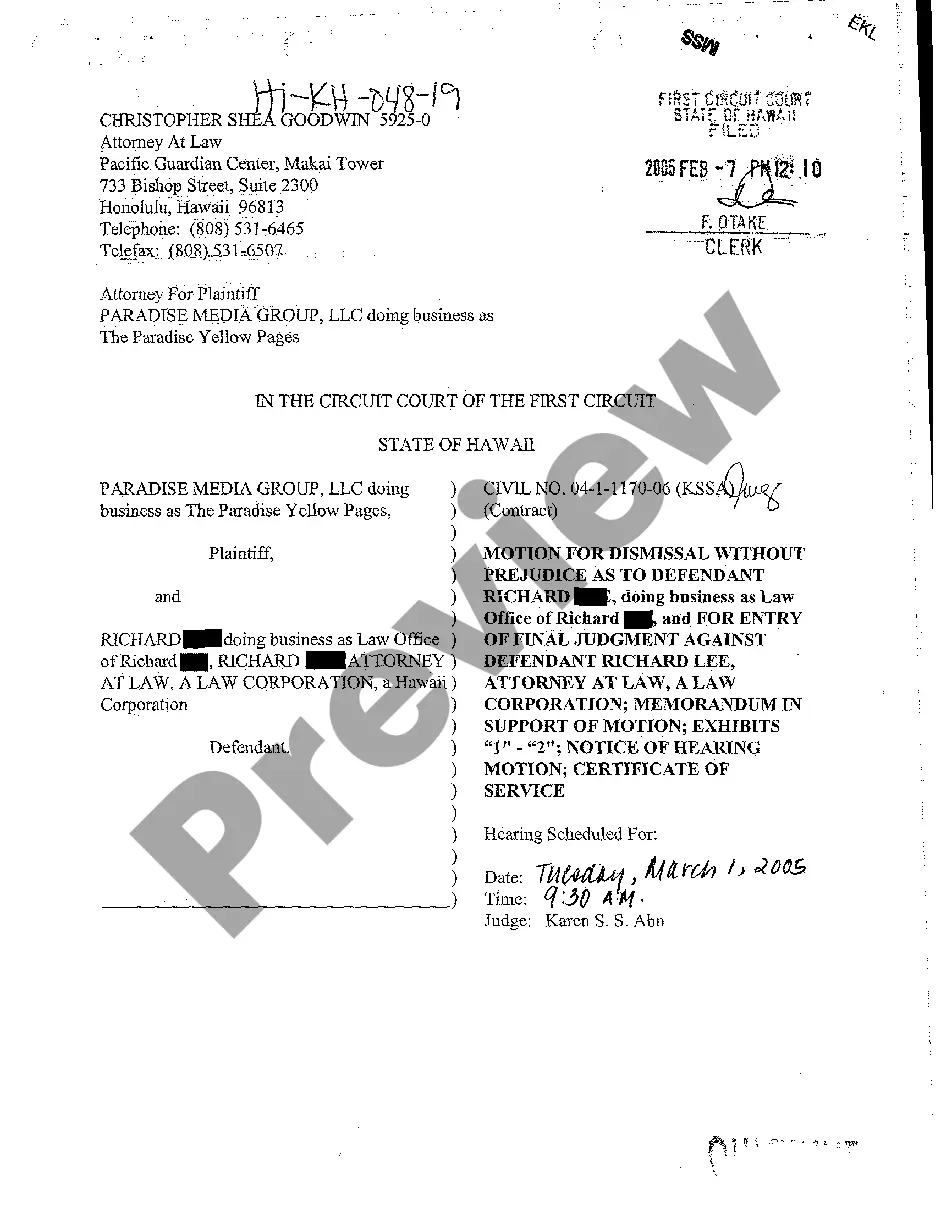

- Utilize the Preview key to analyze the shape.

- Read the information to ensure that you have selected the correct type.

- If the type is not what you are seeking, take advantage of the Lookup area to obtain the type that meets your requirements and specifications.

- When you get the appropriate type, click on Get now.

- Select the pricing strategy you want, fill out the necessary info to make your account, and pay for the transaction making use of your PayPal or bank card.

- Choose a hassle-free data file format and obtain your backup.

Locate each of the document layouts you may have bought in the My Forms food selection. You can obtain a additional backup of Kansas Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan at any time, if possible. Just select the necessary type to obtain or printing the document web template.

Use US Legal Forms, one of the most considerable assortment of legal varieties, to save efforts and avoid mistakes. The services delivers expertly manufactured legal document layouts that you can use for a variety of purposes. Make a merchant account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

PMSI examples Ace Trucking needs to buy a new truck. Ace Trucking applies to Speedy Loans Ltd for the money to buy it. Ace Trucking agrees to allow Speedy Loans to take the truck as security for the loan in order to guarantee repayment.

A security interest is retained in or taken by the seller of the collateral to secure part or all of its price. A security interest is taken by a person who, by making advances or incurring an obligation, gives something of value that enables the debtor to acquire the rights in the collateral or to use it.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

Security Interest: An interest in personal property or fixtures -- i.e., improvements to real property -- which secures payment or performance of an obligation. Security Agreement: An agreement creating or memorializing a security interest granted by a debtor to a secured party.

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the collateral) which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations.

A security interest on a loan is a legal claim on collateral that the borrower provides that allows the lender to repossess the collateral and sell it if the loan goes bad. A security interest lowers the risk for a lender, allowing it to charge lower interest on the loan.

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

Below are common types of security interests that apply to land. Mortgage. This is a loan instrument where an individual acquires a loan to buy a house. ... Deed of Trust. In the US, a deed of trust is a legal instrument used to create security interests. ... A contract for the sale of land.