Kansas Amended and Restated Employee Stock Purchase Plan

Description

How to fill out Amended And Restated Employee Stock Purchase Plan?

Are you presently in a placement in which you need to have files for either business or person reasons virtually every working day? There are tons of legal papers layouts available on the net, but discovering versions you can depend on isn`t effortless. US Legal Forms gives a huge number of develop layouts, much like the Kansas Amended and Restated Employee Stock Purchase Plan, that are composed to satisfy state and federal demands.

When you are previously familiar with US Legal Forms website and have an account, simply log in. Afterward, you are able to download the Kansas Amended and Restated Employee Stock Purchase Plan design.

If you do not provide an account and wish to begin using US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is for that right metropolis/area.

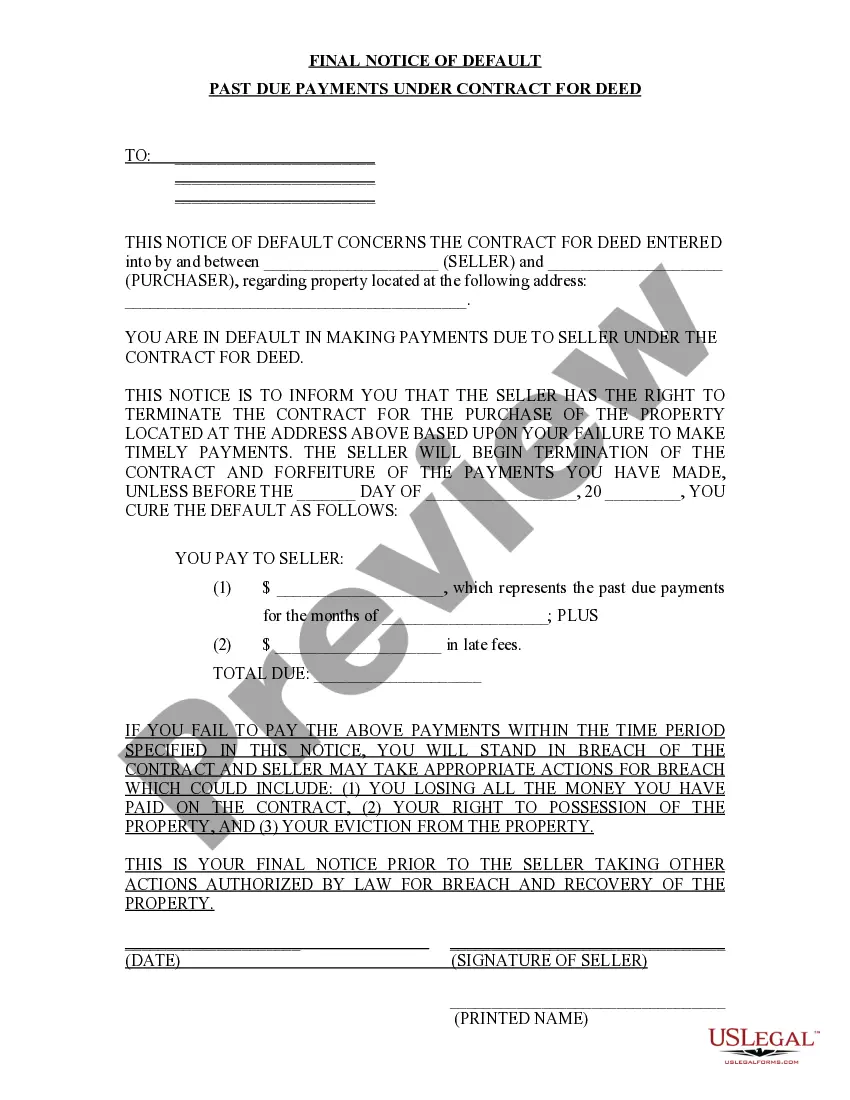

- Use the Preview option to analyze the form.

- See the information to ensure that you have chosen the appropriate develop.

- In case the develop isn`t what you`re searching for, utilize the Look for area to obtain the develop that suits you and demands.

- Whenever you obtain the right develop, click Acquire now.

- Choose the rates prepare you desire, fill out the necessary information to make your money, and purchase the order using your PayPal or credit card.

- Pick a handy data file file format and download your version.

Locate all of the papers layouts you have purchased in the My Forms food selection. You can aquire a more version of Kansas Amended and Restated Employee Stock Purchase Plan at any time, if needed. Just go through the necessary develop to download or printing the papers design.

Use US Legal Forms, probably the most comprehensive selection of legal types, to save efforts and avoid blunders. The service gives professionally created legal papers layouts that you can use for a selection of reasons. Make an account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

You may decrease your contribution 1 time during the offering period. If you choose to change your contribution percentage, you must do so at least 15 days before the purchase date. For example, if the purchase date is June 30, you must make this change prior to June 15.

Yes, you can sell stock purchased through your ESPP plan immediately if you want to guarantee that you profit from your discount. Otherwise, the value of the stock may go up, which increases your profit, or it may go down, causing you to lose money.

If your company offers a tax-qualified ESPP and you decide to participate, the IRS will only allow you to purchase a maximum of $25,000 worth of stock in a calendar year. Any contributions that exceed this amount are refunded back to you by your company.

2.28 ?Section 423 Component? means those Offerings under the Plan, together with the sub-plans, appendices, rules or procedures, if any, adopted by the Administrator as a part of this Plan, in each case, pursuant to which rights to purchase Shares during an Offering Period may be granted to Eligible Employees that are ...

Section 423(a) provides that section 421 applies to the transfer of stock to an individual pursuant to the exercise of an option granted under an employee stock purchase plan if: (i) No disposition of the stock is made within two years from the date of grant of the option or within one year from the date of transfer of ...

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.

With qualified Section 423 employee stock purchase plans, you are not taxed at the time the shares are purchased, only when you sell. Depending on whether the shares were held for the required holding period, a portion of your gain may be taxed as capital gains or as ordinary income.