Kansas Anti-Dilution Adjustments

Description

How to fill out Anti-Dilution Adjustments?

Have you been within a placement the place you need papers for both business or individual purposes almost every day time? There are plenty of legal record templates available on the Internet, but locating types you can depend on isn`t simple. US Legal Forms delivers thousands of develop templates, just like the Kansas Anti-Dilution Adjustments, which can be written in order to meet federal and state demands.

In case you are presently informed about US Legal Forms web site and possess a free account, just log in. Following that, it is possible to download the Kansas Anti-Dilution Adjustments web template.

Should you not come with an accounts and would like to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and ensure it is to the correct city/area.

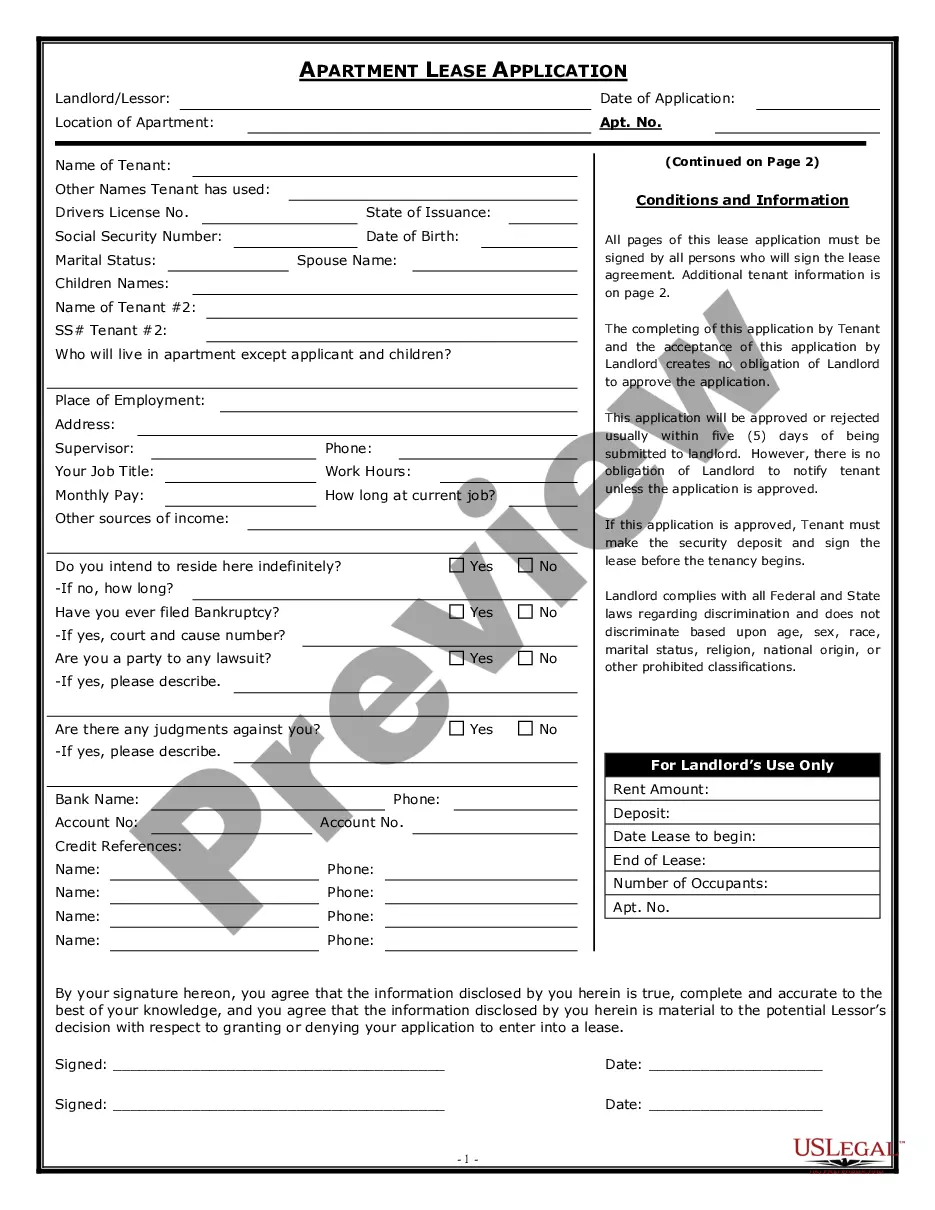

- Use the Review switch to examine the shape.

- See the description to ensure that you have chosen the proper develop.

- In the event the develop isn`t what you are trying to find, utilize the Research field to get the develop that fits your needs and demands.

- If you discover the correct develop, just click Acquire now.

- Choose the costs plan you want, submit the necessary information to make your bank account, and purchase the transaction making use of your PayPal or bank card.

- Select a practical document format and download your duplicate.

Get each of the record templates you might have purchased in the My Forms food selection. You can get a further duplicate of Kansas Anti-Dilution Adjustments whenever, if necessary. Just select the required develop to download or printing the record web template.

Use US Legal Forms, probably the most substantial variety of legal forms, in order to save time as well as avoid faults. The service delivers appropriately manufactured legal record templates which you can use for a variety of purposes. Produce a free account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Full ratchet formula Full ratchet anti-dilution lowers the conversion price of the protected stock to the price paid in the down round. The new conversion price is then divided into the original issue price to arrive at the new conversion ratio.

Traditionally, the anti-dilution provision is used to protect investors in the event a company issues equity at a lower valuation then in previous financing rounds. There are two varieties: weighted average anti-dilution and ratchet based anti-dilution.

For Instance, if an investor holds preference shares at $10 per share, as per full ratchet anti-dilution provisions, if the company issues new shares at $5 per share, the investor has the right to buy twice as many shares, by converting their stake of preferred shares to common stock.

Weighted average anti-dilution protection gives consideration to the relationship between the total shares outstanding as compared to the shares held by the original investor. The formula is CP2 = CP1 * (A+B) / (A+C).

The conversion ratio is 1 to 1. Adjusting the conversion ratio can be used to maintain an investor's value in the company through anti-dilution provisions. The idea is that the investor paid too much for the shares early in the company's life.

For Instance, if an investor holds preference shares at $10 per share, as per full ratchet anti-dilution provisions, if the company issues new shares at $5 per share, the investor has the right to buy twice as many shares, by converting their stake of preferred shares to common stock.

Anti-dilution provisions are clauses that allow investors the right to maintain their ownership percentages in the event that new shares are issued. Dilution refers to a shareholder's ownership decreasing as a result of new shares being issued.

For example, with a conversion rate of $0.50, an investor with one preferred stock will end up with twice as many common shares upon conversion. The full ratchet anti-dilution provision is rare due to the burden placed on the company's founders and initial investors.