Kansas Recruiting Activity Report - Month by Month Numbers

Description

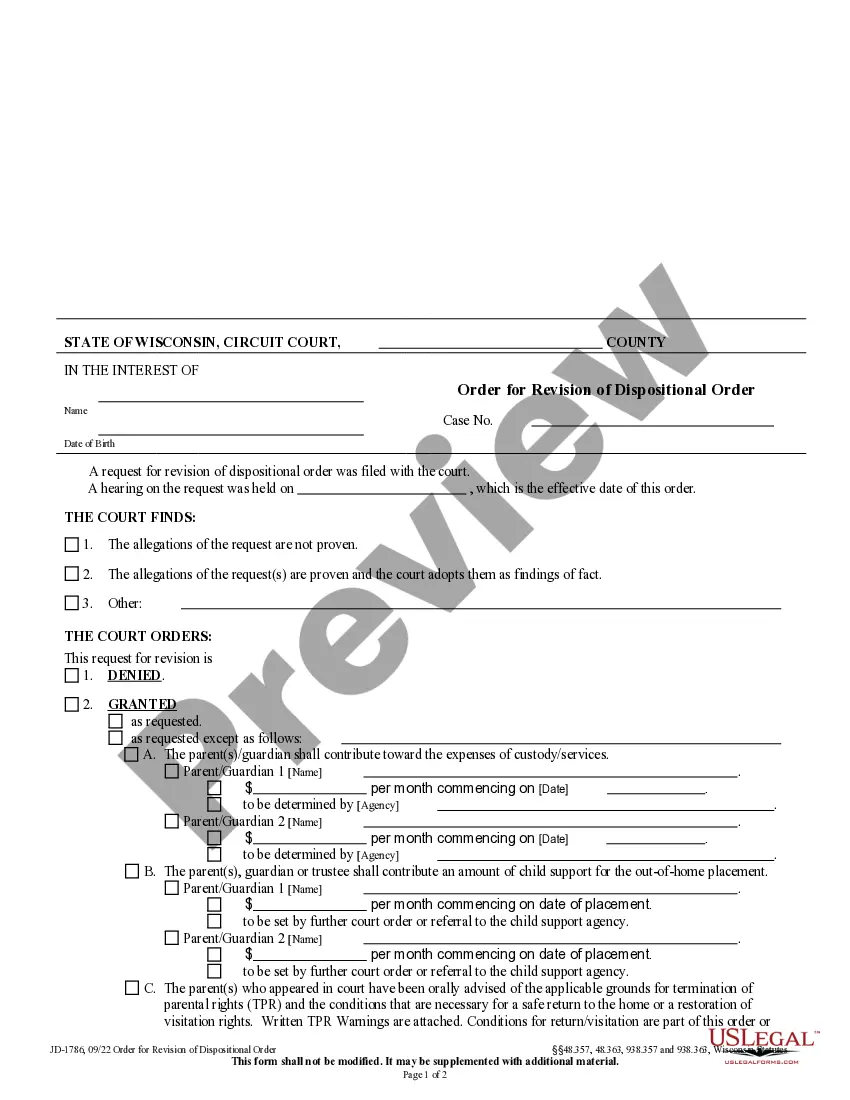

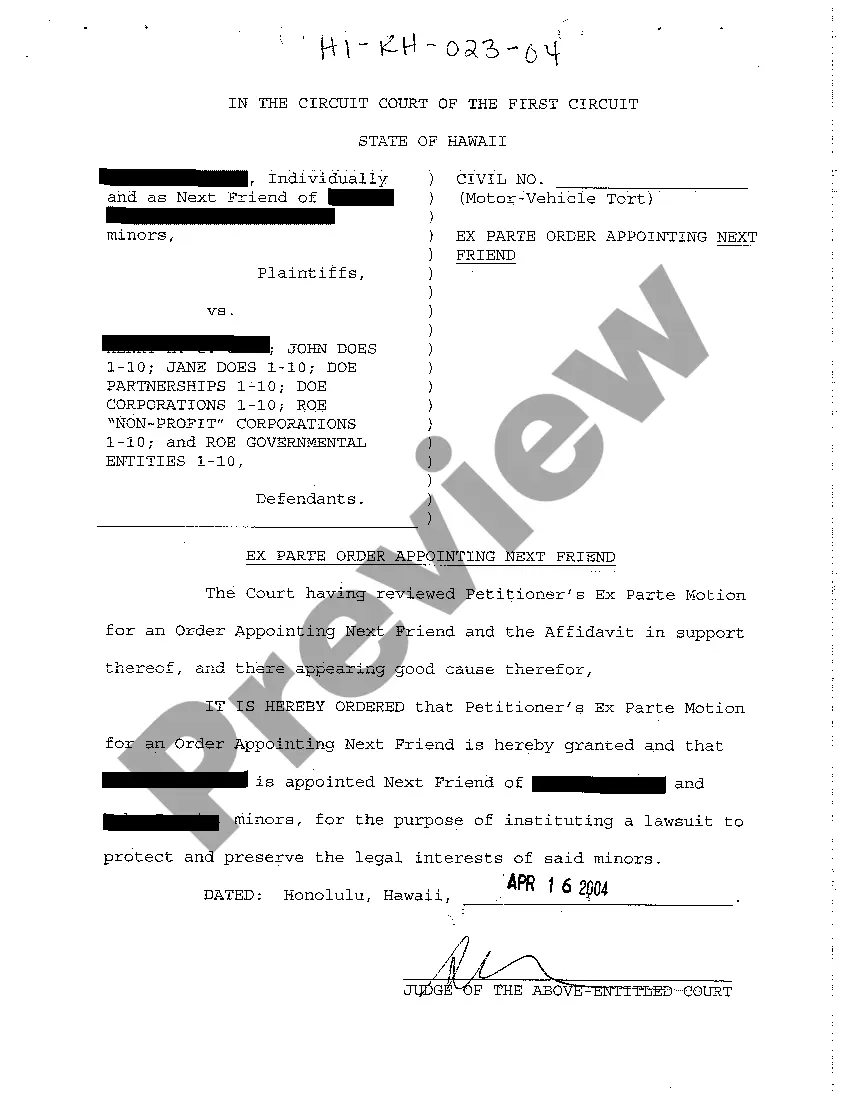

How to fill out Recruiting Activity Report - Month By Month Numbers?

If you intend to finalize, download, or create legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the website's straightforward and user-friendly search feature to locate the documents you need.

Many templates for business and personal purposes are categorized by type and jurisdiction, or by keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Kansas Recruiting Activity Report - Monthly Statistics with just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and click the Download button to access the Kansas Recruiting Activity Report - Monthly Statistics.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Confirm you have selected the correct form for your area/state.

- Step 2. Use the Review function to check the content of the form. Don’t forget to read the details.

- Step 3. If you are not content with the form, use the Search section at the top of the page to find alternative versions of the legal document format.

Form popularity

FAQ

New employees: Employers must report all employees who reside or work in the State of Kansas to whom the employer anticipates paying earnings. Employees should be reported even if they work only one day and are terminated (prior to the employer fulfilling the new hire reporting requirement).

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

Amount and Duration of Unemployment Benefits in Kansas If you are eligible to receive unemployment, your weekly benefit rate will be 4.25% of your wages in the highest paid quarter of the base period. The current maximum (for 2021) is $540 per week; the current minimum is $135.

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.

Your weekly benefit amount in Kansas will be 4.25% of your earnings during the highest paid quarter of the base period. Currently, the most you can receive under Kansas law each week is $540 per week; the minimum amount you can receive is $135 per week.

The weekly benefit amount is the amount of money an unemployed individual is entitled to if they are eligible to receive unemployment. Currently, an individual's weekly benefit rate is 4.25% of his or her wages in the highest paid quarter of the base period. The maximum weekly benefit amount for 2020 is $488.

Those who are eligible should receive payments Thursday or Friday via direct deposit. Claimants who selected to receive their benefits on a debit card that they did not previously have they should receive it within seven to 10 days.

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26, rounded down to the next lower whole dollar.

Yes, you should file a claim each week as long as you remain unemployed. If your case is cleared for payment and you have met all eligibility requirements, you'll get back payments for any weeks you claimed and were eligible to receive, in one lump sum.

Federal and state law requires employers to report newly hired and re-hired employees in Kansas to the New Hire Directory within 20 days of hire. This site, , will provide you with information about reporting new hires including reporting online and other reporting options.