Kansas Co-Employee Applicant Appraisal Form

Description

How to fill out Co-Employee Applicant Appraisal Form?

Selecting the optimal legal document template can pose challenges.

Certainly, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms platform. This service offers thousands of templates, such as the Kansas Co-Employee Applicant Appraisal Form, suitable for both business and personal purposes.

If the form does not meet your requirements, use the Search field to locate the appropriate document.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already a registered user, Log In to your account and click the Obtain button to acquire the Kansas Co-Employee Applicant Appraisal Form.

- Use your account to search through the legal documents you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple directions to follow.

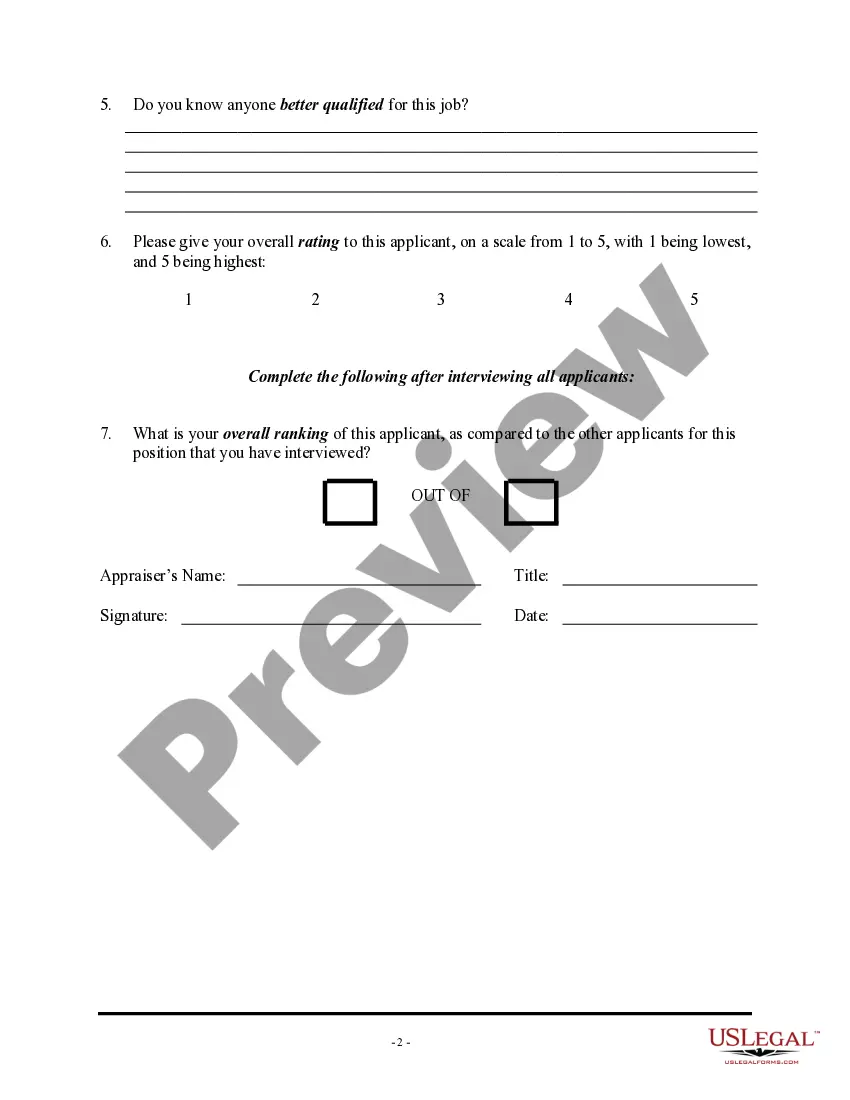

- First, ensure you have selected the correct form for your location. You can review the form using the Preview button and examine the form details to confirm it's the suitable one for you.

Form popularity

FAQ

Completing a self-appraisal form involves honest reflection on your performance. The Kansas Co-Employee Applicant Appraisal Form provides a framework for evaluating your strengths and areas for improvement. By using this structured approach, you can present a well-rounded view of your contributions.

New employees: Employers must report all employees who reside or work in the State of Kansas to whom the employer anticipates paying earnings. Employees should be reported even if they work only one day and are terminated (prior to the employer fulfilling the new hire reporting requirement).

Kansas requires employers to obtain a completed Form K-4, in addition to federal Form W-4, to assist employees in calculating the Kansas employer withholding tax rate.

Steps to Hiring your First Employee in KansasStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.12-Oct-2021

At-Will Employment States:All states in the U.S., excluding Montana, are at-will. Most do have exceptions, but the states of Florida, Alabama, Louisiana, Georgia, Nebraska, Maine, New York, and Rhode Island do not allow any exceptions.

Kansas is an employment at will state which means your employer can fire you for any non-discriminatory and/or non-retaliatory reason.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

Federal and state law requires employers to report newly hired and re-hired employees in Kansas to the New Hire Directory within 20 days of hire. This site, , will provide you with information about reporting new hires including reporting online and other reporting options.

Wrongful Termination - Violation of Public Policy in Kansas City. Wrongful termination has occurred when an employee is fired for any reason other than those such as poor work performance, misconduct, or because the employer cannot afford to keep him or her on.

Contact the Kansas Department of LaborKansas City (913) 596-3500.Topeka (785) 575-1460.Wichita (316) 383-9947.Toll-Free (800) 292-6333.