Kansas Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor

Description

How to fill out Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor?

US Legal Forms - one of many largest libraries of authorized types in the USA - offers a variety of authorized file templates you may obtain or print. Making use of the website, you will get a large number of types for company and person uses, categorized by classes, states, or search phrases.You will find the latest models of types just like the Kansas Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor in seconds.

If you already possess a monthly subscription, log in and obtain Kansas Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor through the US Legal Forms library. The Download button will show up on every type you look at. You have access to all earlier delivered electronically types inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms the first time, allow me to share straightforward instructions to obtain began:

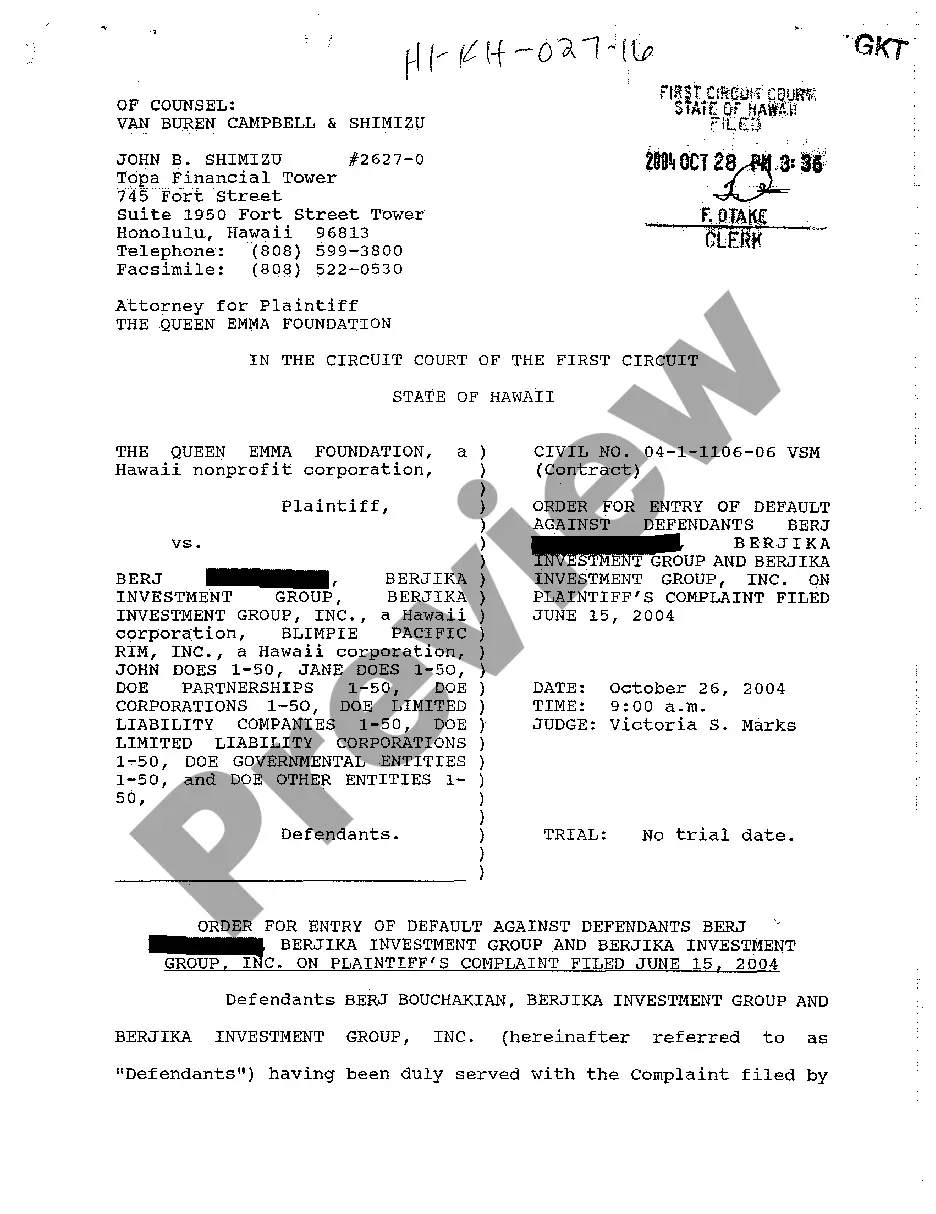

- Be sure to have picked out the proper type for the metropolis/state. Select the Preview button to review the form`s information. See the type description to ensure that you have chosen the appropriate type.

- In case the type does not match your demands, use the Search field at the top of the display to obtain the the one that does.

- Should you be pleased with the shape, verify your option by clicking the Acquire now button. Then, select the rates prepare you want and supply your qualifications to register for an bank account.

- Process the transaction. Use your charge card or PayPal bank account to perform the transaction.

- Choose the formatting and obtain the shape on the product.

- Make modifications. Complete, edit and print and sign the delivered electronically Kansas Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor.

Every format you added to your money lacks an expiry date and is also your own property permanently. So, in order to obtain or print an additional backup, just proceed to the My Forms segment and then click around the type you need.

Get access to the Kansas Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor with US Legal Forms, by far the most considerable library of authorized file templates. Use a large number of professional and express-specific templates that meet your small business or person requires and demands.

Form popularity

FAQ

The general definition of estate property contained in 11 U.S.C. 541(a) is intentionally broad to ensure that all assets are included in the bankruptcy estate, prevent asset hiding or exclusion, and allow for flexibility in interpreting what constitutes estate property.

Section 551 is adopted from the House bill and the alternative in the Senate amendment is rejected. The section is clarified to indicate that a transfer avoided or a lien that is void is preserved for the benefit of the estate, but only with respect to property of the estate.

The bankruptcy estate is the pool of assets that will be used to satisfy the claims of creditors. Generally, all of a debtor's legal and equitable interest in property as of the filing of the bankruptcy petition and commencement of the bankruptcy case becomes property of the bankruptcy estate.

The Texas Pattern Jury Charges series is widely accepted by attorneys and judges as the most authoritative guide for drafting questions, instructions, and definitions in a broad variety of cases.

He policy behind the trustee's "avoiding powers" is: To provide the most equitable distribution to creditors of a debtor's assets. A statutory lien may never be avoided in bankruptcy. A trustee in bankruptcy acquires the avoiding powers as of the date a bankruptcy petition is filed.

Under 11 U.S.C. §541, a debtor has an interest in property even if the property is fully encumbered by liens and the debtor has only an equitable or possessory interest.

Property of the estate is defined broadly to include all tangible and intangible property. Tangible property includes all types of physical property that a debtor owns or has an interest in, such as machinery, equipment, inventory, furniture, and fixtures.