Kansas Superior Improvement Form

Description

How to fill out Superior Improvement Form?

Are you currently in a position where you frequently require documents for company or personal purposes on nearly a daily basis.

There is a multitude of legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Kansas Superior Improvement Form, which are crafted to comply with state and federal requirements.

Once you find the right form, click Get now.

Select a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Kansas Superior Improvement Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is appropriate for the correct city/region.

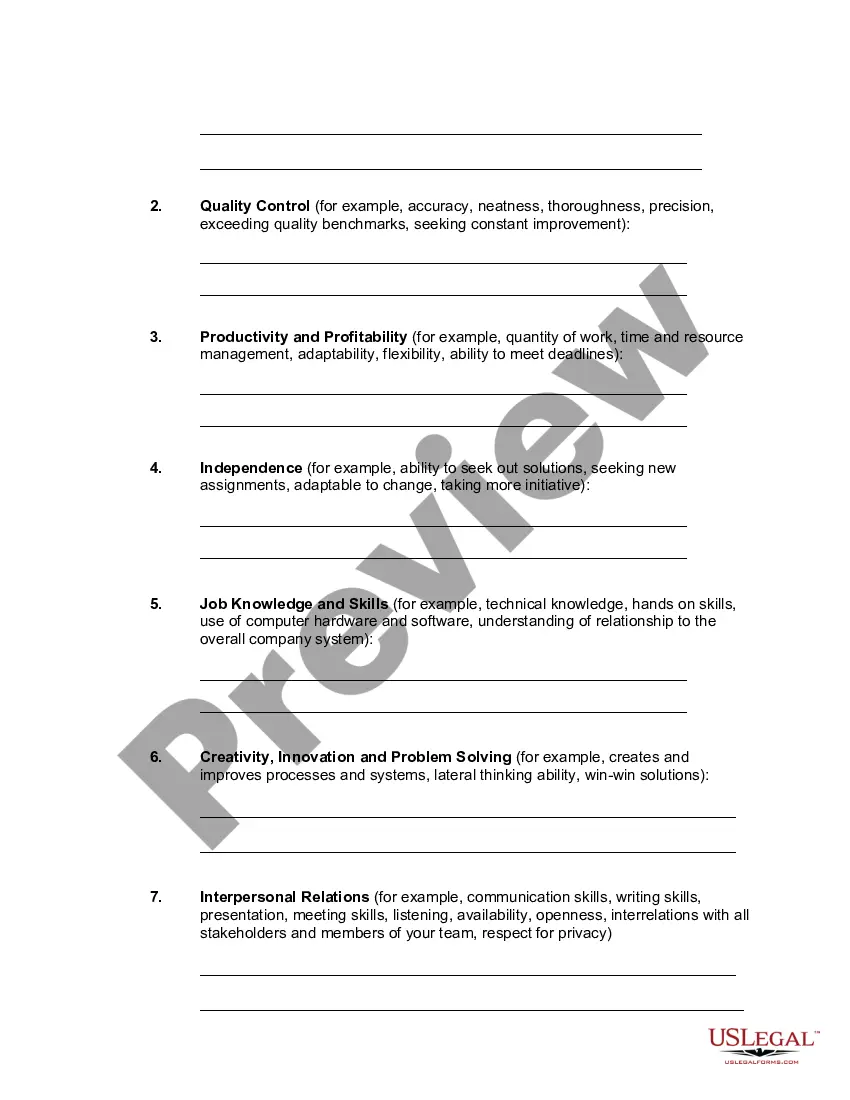

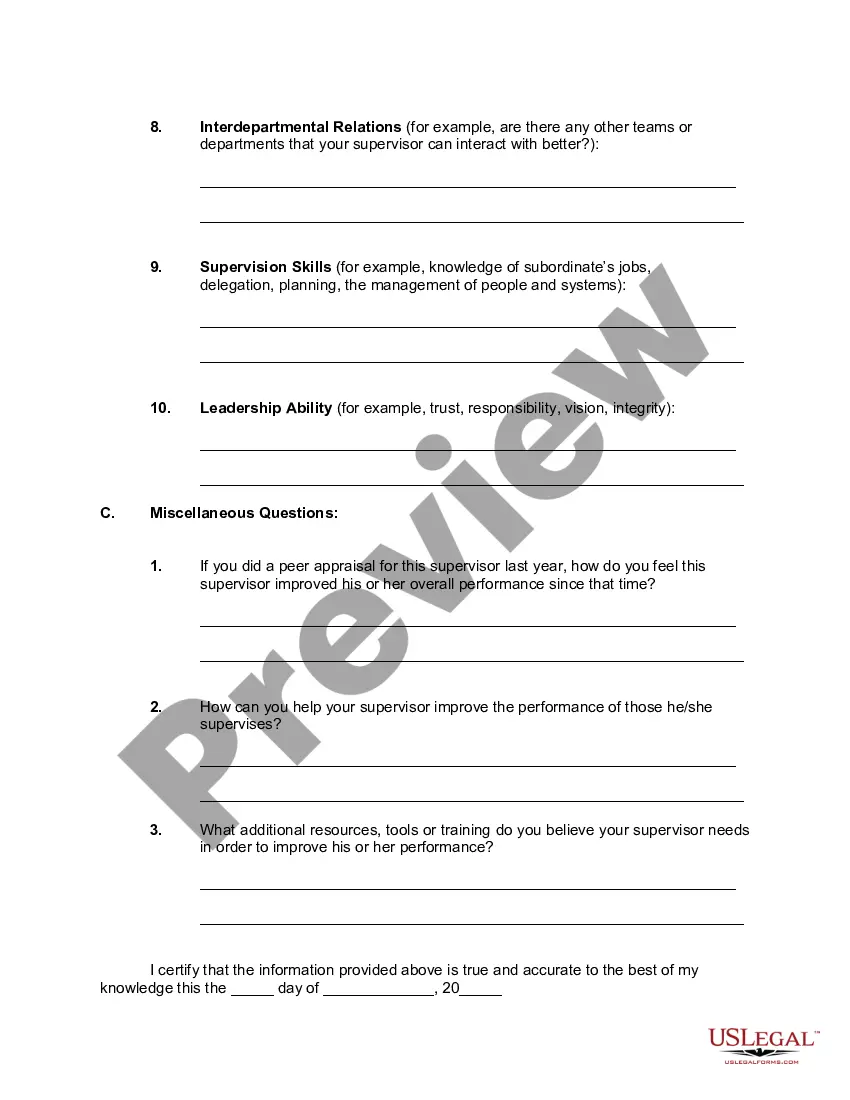

- Utilize the Preview option to examine the form.

- Review the information to confirm you’ve selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs and criteria.

Form popularity

FAQ

Filling out a W-4 form involves several clear steps, starting with your personal information and moving on to your withholding allowances. First, complete the identification section, then determine how many allowances to claim based on your situation. For additional clarity throughout this process, consider consulting the Kansas Superior Improvement Form for valuable insights.

When deciding whether to enter 0 or 1 on your K-4 form, consider your tax situation and withholding preferences. Entering 0 means more tax will be withheld, while entering 1 may result in less tax withholding. It is wise to evaluate your financial needs, and the Kansas Superior Improvement Form can assist you in this assessment.

Filling out the K-4 form in Kansas involves inputting your personal information, including your income and any dependents. Be sure to review each section thoroughly, as accuracy is critical to prevent errors on your tax return. Utilizing the Kansas Superior Improvement Form can provide you with supplemental information and tips for a smooth completion.

The K-4C form is a part of Kansas tax documentation that is specifically for claiming credits for low-income households. This form helps you ensure you receive the financial assistance you deserve, especially if you are in a qualifying income bracket. It can be an essential document when filling out the Kansas Superior Improvement Form, as it may affect your overall tax benefits.

To file a Kansas state tax extension, you need to submit Form K-40 as a part of your application. This form allows you to request an additional time to file your taxes, giving you until October 15. You should act quickly; using the Kansas Superior Improvement Form can help you understand the required steps and deadlines.

In Kansas, seniors over 65 years old may qualify for a higher standard deduction, enhancing tax savings. This means you can deduct a larger amount from your taxable income, which can lower your overall tax liability. When completing your taxes, make sure to reference the Kansas Superior Improvement Form for guidance on eligible deductions.

To determine the number of allowances to claim in Kansas, consider your personal and financial situation. Each allowance you claim reduces the amount of tax withheld from your paycheck, so assess your dependents and any deductions you might qualify for. Using the Kansas Superior Improvement Form can help you make this calculation simpler and ensure that you get it right.

The petition for determination of descent form is a legal document used in Kansas to ascertain rightful heirs. Filing this petition helps clarify inheritance issues when there is no clear will. The court will review the submitted information to establish who is entitled to the decedent's assets. The Kansas Superior Improvement Form can facilitate the completion of this necessary petition.

In Kansas, the order of inheritance follows a specific hierarchy when someone dies without a will. Surviving spouses, children, and parents have legal rights to the deceased's assets. If no immediate family exists, distant relatives may inherit. To understand your rights and navigate inheritance matters, consider the Kansas Superior Improvement Form for helpful tools.

A petition for descent of omitted property in Kansas allows heirs to claim property not mentioned in a will. This petition is crucial for ensuring that all assets are recognized and distributed correctly. The process requires specific documentation and a court hearing. The Kansas Superior Improvement Form can assist you in formatting your petition correctly.