Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse range of legal form templates that you can download or print.

Through this site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant in seconds.

If you currently have a monthly subscription, Log In and download the Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant from your US Legal Forms library. The Download button will be visible on each form you view. You have access to all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.Make adjustments. Fill out, modify, print, and sign the acquired Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant. Every template you add to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant through US Legal Forms, one of the most extensive collections of legal form templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state.

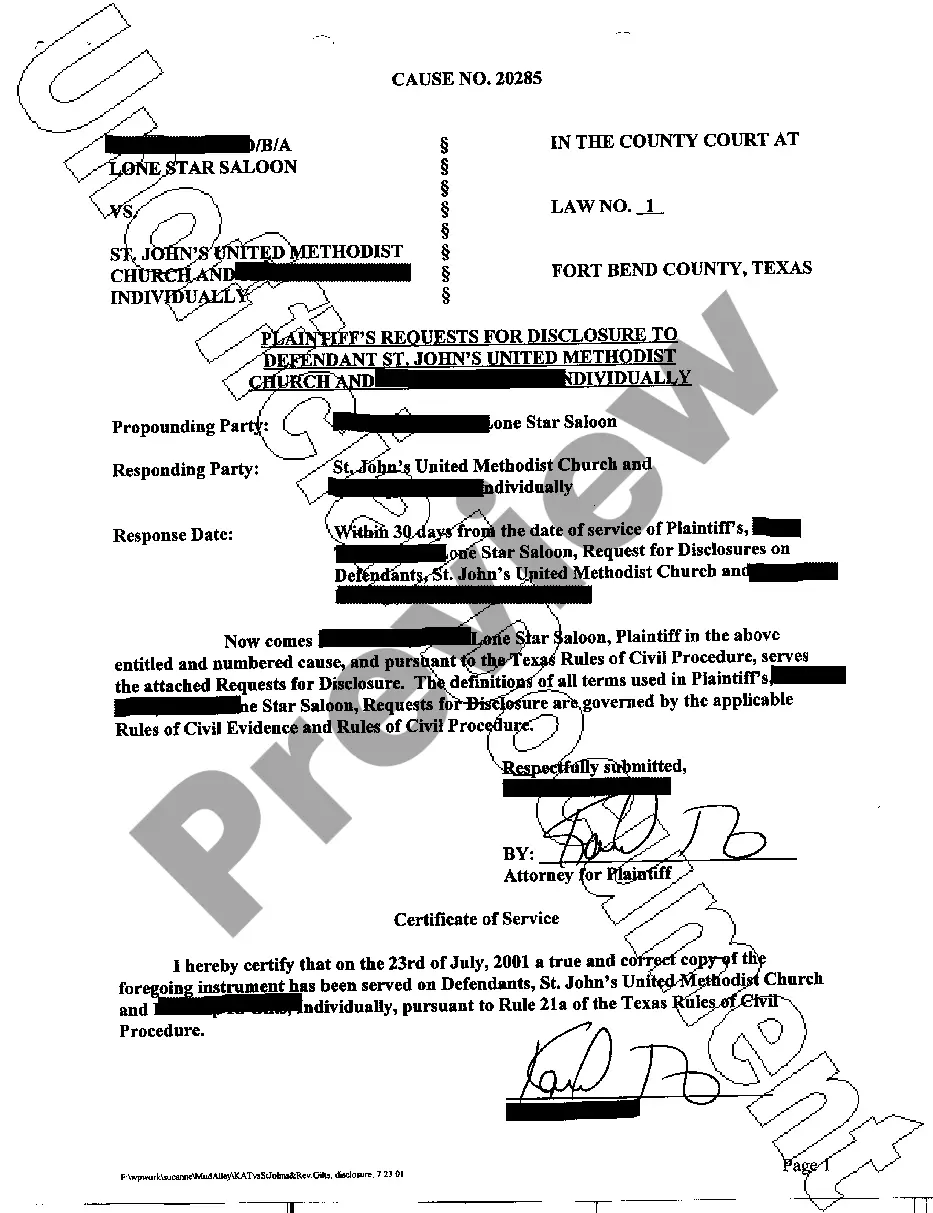

- Click on the Preview button to review the form's content.

- Check the outline of the form to confirm you have chosen the right one.

- If the form doesn't meet your requirements, use the Lookup field at the top of the screen to find the one that does.

- If you are content with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

A private annuity works by allowing one party to transfer a lump sum to another party, who in return agrees to make regular payments to the first party for their lifetime. In a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant, this arrangement ensures financial support and income security during retirement. The structure is often utilized in estate planning to provide benefits while minimizing tax implications. USLegalForms can assist in drafting the agreement to ensure it meets your needs.

An annuity agreement is a legal document outlining the terms under which payments will be made between parties. In the context of a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant, this document specifies the payment amounts, duration, and conditions of the payouts. Annuity agreements serve as crucial tools for managing financial assets and ensuring income stability. With USLegalForms, you can easily create a clear and enforceable annuity agreement.

While private annuities offer benefits, they also present several disadvantages. One key drawback is the potential loss of control over the principal amount since the lump sum is transferred to the other party. Additionally, a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant may not offer the same consumer protections as commercial products. It's essential to consider these factors and seek legal advice when setting up your agreement, which USLegalForms can help facilitate.

A private annuity agreement is a financial contract between two parties, where one party provides a lump sum payment to another in exchange for a promise of regular payments over time. Specifically, a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant ensures that the annuitant receives payments for their lifetime, providing stable income. This agreement can be beneficial for estate planning, as it may help in reducing estate taxes. USLegalForms offers templates that simplify the process of creating a private annuity agreement.

Typically, the payments from a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant cease upon the death of the annuitant. However, some agreements may offer options for beneficiaries, allowing them to continue receiving payments or a lump-sum payment. It is crucial to review the terms of your agreement closely, as these details can significantly impact your estate planning.

Yes, under a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant, the payments can last for the entire life of the annuitant. This feature provides financial security and peace of mind, as you are guaranteed income regardless of how long you live. It makes the agreement an attractive option for those who desire stable, lifelong financial support.

An annuity settlement arrangement that ceases payments upon the annuitant's death is known as a life only annuity. Under this option, income is generated for the annuitant's lifetime, but payments stop entirely after the annuitant passes away. This approach serves those who prioritize maximizing their income while living. If you're considering a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant, this arrangement offers a straightforward method to ensure you receive income during your life.

The life only annuity payout option offers payments exclusively for the lifetime of the annuitant, with no guaranteed payments to beneficiaries after the annuitant's death. This arrangement typically results in higher monthly payments since it does not factor in any guaranteed return for heirs. Thus, it provides maximum income during the annuitant's lifetime. When considering a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant, this option can be an efficient way to maximize your retirement income.

The annuity payout option that allows for lifetime payments to the annuitant while ensuring a minimum term is known as a period certain annuity. This option guarantees payments for a specified number of years, even if the annuitant passes away during that time. After the minimum term, the payments continue for the rest of the annuitant's life. Considering a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant can help you secure both lifetime income and a minimum payout period.

One downside of a Single Premium Immediate Annuity (SPIA) is the lack of liquidity; once you invest, accessing that principal amount can be challenging. Additionally, certain types of SPIAs may not offer inflation protection, meaning purchasing power could diminish over time. Evaluating your needs and understanding the terms of a Kansas Private Annuity Agreement with Payments to Last for Life of Annuitant will help you make informed choices.