Kansas Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

If you wish to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the most significant repository of legal forms, accessible online.

Take advantage of the website's straightforward and user-friendly search feature to acquire the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finish the payment.

- Utilize US Legal Forms to obtain the Kansas Promissory Note in Relation to a Sale and Purchase of a Mobile Home with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the Kansas Promissory Note in Relation to a Sale and Purchase of a Mobile Home.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct area/state.

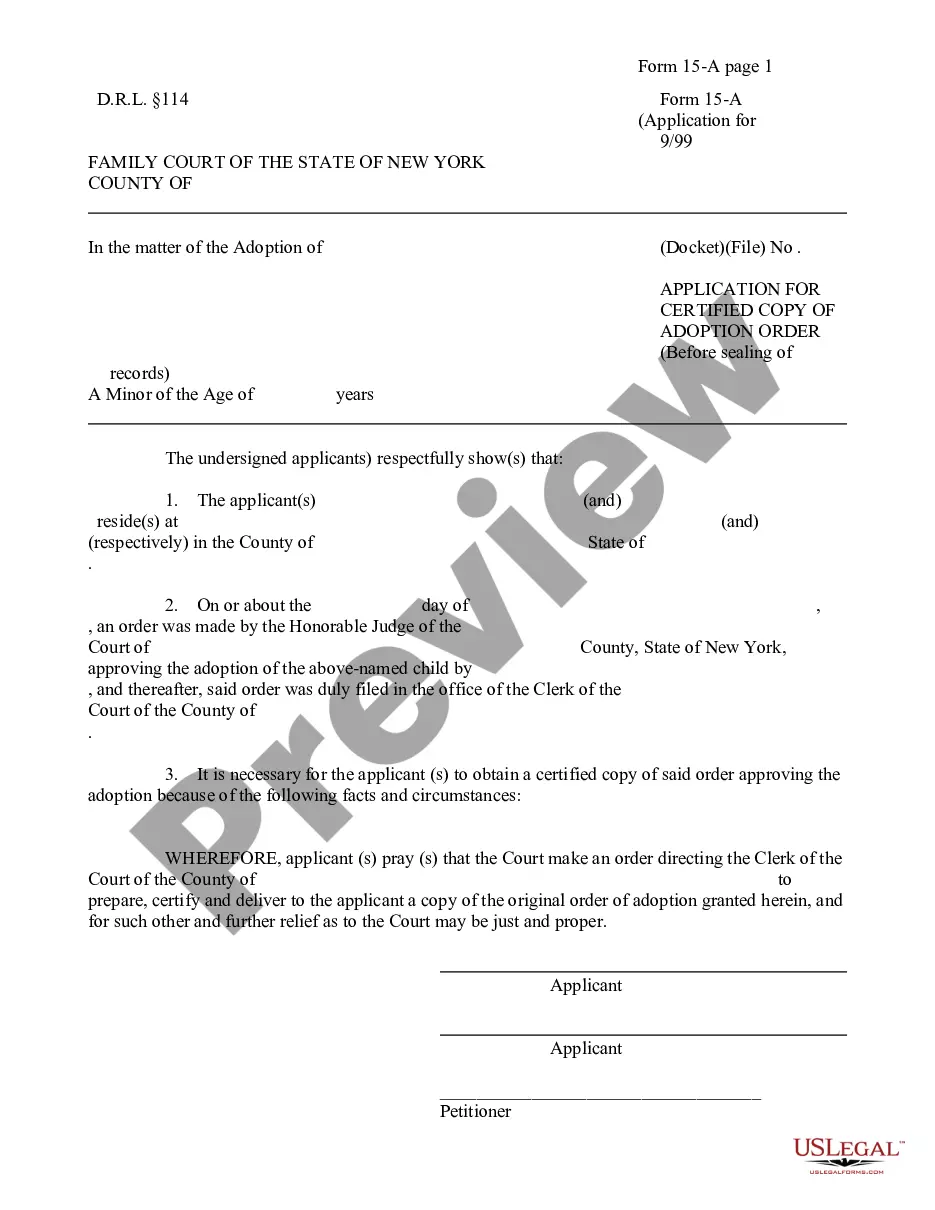

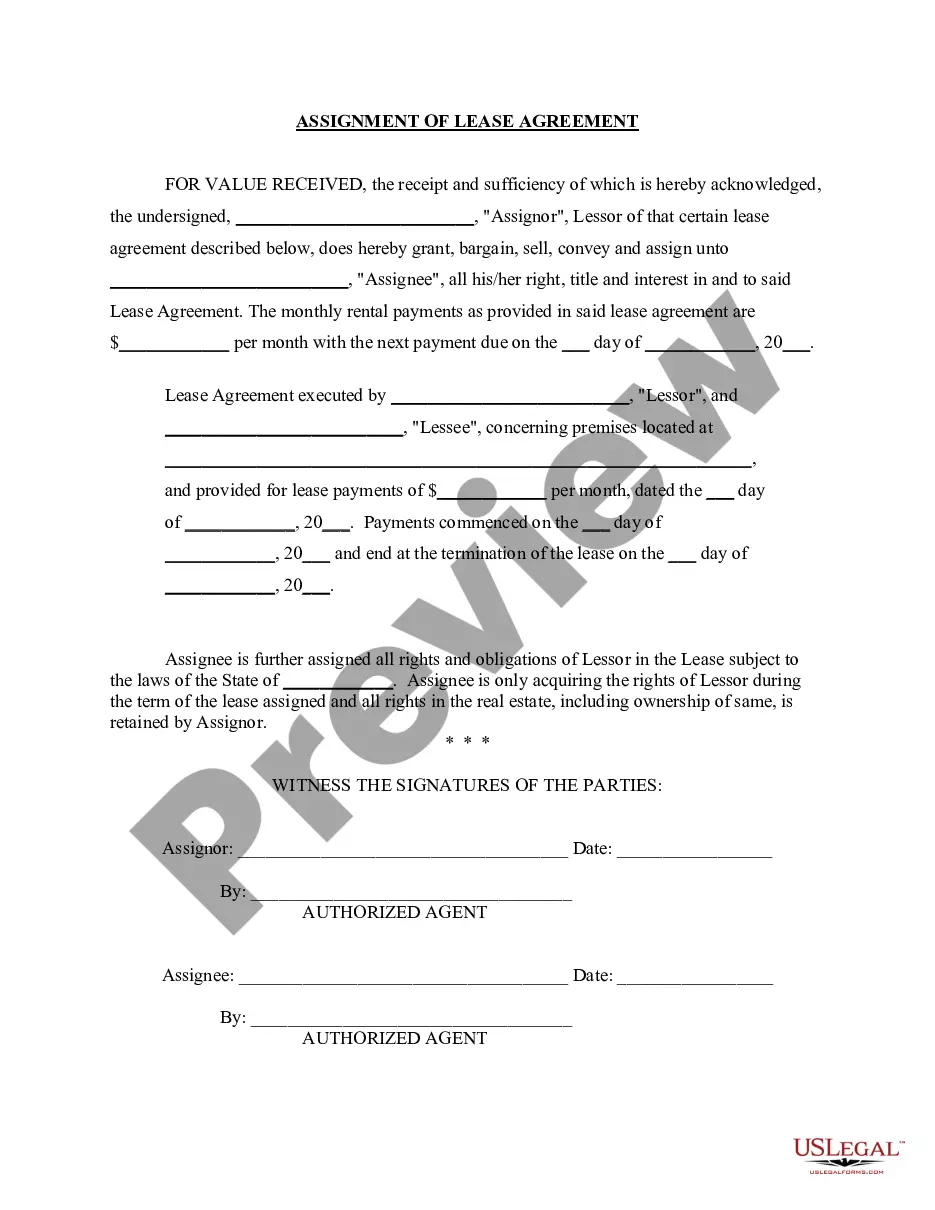

- Step 2. Use the Review option to examine the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Filling out a Kansas Promissory Demand Note requires you to clearly state the terms of repayment. Indicate the total amount borrowed, the interest rate if applicable, and confirm that the lender can demand repayment at any time. Ensure both parties sign the document to validate it legally. For templates, USLegalForms offers resources that can assist you in creating a demand note effectively.

Information to include in a mobile home bill of sale.Mobile home description, including VIN, serial number, make, model, and year.Buyer and seller names, addresses and contact information.Sale date.Sale price, including any taxes.Sale conditions and terms, including warranties or as is status.

Sales of immovable property are not subject to Louisiana sales and use tax. A dealer is allowed an exemption for the purchase of manufactured homes for resale as tangible personal property. The Department of Revenue issues Form R-1018, Sales Tax Exemption for Mobile Home Dealers, for this purpose.

Bring forms to your local DMV in the parish to pay fees and transfer ownership. Only buyer(s) must be present at DMV to transfer title, however ideally buyer and seller go to DMV to transfer title to help expedite any last-minute issues that arise at the DMV. All forms should already be signed.

The bill is signed by both the buyer and the seller in a company of a notary witness. The reason is to have the document notarized, and once it has been, you will then stand as the owner since the bill is a legal binder.

To move a manufactured home, the state requires the owner to get a permit from the Department of Motor Vehicles (DMV). They must submit a copy of this permit when they apply for a new Statement of Ownership, showing the new location of the home.

A promissory note is not the same as a contract. A contract details all the terms of a legal agreement. A promissory note covers only the following: The date by when someone needs to be paid.

Manufactured homes, including mobile and modular homes, are considered movable property in Louisiana, and are subject to the motor vehicle title law.

Selling a Mobile Home Without TitleYou will need a Bill of Sale and a statement from the Tax Assessor-Collector at the local tax collector's office to prove all taxes have been paid on the home. Within 60 days of closing a sale, sellers are required to submit an Application for SOL along with the required fee.

Texas Mobile Home PaperworkSale, transfer and current ownership of a manufactured home.Whether a home is titled as personal or real property.The home's physical location.Outstanding liens.