Kansas Assignment of Domain Name in Conjunction with Asset Purchase Agreement

Description

How to fill out Assignment Of Domain Name In Conjunction With Asset Purchase Agreement?

Have you ever found yourself in a circumstance where you require documents for either professional or personal purposes almost constantly.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't easy.

US Legal Forms provides a vast array of form templates, including the Kansas Assignment of Domain Name in Conjunction with Asset Purchase Agreement, which can be customized to meet both state and federal regulations.

You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Kansas Assignment of Domain Name in Conjunction with Asset Purchase Agreement at any time if needed. Just click on the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers appropriately crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kansas Assignment of Domain Name in Conjunction with Asset Purchase Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need, ensuring it is for the correct city/state.

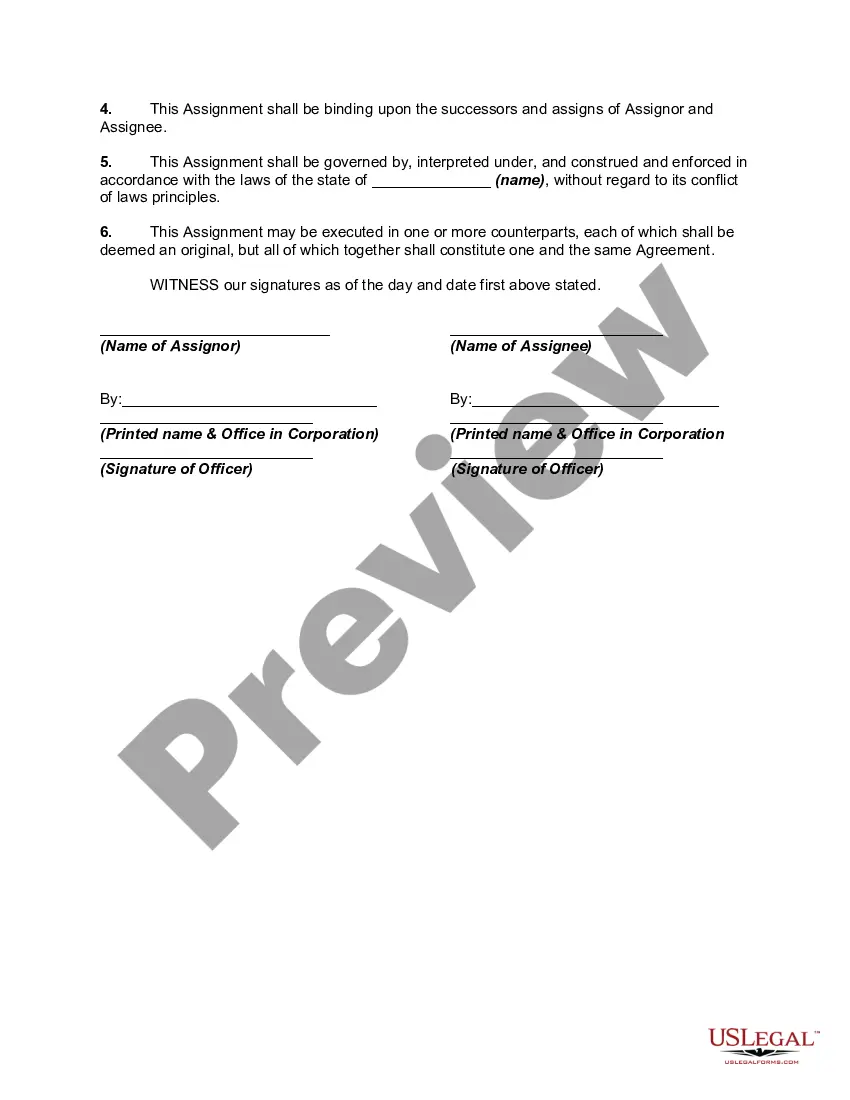

- Utilize the Review option to examine the document.

- Check the description to ensure that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to locate the form that satisfies your needs and specifications.

- Once you find the correct form, click Purchase now.

- Select the payment plan you desire, fill in the required information to set up your account, and pay for the order using your PayPal or credit card.

- Choose a suitable document format and download your copy.

Form popularity

FAQ

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset purchase transaction, the vendor is the company that owns the assets. The vendor sells some or all of its assets to the purchaser resulting in a transfer of such assets, including those desired contracts to which the company is a party to. Such transfer of the contracts will be done by way of an assignment.

Voting Rights and OwnershipUnlike an asset purchase, where the buyer simply buys the assets of the company, an equity purchaser actually buys the company itself, which can be beneficial if the company is performing well or has additional value as a going concern.

A basic, fairly typical anti-assignment clause is triggered by the type of assignment that is done in an asset purchase agreement. In other words, in an asset purchase deal, the buyer and seller often need the approval of third parties to the seller's commercial contracts.

Conversely, stock purchases usually do not require the assignment of contracts, so third-party consents are not required unless the contracts contain change of control provisions. Further, stock purchases are often not subject to as many filing requirements that need to be satisfied by the parties (if any).

Asset PurchasesSuch transfer of the contracts will be done by way of an assignment.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.