Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits

Description

How to fill out Affidavit Of Both Domestic Partners To Employer In Order To Receive Benefits?

Finding the appropriate official document template can be a challenge. Of course, there are many templates available online, but how do you locate the official form that you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Kansas Affidavit of Both Domestic Partners to Employer for Benefits, which can be used for both business and personal purposes. All templates are verified by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to get the Kansas Affidavit of Both Domestic Partners to Employer for Benefits. Use your account to review the official documents you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are some simple instructions to follow: First, ensure you have selected the appropriate form for your state/region. You can browse the form using the Review button and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search field to find the correct form. When you are confident that the form is suitable, click on the Buy now button to purchase the form.

- Select the pricing plan you prefer and enter the required details.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the official document template to your device.

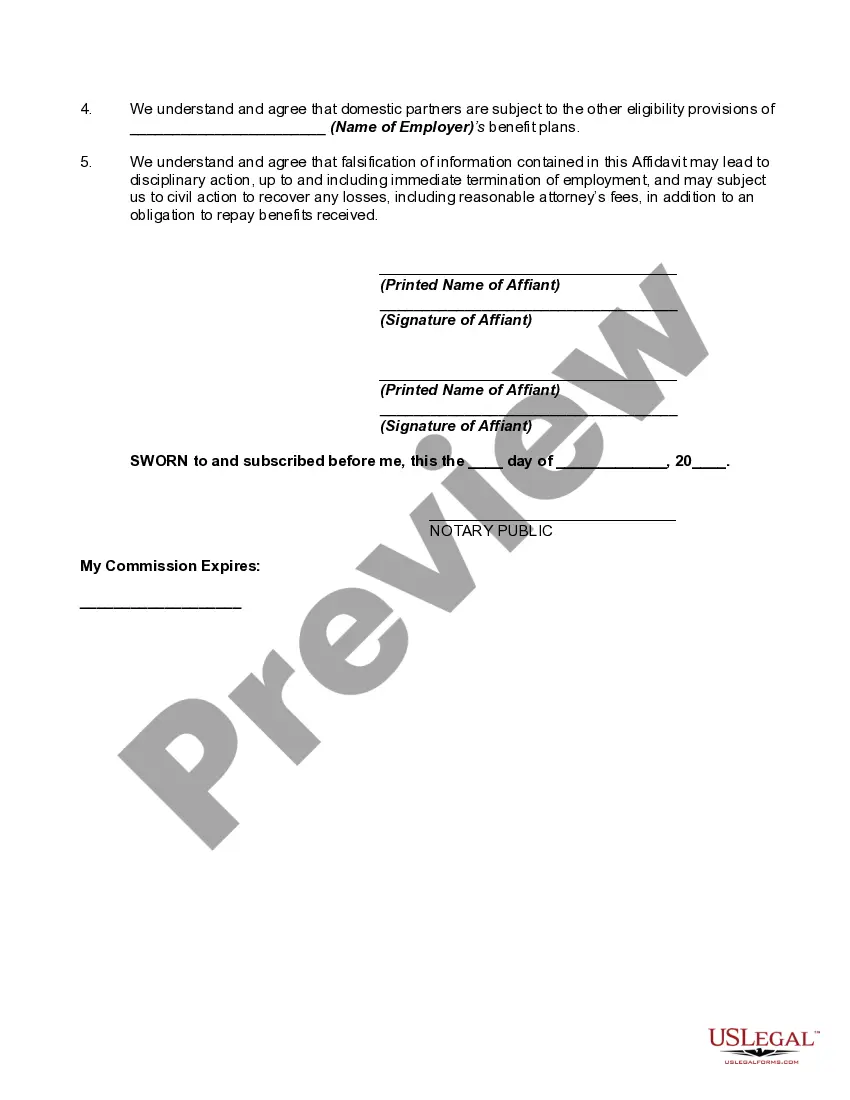

- Complete, edit, print, and sign the obtained Kansas Affidavit of Both Domestic Partners to Employer for Benefits.

- US Legal Forms is the largest repository of official forms where you can find a multitude of document templates.

- Utilize the service to download professionally crafted paperwork that meets state regulations.

Form popularity

FAQ

The domestic partner relationship status refers to a committed, intimate relationship between two people who live together but are not married. This recognition can provide access to certain benefits, such as health insurance or retirement plans. If you want to gain benefits like those outlined in the Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, it's essential to understand your relationship status.

To claim your domestic partner on your taxes, you should ensure that you are eligible for any applicable deductions or credits. Typically, this means both partners need to file as single. The Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits does not change this filing process but may offer other benefits through your employer.

If you live together but are not married, you must usually file your taxes as single. Living together does not affect your filing status under federal law. Understanding the Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can help you navigate any potential benefits calculations with your tax situation.

To prove your domestic partnership for health insurance, you usually need to provide documentation, such as an affidavit or a joint lease agreement. This verification is essential for your employer to process the Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. Be sure to check your employer’s specific requirements for documentation.

Yes, domestic partners generally file their taxes as single individuals. This is because domestic partnership does not create a marriage for tax purposes in most states. If you want to ensure that you maximize your benefits, understand how the Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits applies to your tax preparation.

To determine if your girlfriend qualifies as a domestic partner, you should evaluate your relationship based on criteria set by your employer or state law. Key factors include living together and sharing financial responsibilities. The Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can help provide the necessary proof for benefits.

Domestic partners typically file their taxes as single individuals, unless they qualify for specific tax benefits offered in some states. In Kansas, the Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits does not change your filing status. It is important to consult a tax professional regarding your specific situation.

An affidavit is a legal document that you and your domestic partner can sign, affirming that your relationship meets specific criteria. This document serves as proof of your partnership when applying for benefits. In the context of the Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, it ensures you receive the benefits entitled to you.

Your girlfriend may qualify as a domestic partner if you both meet the criteria established by your employer or state law. Generally, you need to share a domestic life and have a committed relationship. It is advisable to check your employer's policies regarding the Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits to confirm eligibility.

An affidavit of domestic partnership is a formal declaration that acknowledges a couple's committed relationship, often providing legal recognition for benefits. This document acts as proof of partnership for various purposes, including health insurance and other employer-related benefits. The Kansas Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits specifically serves to inform employers of your partnership status.