US Legal Forms - one of many most significant libraries of legal types in America - delivers an array of legal document themes you are able to down load or print out. While using website, you can get 1000s of types for enterprise and specific uses, categorized by groups, says, or key phrases.You can get the most up-to-date variations of types much like the Kansas Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act in seconds.

If you currently have a subscription, log in and down load Kansas Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act through the US Legal Forms local library. The Down load button can look on every type you see. You have accessibility to all in the past saved types inside the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, allow me to share straightforward recommendations to obtain started off:

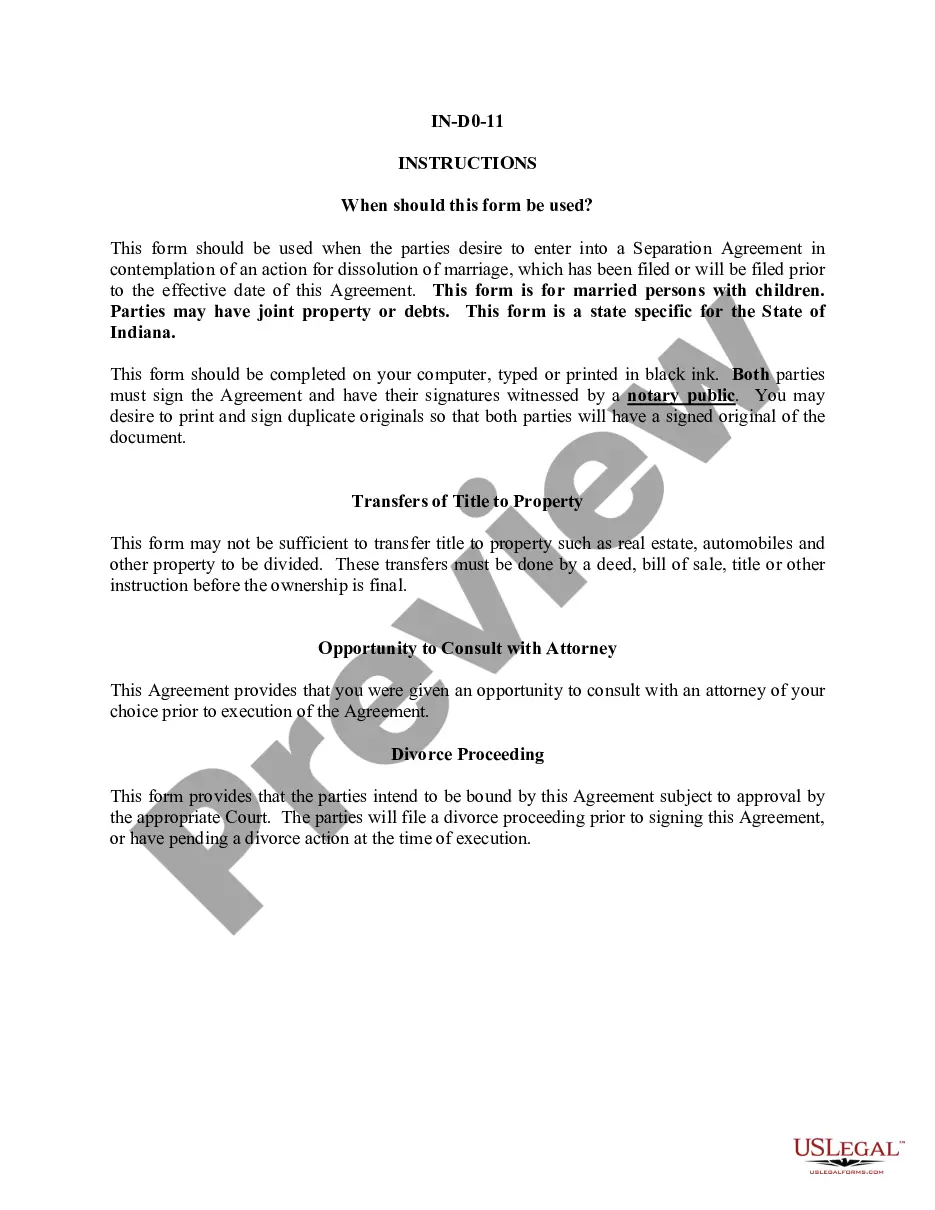

- Make sure you have chosen the proper type for your personal area/county. Click the Preview button to review the form`s content. Look at the type outline to actually have selected the proper type.

- In case the type does not satisfy your demands, take advantage of the Research industry towards the top of the display screen to obtain the the one that does.

- If you are satisfied with the shape, affirm your option by simply clicking the Buy now button. Then, opt for the prices strategy you like and offer your accreditations to register on an bank account.

- Procedure the transaction. Make use of your charge card or PayPal bank account to accomplish the transaction.

- Find the structure and down load the shape on the system.

- Make alterations. Fill out, edit and print out and indication the saved Kansas Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act.

Each format you added to your account does not have an expiry time and is also yours eternally. So, in order to down load or print out yet another version, just check out the My Forms section and click about the type you need.

Gain access to the Kansas Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with US Legal Forms, the most comprehensive local library of legal document themes. Use 1000s of specialist and condition-specific themes that meet your company or specific requires and demands.