Kansas Property Information Check List - Residential

Description

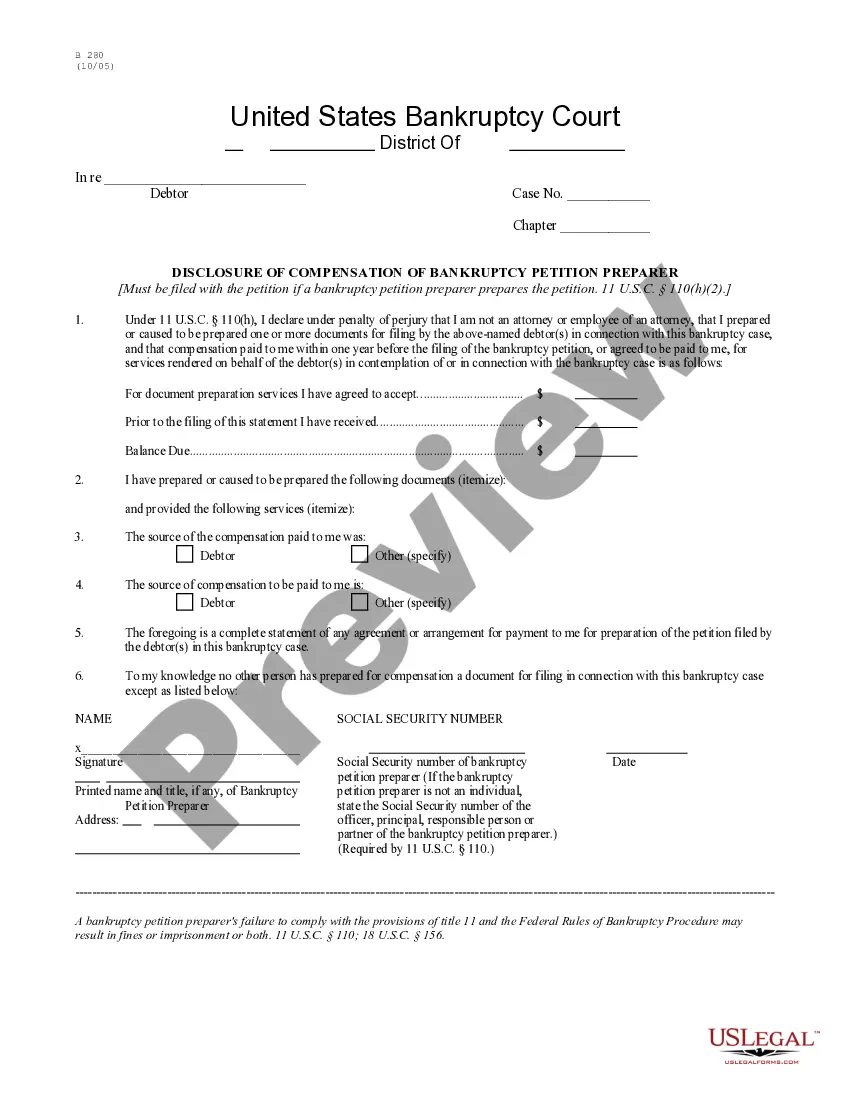

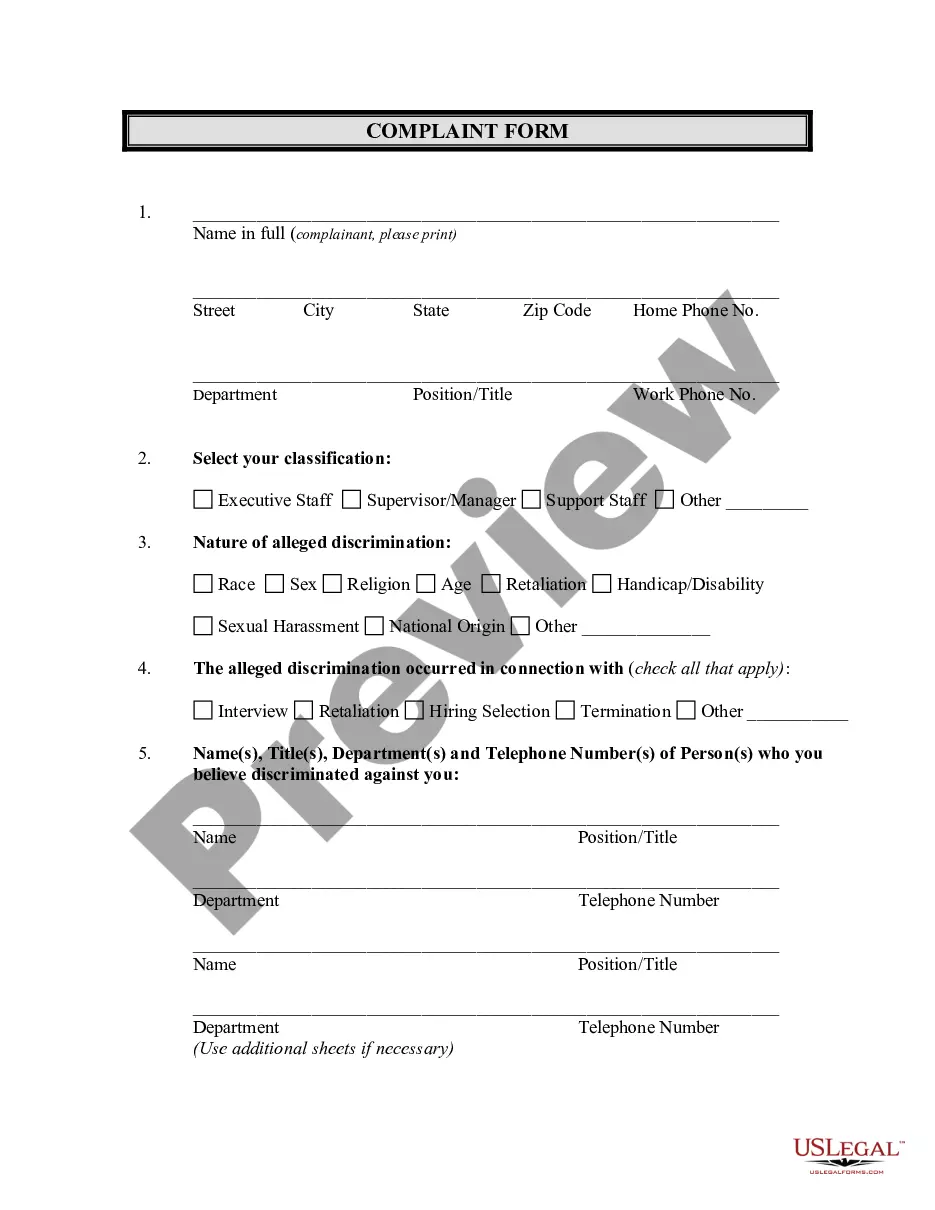

How to fill out Property Information Check List - Residential?

You can spend hours online looking for the proper legal document template that meets both state and federal requirements.

US Legal Forms offers countless legal templates that have been evaluated by experts.

You can download or print the Kansas Property Information Check List - Residential from my service.

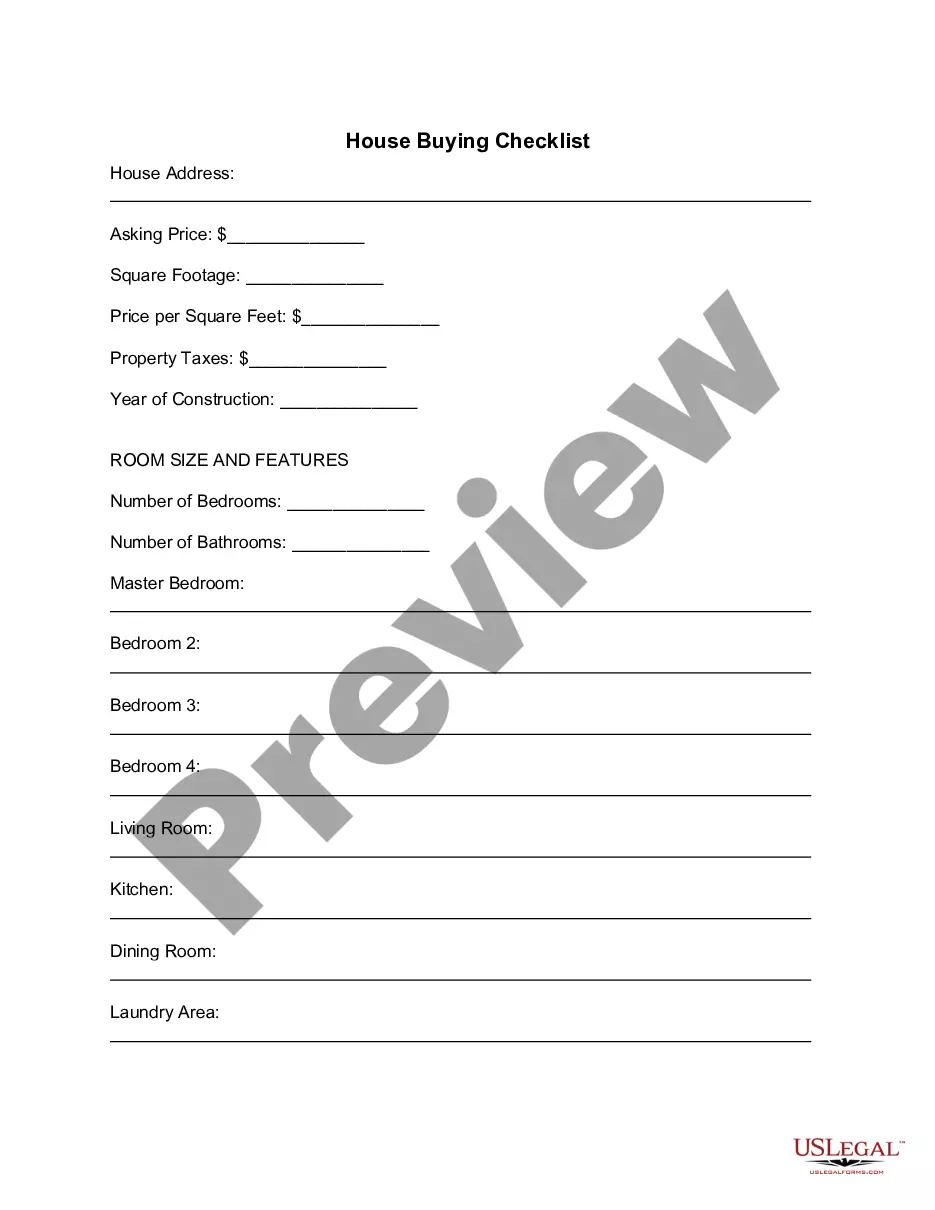

If available, use the Preview option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then select the Download option.

- Afterward, you can fill out, modify, print, or sign the Kansas Property Information Check List - Residential.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click on the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- Firstly, ensure you have chosen the right document template for the state/region you select.

- Review the form outline to confirm you have chosen the correct type.

Form popularity

FAQ

The appraised value represents the current market value of your property, while the assessed value is a percentage of that appraisal used to calculate taxes. In Kansas, the assessed value is typically 11.5% of the appraised value. For clarity on these terms, consult our Kansas Property Information Check List - Residential; it explains these concepts in an easy-to-understand format.

Property taxes in Kansas are assessed based on a property's fair market value. Local appraisers examine real estate factors such as location and property improvements. For a deeper understanding of how these assessments work, refer to our Kansas Property Information Check List - Residential, where you can find helpful resources and examples.

In Kansas, property taxes are assessed annually. Assessors review property values each year to keep them current with market trends. Therefore, understanding your property’s assessed value is crucial. Utilize the Kansas Property Information Check List - Residential to stay informed on assessment processes and deadlines.

Johnson County consistently has the highest property tax rates in Kansas. Residents often find that local funding for schools and public services drives these rates. If you're planning to buy property in this area, consider our Kansas Property Information Check List - Residential. It provides key insights that can help clarify your financial commitments.

In Kansas, property taxes do not automatically stop at a certain age. However, individuals aged 65 or older may qualify for property tax exemptions or rebates that significantly reduce their tax burden. Utilizing the Kansas Property Information Check List - Residential can provide you with essential information about these exemptions and help you navigate the benefits available for senior residents.

To calculate personal property tax in Kansas, you first need to determine the assessed value of your personal property, which is typically a percentage of its fair market value. Next, multiply the assessed value by the local property tax rate, which varies by county. For your convenience, the Kansas Property Information Check List - Residential can guide you in understanding exemptions and deductions, optimizing your tax calculations effectively.

The Assessor's Parcel Number (APN) can typically be found on your property tax bill, in property records, or on your local assessor's website. It's a unique identifier for your property that helps streamline searches and transactions. To effectively navigate through these resources, the Kansas Property Information Check List - Residential serves as a handy guide.

In Kansas, property taxes do not automatically cease at a specific age. However, seniors may qualify for a property tax exemption or reduction under certain programs. Familiarizing yourself with these options can provide financial relief, and the Kansas Property Information Check List - Residential offers valuable insights into eligibility and application processes.

You can find the assessed value of your property by visiting your local tax assessor's office or their website. Many states, including Kansas, offer online databases where you can search by property address or owner name. For a more structured approach, refer to the Kansas Property Information Check List - Residential, which provides resources and tips to easily locate this information.

To find the appraised value of your property in Kansas, you can request an appraisal from a certified appraiser or check your county's property records online. Many counties provide access to this information through their official websites. Utilizing the Kansas Property Information Check List - Residential can streamline your search, helping you gather necessary documents and insights.