Kansas Sale or Return

Description

How to fill out Sale Or Return?

US Legal Forms - a prominent collection of legal documents in the United States - offers an assortment of legal template files that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest iterations of forms like the Kansas Sale or Return in mere moments.

If you currently hold a subscription, Log In and download the Kansas Sale or Return from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Proceed with the purchase. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit it as needed. Fill out, modify, and print and sign the downloaded Kansas Sale or Return. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you require. Access the Kansas Sale or Return with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct form for your city/state.

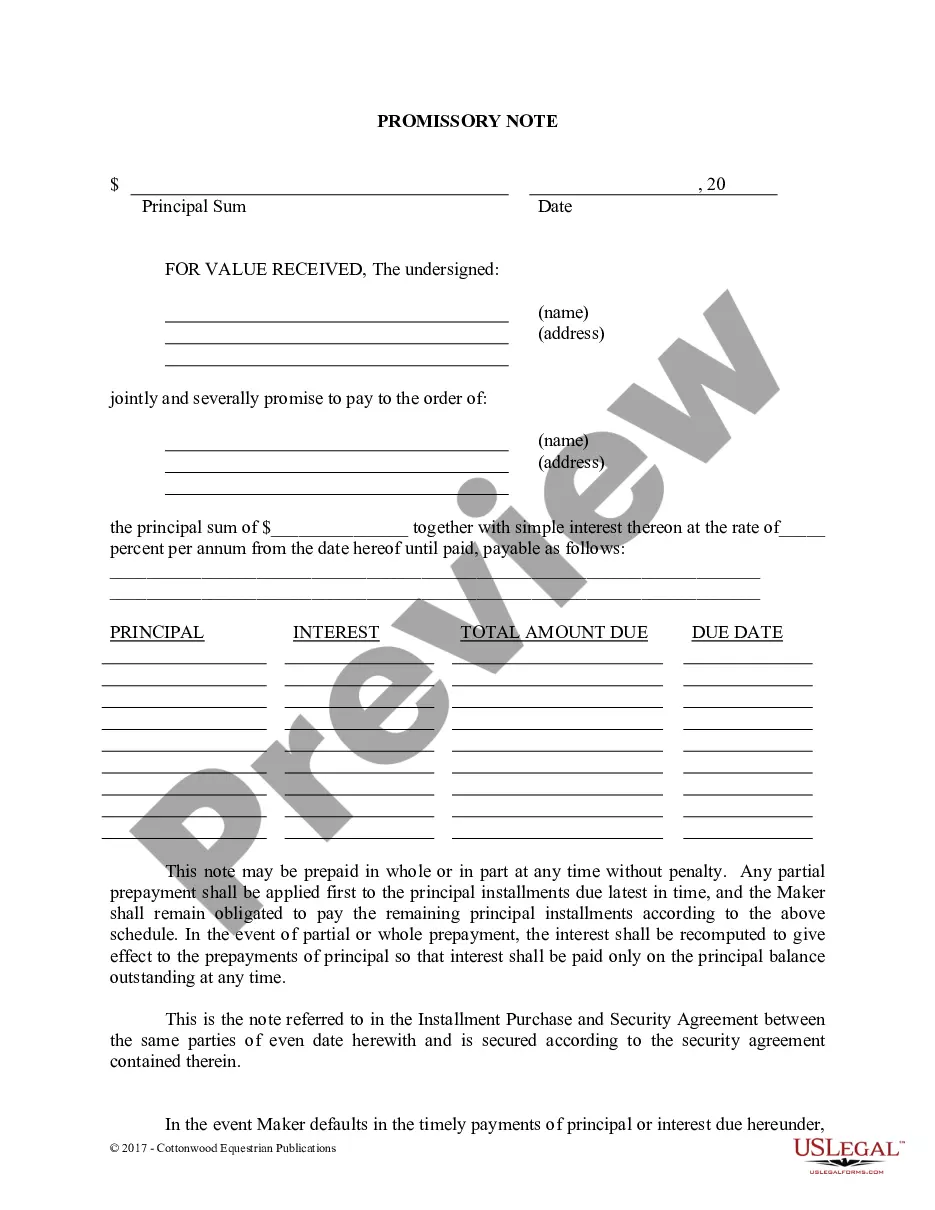

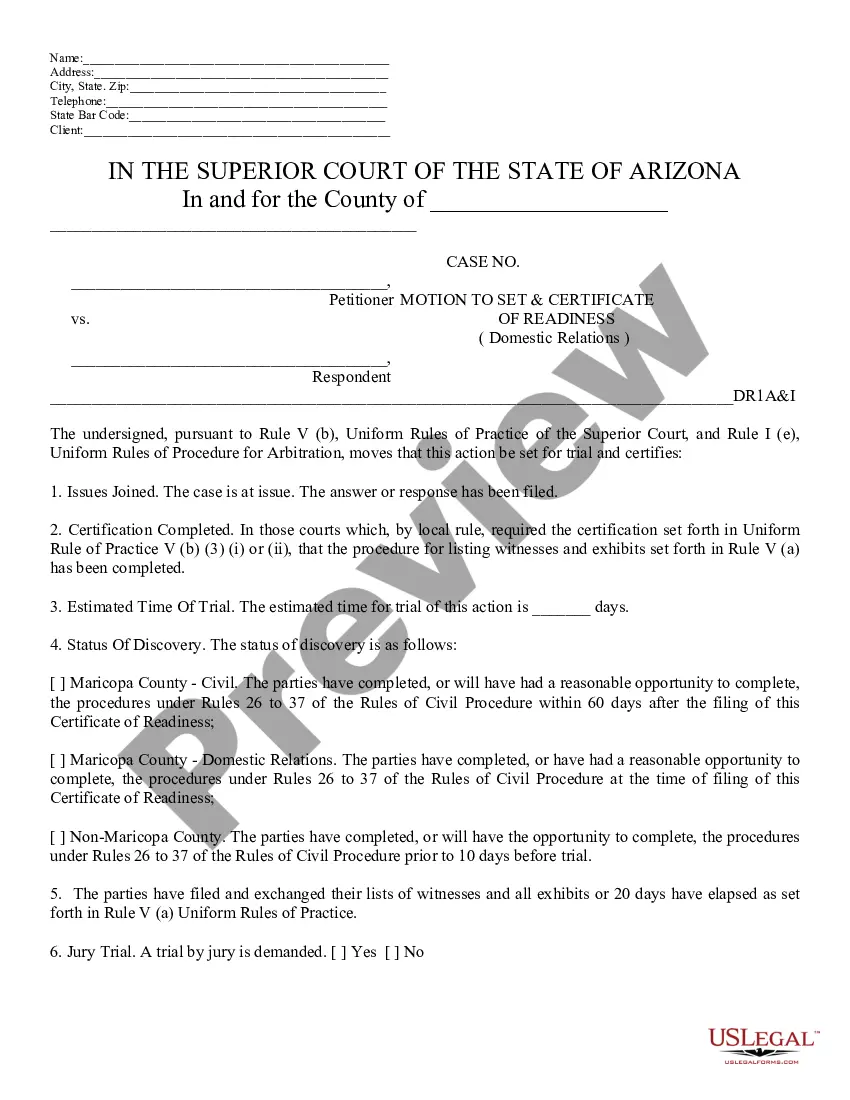

- Click the Preview button to examine the form's details.

- Review the form information to confirm you have selected the correct one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the appropriate one.

- Once satisfied with the document, confirm your choice by clicking the Purchase now button.

- Next, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

To amend a Kansas sales tax return, complete the Kansas Department of Revenue’s Sales and Use Tax Amended Return form, clearly indicating the corrections. Include any necessary documentation that supports your changes, and double-check for accuracy. This will help prevent issues with the state regarding your tax accountability. Remember, understanding Kansas Sale or Return will enhance your knowledge and ensure your amendments are correctly processed.

Kansas sales tax is imposed on the retail sale of tangible personal property and certain services. The state provides a basic tax rate of 6.5%, but local jurisdictions may also add taxes, which can vary by city and county. Understanding how these rates apply to your purchases is crucial for compliance. Familiarizing yourself with the Kansas Sale or Return process can make tax season much less stressful and ensure you stay informed.

Adjustments on a sales tax return refer to changes made to the original figures reported, which could include exemptions or incorrect sales amounts. It’s important to accurately report these adjustments to avoid penalties or further issues. Review your records and make necessary correction before submitting the amended return. Knowing about Kansas Sale or Return helps you understand when and how to make these adjustments.

You can contact the Kansas Department of Revenue through their official website or call their dedicated hotline for sales tax inquiries. They offer assistance via email and online chat as well, making it easy for you to get the help you need. Always have your tax information ready to expedite the process. If you have questions about Kansas Sale or Return, their representatives can provide valuable insights.

To amend a tax return you’ve already filed in Kansas, you need to submit a corrected form along with any supporting documentation. Use the appropriate form, usually the Kansas 1040X, to detail the changes. This process is essential to ensure the accuracy of your tax information and potentially to reclaim any overpaid taxes. For Kansas Sale or Return, make sure to check for adjustments that may affect your amended return.

If you earn income in Kansas City, you are generally required to file a local tax return. Kansas City imposes its own income tax, which is mandatory for residents and non-residents earning income there. By following the regulations surrounding your Kansas Sale or Return, you can ensure you remain compliant with both state and local tax obligations.

Filing a Kansas return is typically required if you meet specific income thresholds and residency requirements. If you're unsure whether you need to file, reviewing your financial situation is advisable. Consulting during the Kansas Sale or Return process can provide clarity and ease your compliance with state tax laws.

Yes, Kansas recognizes bills of sale as important legal documents for transferring ownership of tangible personal property. When you make a sale in Kansas, using a bill of sale can protect both the buyer's and seller's rights. Therefore, incorporating a Kansas Sale or Return agreement may enhance the clarity of the transaction.

Certain individuals may not need to file a Kansas state tax return, including those with very low income or specific exemptions. Additionally, if you only earn income from certain sources that are tax-exempt, you may be eligible. Understanding these exemptions can simplify your Kansas Sale or Return process, saving you time and effort.

Yes, if you earn income in Kansas, you generally need to file a separate Kansas state tax return. This process ensures that you report your income accurately and fulfill your tax obligations. Managing your Kansas Sale or Return requirements will help you stay compliant while potentially benefiting from various deductions and credits.