Kansas Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC

Description

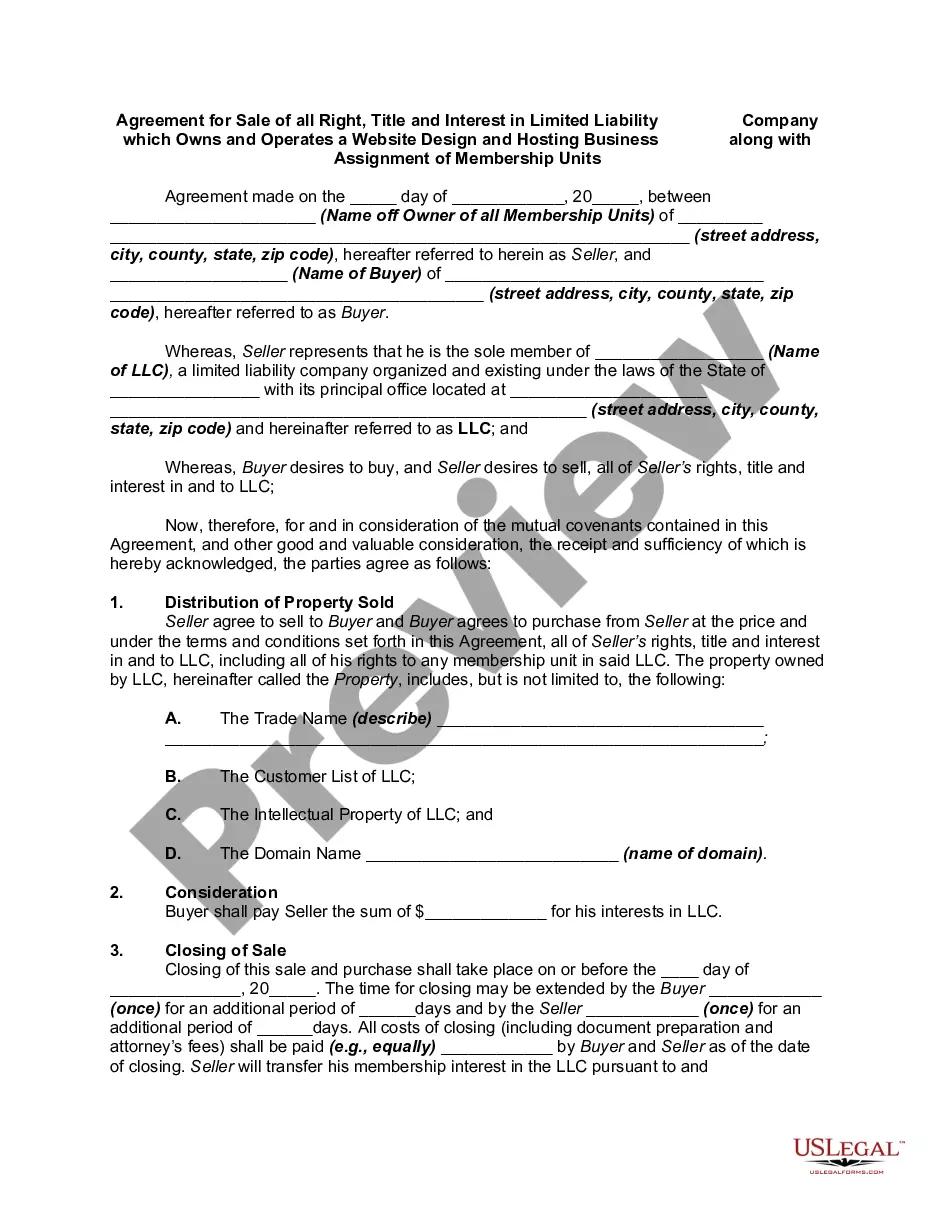

A distributional interest in a limited liability company is personal property and may be transferred in whole or in part. The following form is a agreement whereby the sole member of the LLC transfers his 100% interest as such member to another party.

How to fill out Agreement For Sale Of All Rights, Title And Interest In Limited Liability Company LLC?

Are you in a position that you will need documents for either business or person purposes almost every working day? There are plenty of lawful file web templates accessible on the Internet, but discovering versions you can depend on isn`t straightforward. US Legal Forms offers thousands of form web templates, much like the Kansas Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC, that happen to be created to meet state and federal requirements.

When you are presently knowledgeable about US Legal Forms internet site and possess your account, basically log in. Next, you are able to download the Kansas Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC format.

If you do not provide an account and want to start using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is for your proper metropolis/area.

- Utilize the Preview switch to analyze the form.

- Browse the description to ensure that you have chosen the proper form.

- When the form isn`t what you are trying to find, make use of the Lookup discipline to obtain the form that fits your needs and requirements.

- If you discover the proper form, click Acquire now.

- Opt for the prices program you need, fill in the required information to create your money, and pay for the order with your PayPal or charge card.

- Pick a practical document structure and download your version.

Find each of the file web templates you may have purchased in the My Forms food list. You may get a more version of Kansas Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC anytime, if required. Just click on the essential form to download or produce the file format.

Use US Legal Forms, by far the most considerable variety of lawful kinds, in order to save time and avoid blunders. The support offers expertly produced lawful file web templates that you can use for a range of purposes. Produce your account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Do you need an operating agreement in Kansas? No, it's not legally required in Kansas under § 17-76,134. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

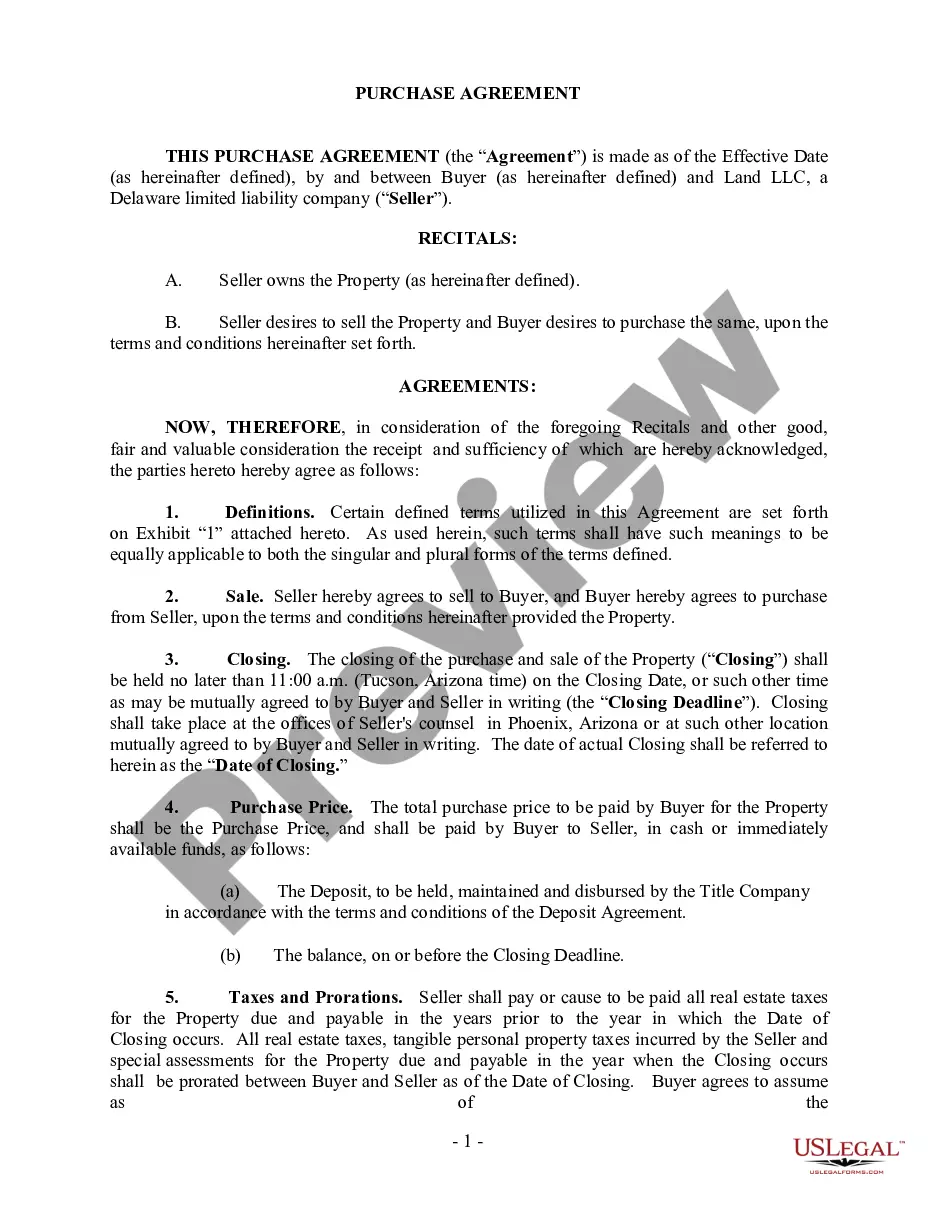

When a taxpayer sells an LLC interest, the taxpayer will usually have a capital gain or loss on the sale of the interest. However, capital gain or loss treatment does not apply to the sale of every LLC interest.

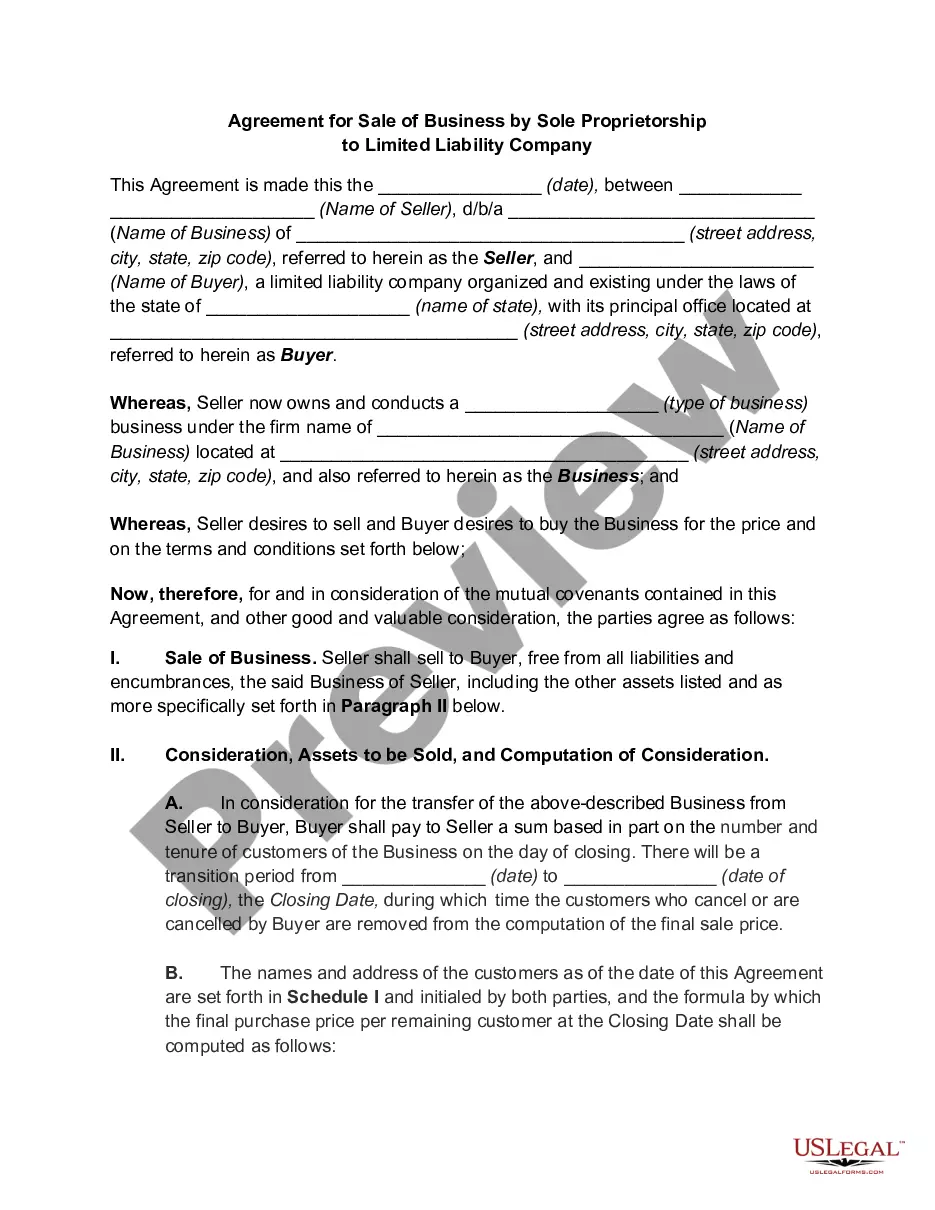

Transferring Ownership in an LLC When the ownership transfer is a sale of the LLC, a buy-sell agreement may be necessary. An operating agreement should specify the process for ownership transfer, but if it doesn't, you must follow state guidelines. Under some circumstances, the state may require you to form a new LLC.

Every equity owner of an LLC is called a Member and they own a percentage of the company. If one of the Members wants to sell their ownership interest to a buyer, they can do this through a sale of an LLC membership interest agreement.

What Must You Include in an Asset Purchase Agreement? Party information. Include the full legal names of the business, buyer, and seller in the opening paragraph. Definitions. ... Purchase price. ... Purchased assets. ... Representations and warranties. ... Dispute Resolution. ... Indemnification. ... Closing conditions.

After the terms of sale are negotiated, a written membership interest sales agreement can be created to record the transaction. This agreement should detail the new member's ownership percentage, the amount of the buy-in, and require that the new member agree to be bound by the existing Operating Agreement of the LLC.

After the terms of sale are negotiated, a written membership interest sales agreement can be created to record the transaction. This agreement should detail the new member's ownership percentage, the amount of the buy-in, and require that the new member agree to be bound by the existing Operating Agreement of the LLC.

A membership interest purchase agreement, sometimes called a MIPA, is a contract between a seller and a buyer to transfer the ownership of an LLC. A MIPA transfers the whole company with all of its assets and liabilities being transferred by the contract.