Kansas Stock Retirement Agreement

Description

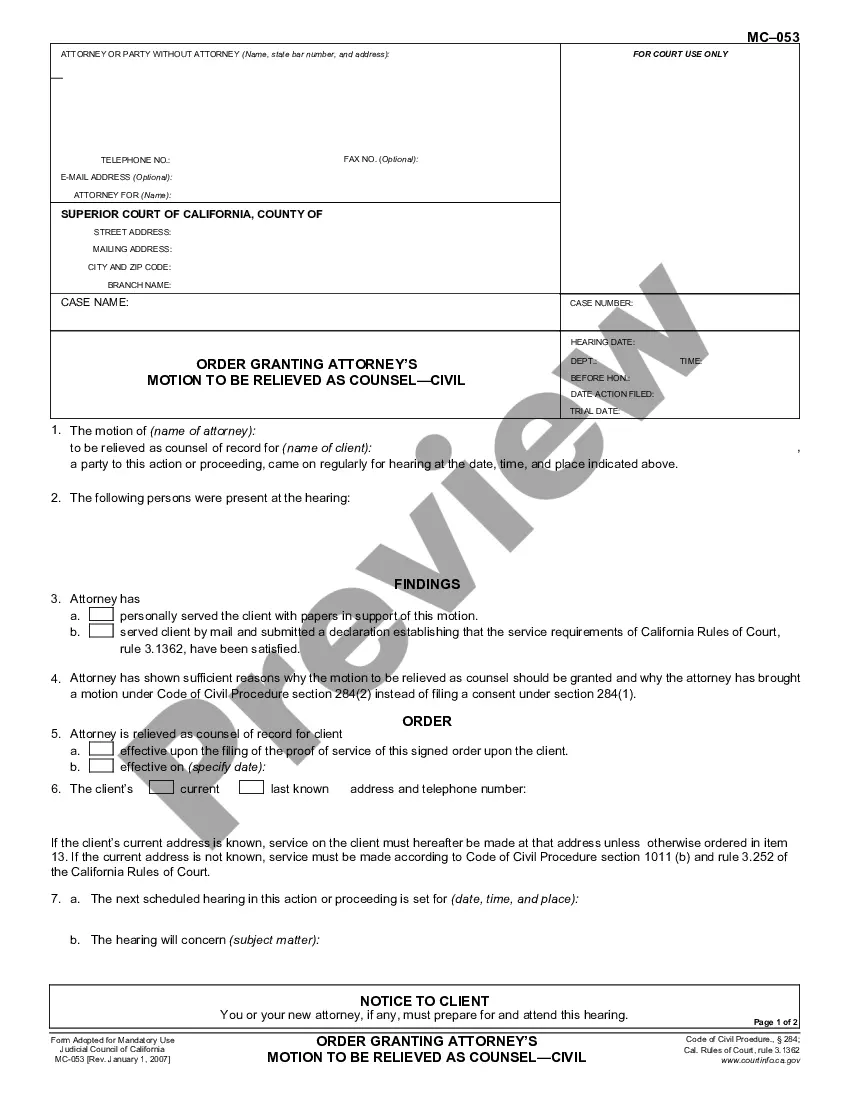

How to fill out Stock Retirement Agreement?

Are you currently in a circumstance that necessitates documentation for both business and personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the Kansas Stock Retirement Agreement, designed to comply with state and federal regulations.

Once you locate the correct form, simply click Buy now.

Choose the pricing plan you desire, fill out the required information to create your account, and complete the payment through your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Stock Retirement Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it aligns with the appropriate city/county.

- Use the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form does not match your needs, use the Search area to find the form that suits your requirements.

Form popularity

FAQ

KPERS benefits are subject to state taxes, but the rates and structures can vary. Understanding the tax implications of your KPERS benefits can help you better integrate them with other retirement strategies, such as a Kansas Stock Retirement Agreement. Consulting financial experts is recommended to ensure you maximize your retirement income while minimizing tax liabilities.

Yes, Kansas eliminated the taxation of Social Security benefits, creating a more favorable environment for retirees. This change means that seniors can keep more of their income while potentially utilizing options like a Kansas Stock Retirement Agreement to secure their financial future. It's essential to stay informed about state tax policies, as they can significantly impact your retirement planning.

The best state for avoiding taxes in retirement varies based on individual financial situations. Some states have no income tax, while others offer significant deductions on retirement income. However, Kansas is becoming increasingly attractive, especially with favorable conditions for a Kansas Stock Retirement Agreement, making it a competitive option for retirees.

As of 2024, Social Security income will not be taxed in Kansas, offering a financial relief for retirees. This decision helps residents retain more of their income, complementing other retirement plans like a Kansas Stock Retirement Agreement. Therefore, if you're planning for retirement, you can feel more secure knowing this income is exempt from state taxes.

Kansas offers several tax breaks aimed at seniors. These may include exemptions on certain forms of retirement income, which can include those derived from a Kansas Stock Retirement Agreement. By being aware of these benefits, seniors can effectively plan their retirement finances and minimize their tax burdens.

In Kansas, retirement income is generally taxed, but the specifics can depend on the source of the income. For instance, benefits from a Kansas Stock Retirement Agreement can have different tax implications compared to other retirement accounts. It's essential to consult a tax professional to understand how your retirement income may be impacted by Kansas tax laws.

The Kansas Public Employees Retirement System (KPERS) provides retirement benefits to state and local government employees in Kansas. KPERS operates through employee contributions and employer matching, ensuring you build a secure retirement fund. When drafting your Kansas Stock Retirement Agreement, knowing how KPERS functions will help you align your retirement savings effectively.

Yes, the state of Kansas does tax retirement income, although there are specific exemptions and considerations for retirees. Certain types of retirement income may be taxed differently, such as Social Security benefits. Understanding the tax implications of your Kansas Stock Retirement Agreement is essential to secure your financial future post-retirement.

Yes, Kansas state employees typically receive a pension as part of their retirement benefits. This pension is funded through contributions from both employees and the state. A Kansas Stock Retirement Agreement plays an essential role in ensuring you receive the full benefits of your pension plan as you prepare for retirement.

The Kansas State employee retirement system refers to a structured framework that provides retirement benefits to state employees. This system includes multiple plans designed to support employees throughout their retirement journey. Familiarizing yourself with your specific program under the Kansas Stock Retirement Agreement can help you navigate your retirement options and make informed decisions.