Kansas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

You might spend hours online attempting to locate the official document format that meets the state and federal requirements you need. US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Kansas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan from our platform.

If you already have a US Legal Forms account, you can sign in and click the Obtain button. After that, you can complete, modify, print, or sign the Kansas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan.

Once you have found the format you need, simply click Acquire now to proceed. Select the pricing plan you want, enter your credentials, and register for a free account on US Legal Forms. Complete the payment. You can use your Visa, Mastercard, or PayPal account to pay for the legal document. Retrieve the format of your document and download it to your device. Make modifications to the document if possible. You can complete, edit, sign, and print the Kansas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. Access and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- Every legal document template you obtain is yours permanently.

- To get another copy of any obtained form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, make sure you have chosen the correct document format for the area/city you select.

- Review the form details to confirm you have chosen the right template.

- If available, use the Preview button to view the document format as well.

- If you want to find another version of your template, use the Search field to locate the format that fits your needs and specifications.

Form popularity

FAQ

FHA loans are backed by the Federal Housing Administration and offered by FHA-approved lenders. Unlike FHA loans, conventional loans are not insured or guaranteed by the government. Mortgage insurance is mandatory with FHA loans; you can avoid it on a conventional loan by putting down at least 20%.

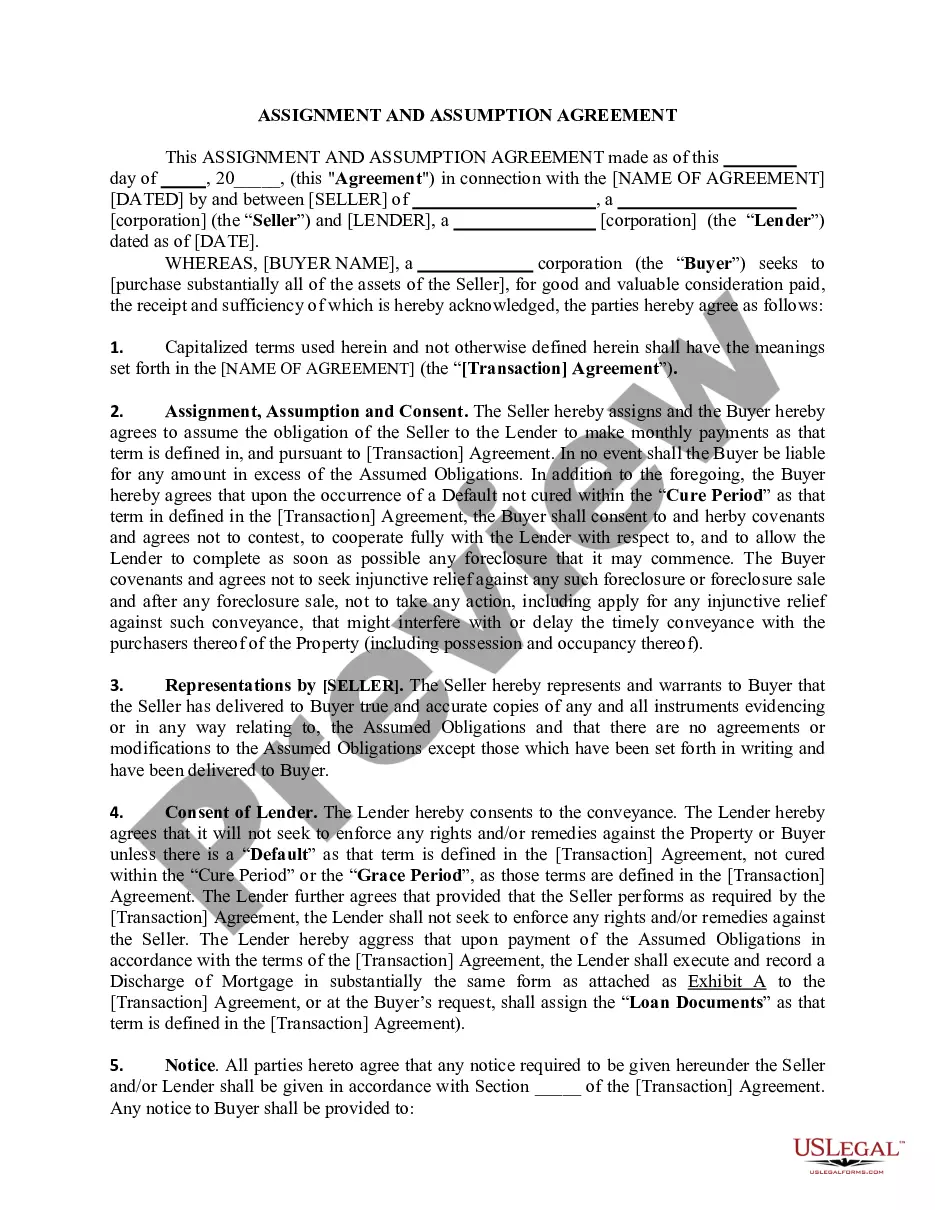

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

With other mortgage programs such as USDA loans or FHA (Federal Housing Administration) loans, you still have to pay PMI. Only the VA covers it as a way to make home ownership more available to military service members and eligible veterans.

The short answer is no. There is no monthly mortgage insurance with VA loans. Unlike regular loans, which require mortgage insurance if you put less than 20% down, VA loans do not add this cost to your monthly mortgage bill. However, there is a VA funding fee that serves a similar purpose.

Like the FHA loan program, the VA loan program is a government-insured mortgage program. Also, like FHA loans, VA loans are made by private lenders and banks. However, in the case of VA loans, The Department of Veterans Affairs backs or insures the loans.

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option. These are only general guidelines, though.

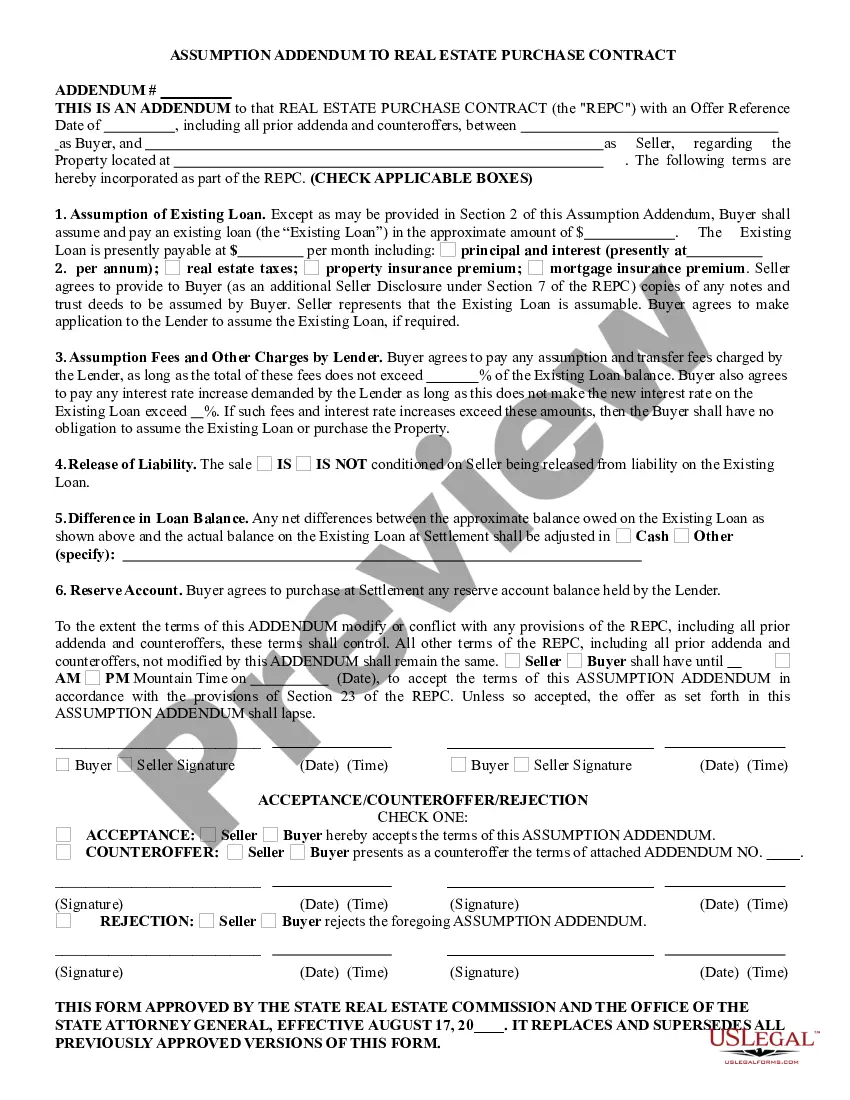

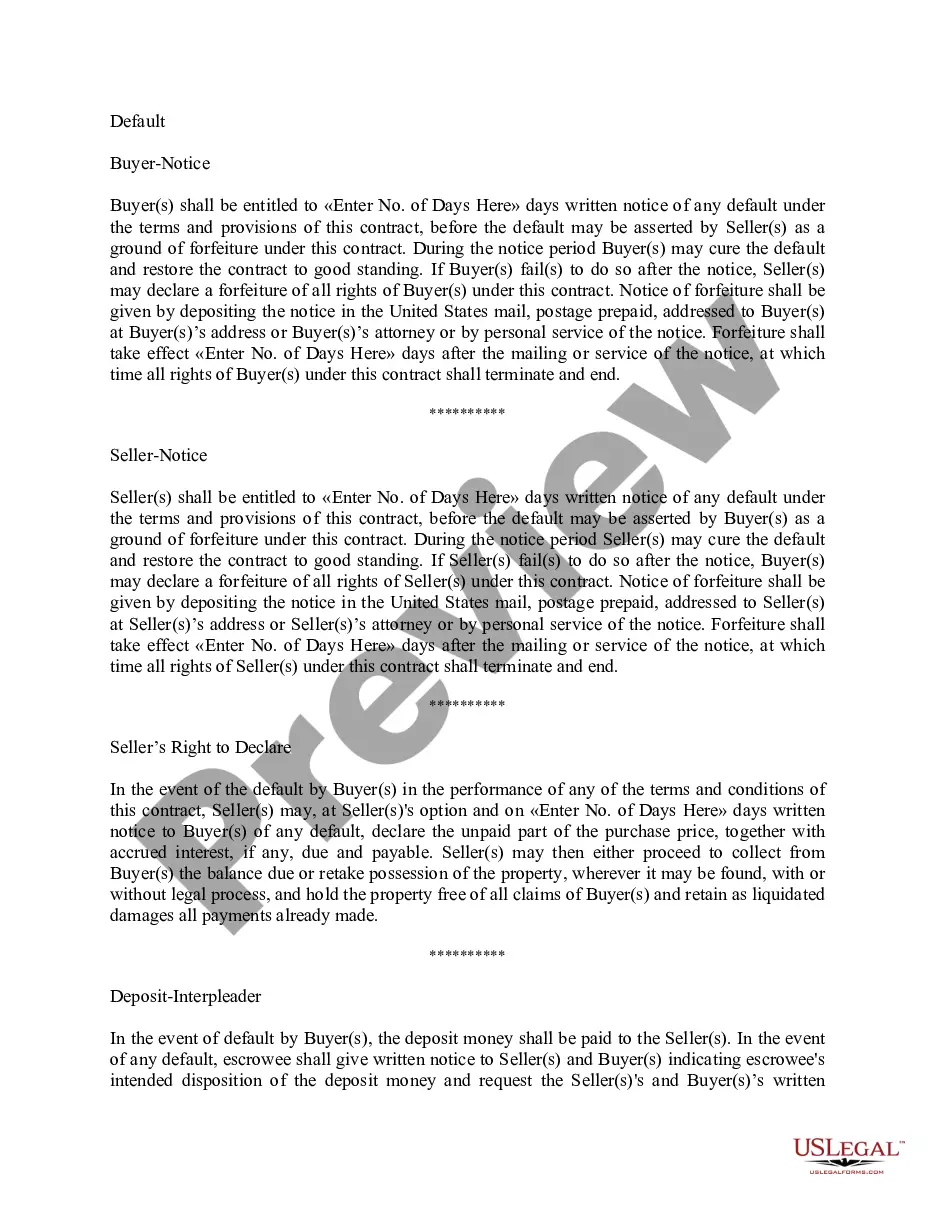

Addendum for Release of Liability on Assumed Loan and/or Restoration of Seller's VA Entitlement. Description: This Addendum is used in conjunction with the Loan Assumption Addendum if the Seller wants to be released from future liability of the loan.

FHA loans allow lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow slightly lower down payments. VA loans are reserved for those with VA eligibility and allow lower credit scores, zero down payment options.

The benefits of a VA loan include no down payment and no mortgage insurance requirements. VA loans also tend to have lower interest rates and looser credit standards. VA loan borrowers pay a funding fee, a one-time charge ranging up to 3.3 percent of the loan amount.