Kansas Construction Contract for Repairs

Description

How to fill out Construction Contract For Repairs?

Are you currently in a situation where you need documents for various business or specific purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers thousands of form templates, including the Kansas Construction Contract for Repairs, which are designed to comply with federal and state regulations.

Once you find the suitable form, click Get now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and process your order using PayPal or a debit/credit card. Select a convenient document format and download your copy. You can access all the document templates you have purchased in the My documents section. You can obtain another copy of the Kansas Construction Contract for Repairs at any time, if necessary. Just click on the relevant form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates for a variety of applications. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Kansas Construction Contract for Repairs template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct region.

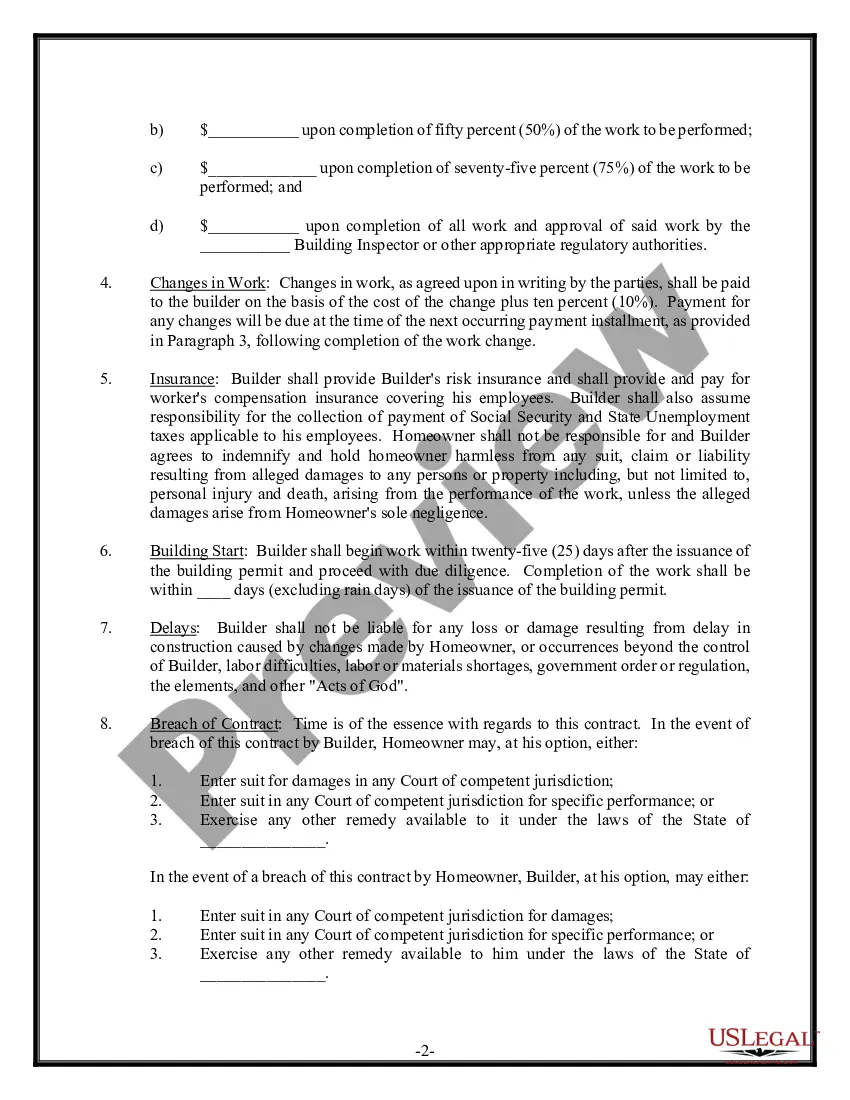

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your criteria, make use of the Search field to locate a template that suits your needs.

Form popularity

FAQ

Sales Tax Exemptions in KansasAll construction materials and prescription drugs (including prosthetics and devices used to increase mobility) are considered to be exempt. While groceries are not tax exempt, any food that is used to provide meals for the elderly or homebound is considered to be exempt from taxes.

However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers. Generally, if you perform taxable labor in California, you must obtain a seller's permit and report and pay tax on your taxable sales.

GENERAL RULE: MATERIALS ARE TAXABLE All contractors (whether contractors or contractor-retailers) are considered to be the final user or consumer of the materials they install for others, and must pay Kansas sales or use tax on them. Under K.S.A.

As a general rule, all of these items are subject to sales tax when purchased by contractors and subcontractors. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule).

Kansas sales tax is due on the total charge to the customer on the repair of tangible personal property. These are retail sales and as such, the sale of an appliance, repair parts and labor are all subject to sales tax and should be billed and collected from the repairman's customer on the total amount billed.

Kansas imposes a 6.5 percent (effective July 1, 2015) percent state retailers' sales tax, plus applicable local taxes on the: Retail sale, rental or lease of tangible personal property; Labor services to install, apply, repair, service, alter, or maintain tangible personal property, and.

Lien must be filed within 4 months of last providing materials or labor, unless a one-month extension is filed and served. Action to enforce a Kansas mechanics lien must be commenced within 1 year of filing the lien.

Kansas imposes a 6.5 percent (effective July 1, 2015) percent state retailers' sales tax, plus applicable local taxes on the: Retail sale, rental or lease of tangible personal property; Labor services to install, apply, repair, service, alter, or maintain tangible personal property, and.