Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms

Description

How to fill out Obtain Credit Card For An Officer - Corporate Resolutions Forms?

You can invest hours on the internet looking for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast collection of legal forms that have been evaluated by experts.

You can conveniently obtain or create the Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms from the service.

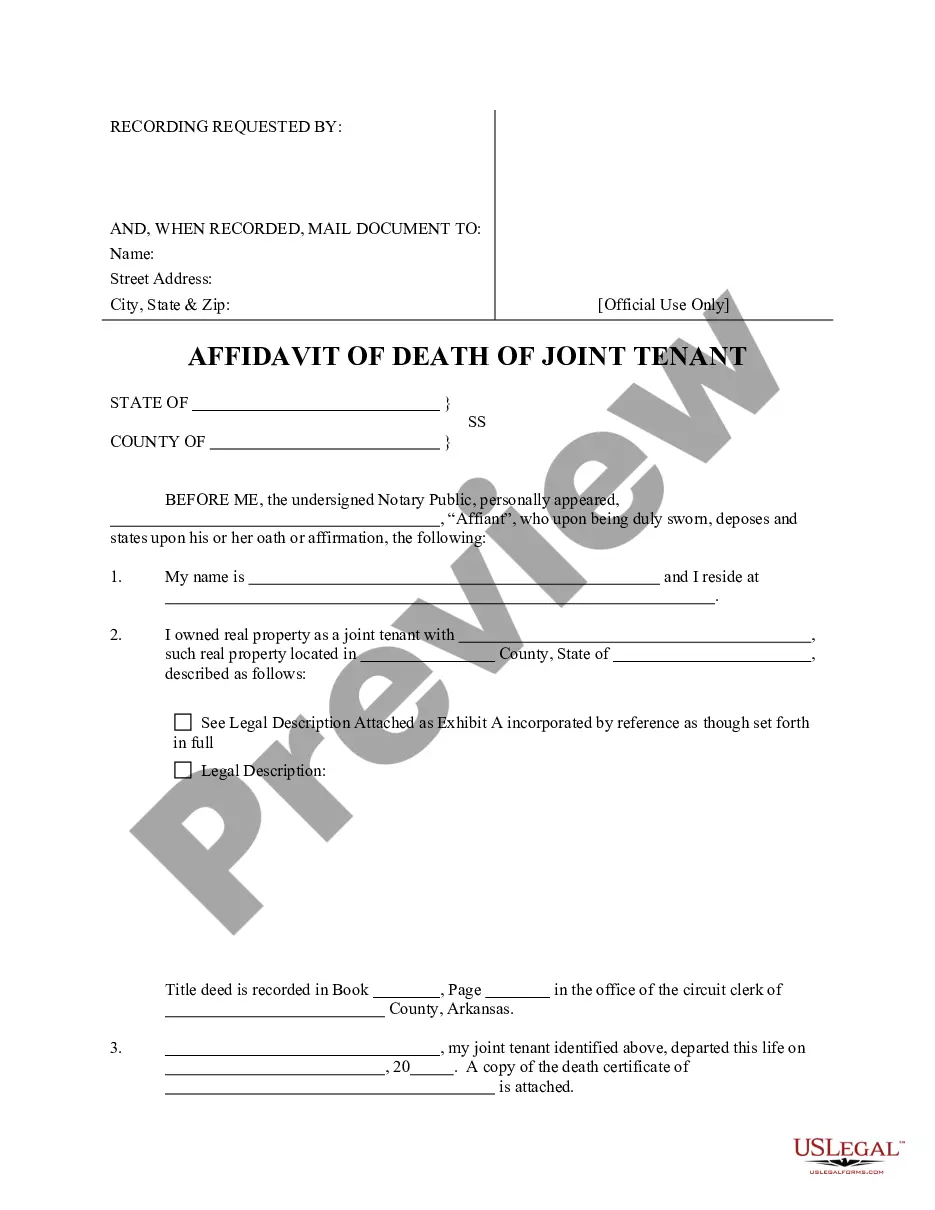

If available, utilize the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can complete, modify, create, or sign the Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the acquired form, navigate to the My documents tab and click the appropriate option.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- Firstly, confirm that you have selected the correct document template for your desired region/city.

- Review the form details to ensure that you have chosen the right form.

Form popularity

FAQ

While some may find it difficult to obtain a corporate credit card, the process can be manageable with the right preparation. Having a good credit score and sound financial statements enhances the likelihood of approval. Building relationships with lenders and understanding their requirements will also help. Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms offers valuable resources to simplify your application.

Typically, business owners, authorized officers, and designated employees can be eligible for a corporate credit card. Eligibility requirements may vary by lender and often include a review of the business's financial health and credit history. It’s vital to check the specific criteria for each card issuer. Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms helps ensure you have the right documents to establish eligibility.

Obtaining a business credit card can be straightforward if your business has a solid financial foundation. Lenders evaluate credit history, business income, and other factors during the approval process. Preparing your documentation and financial statements can ease the journey. Consider using Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms to streamline your application process.

Securing a corporate credit card with bad credit is challenging, but not impossible. Some lenders specialize in offering credit options to businesses with lower credit ratings. It's essential to enhance your business's financial profile and prepare strong supporting documents. Utilizing Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms can provide the crucial forms needed to present your case effectively.

Typically, the business owner or an authorized officer is responsible for corporate credit cards. This accountability includes ensuring that all transactions are appropriate and properly documented. The card's transactions should align with the business’s financial goals and policies. If you need guidance on setting up responsibilities, Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms can help.

To obtain a corporate credit card, most issuing companies prefer a credit score of at least 700. However, some may offer options for scores as low as 650, especially if you provide strong business financials. Keep in mind that a higher score can result in better terms. If you need assistance in navigating these options, consider using Kansas Obtain Credit Card for an Officer - Corporate Resolutions Forms.

Starting an LLC in Kansas requires several steps, including selecting a unique name for your business and filing Articles of Organization with the Secretary of State. You will also need to create an operating agreement, which outlines the management structure. Once your LLC is established, you can use Corporate Resolutions Forms to obtain a credit card for an officer in a seamless manner, ensuring that all aspects of your business are covered.

Forming an LLC in Kansas typically takes about 3 to 5 business days if you file online. However, if you choose to file by mail, it may take considerably longer. Once your LLC is established, you can easily manage other aspects, such as obtaining a credit card for your officer, using Corporate Resolutions Forms. Keeping everything organized helps streamline the entire process.

A credit card authorization form should begin with your full name and the details of the card, including the card number and expiration date. Include the name of the person you are authorizing and a clear statement of the authorization parameters, such as the amount and duration. To simplify this process, consider using US Legal Forms, which provides customizable templates for corporate resolutions and authorizations.

To give someone permission to use your credit card, you can write a permission letter or use a formal authorization form, which specifies the cardholder's details and the authorized user's information. Clearly outline the purpose and limits of the authority granted. Utilizing online resources like US Legal Forms can help you find the right templates to ensure this process is secure and transparent.