Kansas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What is this form?

The Fiduciary Deed is a legal document utilized by Executors, Trustees, Trustors, Administrators, and other Fiduciaries to transfer property ownership on behalf of an estate or trust. This form differs from a standard warranty deed as it specifically allows fiduciaries to fulfill their responsibilities in managing and distributing assets according to a will or trust agreement.

Form components explained

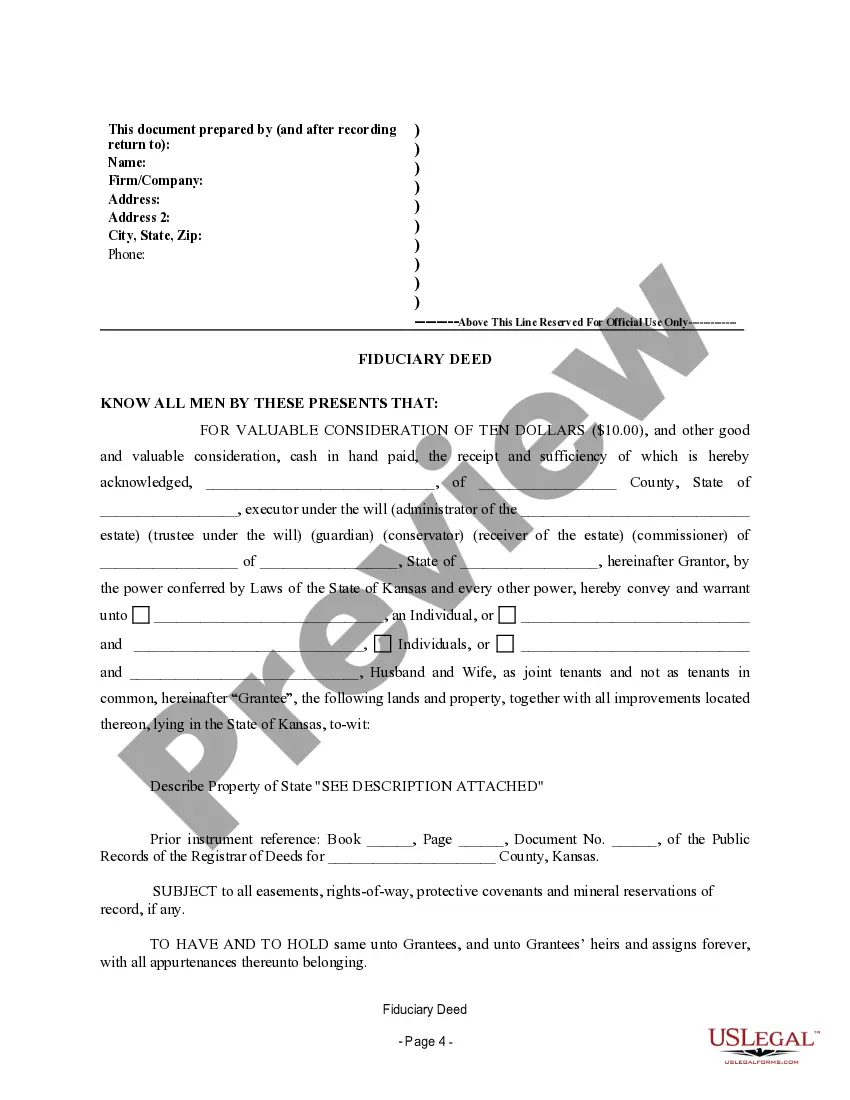

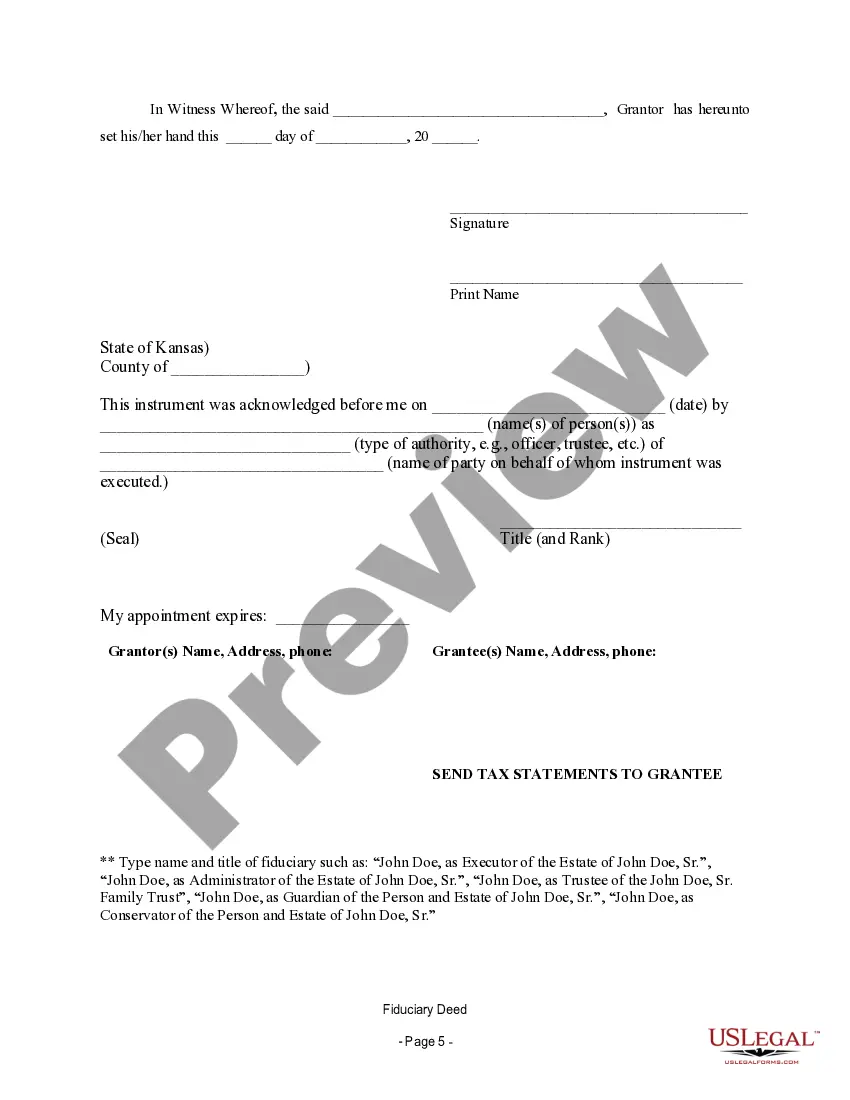

- Identification of the Grantor: This section requires the name and title of the fiduciary executing the deed.

- Property Description: This includes legal details about the property being transferred.

- Grantee Information: The name(s) of the individual or entity receiving the property must be provided.

- Signatures: The Grantor must sign the document to effectuate the transfer.

- Notarization Section: A section for the notarization of the document, affirming its authenticity.

Situations where this form applies

This form should be used when a fiduciary, such as an executor of a will or a trustee of a trust, needs to transfer property as part of their legal duties. Examples include situations where an executor is settling an estate or when a trustee is distributing trust assets to beneficiaries. It is essential to have this document in place to legally formalize the transfer of property rights.

Who needs this form

- Executors assigned to manage an estate after someone's passing.

- Trustees responsible for overseeing the distribution of assets from a trust.

- Trustors who are establishing the transfer of property as part of a trust agreement.

- Administrators overseeing an estate for which no will exists.

- Guardians or conservators managing property for someone unable to do so themselves.

How to prepare this document

- Identify the Grantor: Enter the full name and title of the fiduciary signing the deed.

- Fill in Property Details: Provide a detailed description of the property being transferred.

- Specify the Grantee: Include the name(s) of the individual or entity receiving the property.

- Obtain Necessary Signatures: The Grantor must sign the deed in the designated area.

- Have the Document Notarized: Ensure the deed is notarized to confirm its authenticity.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to properly identify the Grantor and Grantee, which can lead to legal disputes.

- Not providing a complete legal description of the property, which is essential for clear title transfer.

- Forgetting to sign the document or have it notarized, making it invalid for legal use.

Advantages of online completion

- Convenience: Easily download the form anytime from anywhere.

- Editability: The digital format allows for quick updates and changes before printing.

- Reliability: Forms are drafted by licensed attorneys, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

(c) The Mortgagor has paid off all the dues of the Mortgagee under the said Deed in full and the Mortgage debt stands satisfied in full. (d) In the circumstances, the Mortgagor has requested the Mortgagee to execute the reconveyance of Mortgaged property to which the Mortgagee has agreed as appearing hereinafter.

A deed of reconveyance refers to a document that transfers the title of a property to the borrower from the bank or mortgage holder once a mortgage is paid off. It is used to clear the deed of trust from the title to the property.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

When you sign a trust deed, you agree to make affordable monthly payments over a fixed period of up to four years to reduce your debts. At the end of the four-year period, any remaining debts will be written off. In other words, you will have nothing more to pay.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Upon the return receipt of the Address Verification Letter, the property reconveyance process will begin. Once all the paperwork has been received by the Administrative Office, it may take up to thirty (30) calendar days to process. The deeds of trust are processed in the sequence received.

In real estate in the United States, a deed of trust or trust deed is a legal instrument which is used to create a security interest in real property wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender.