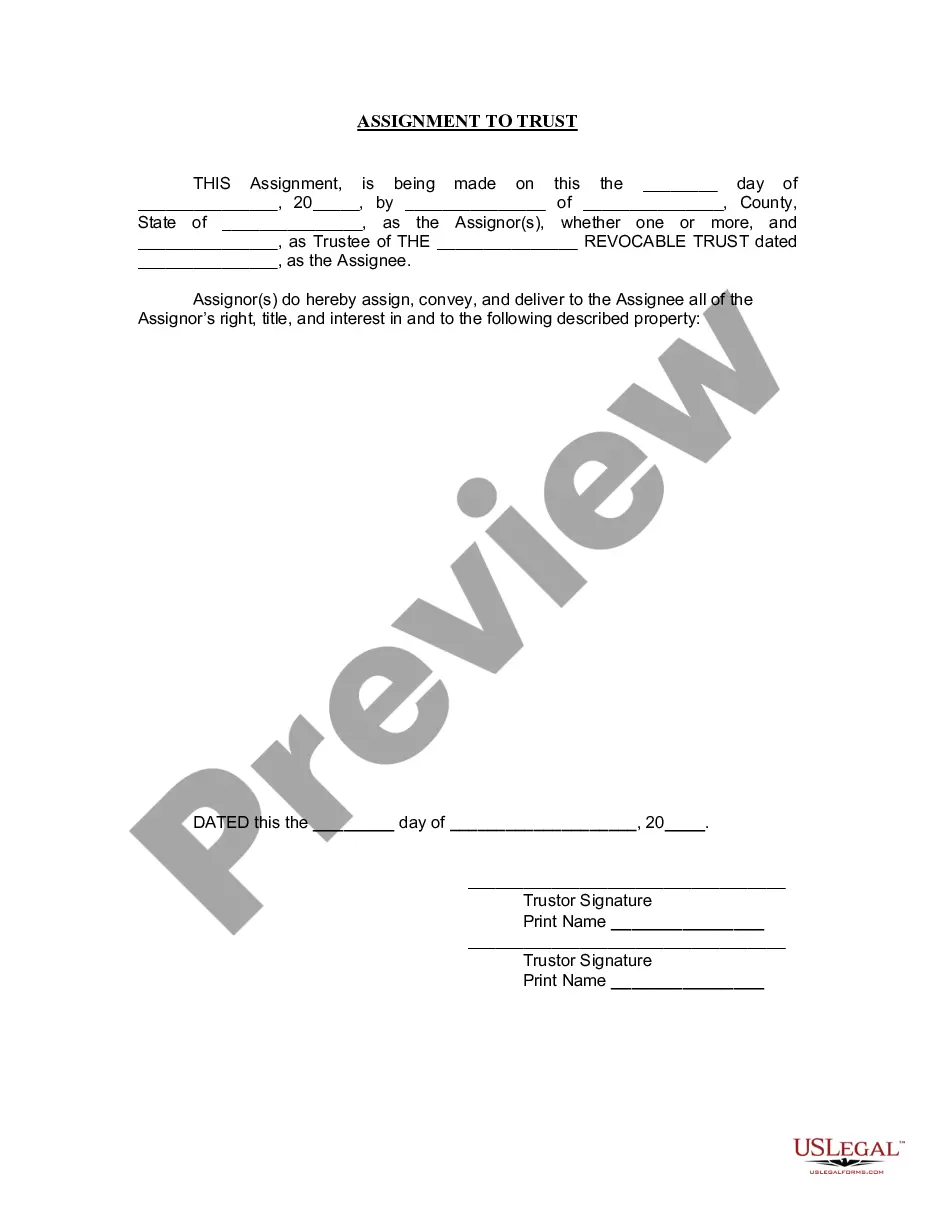

Kansas Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

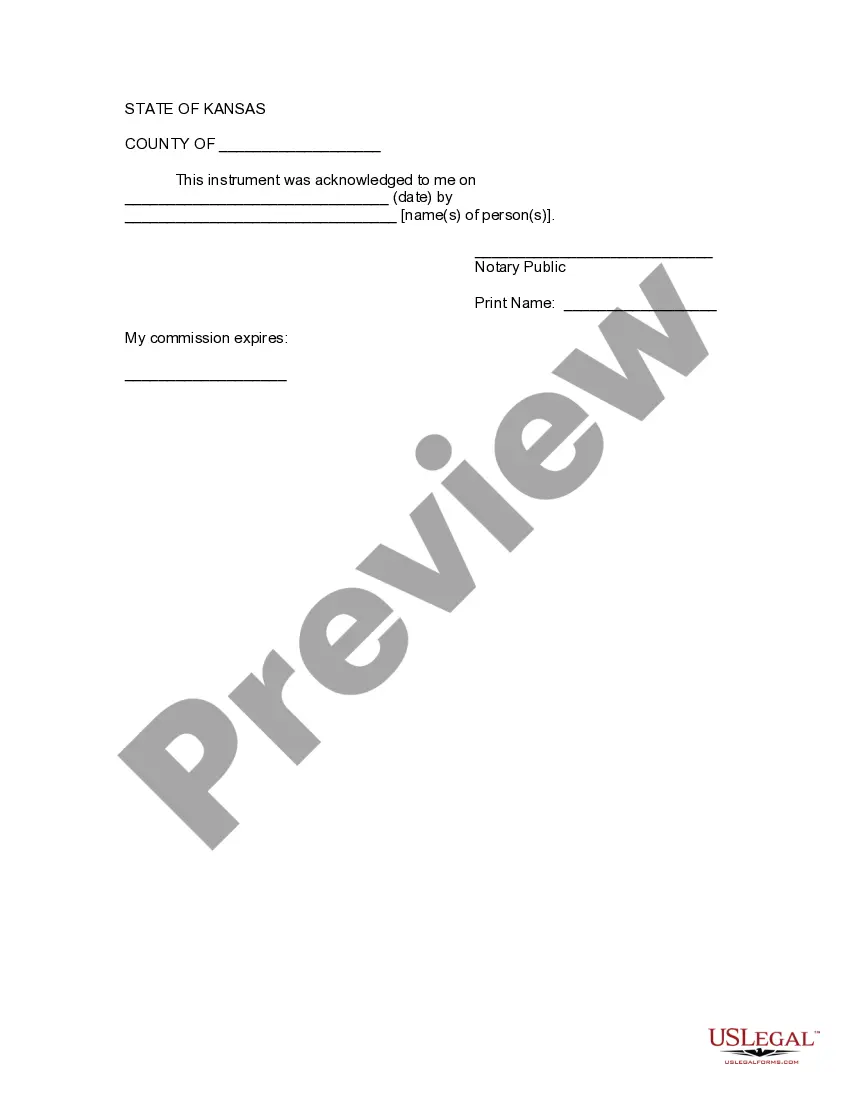

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kansas Assignment To Living Trust?

Locating a Kansas Assignment to Living Trust specimen and completing it can be relatively difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in merely a few clicks.

Our legal experts create each document, so you just need to fill them in.

Select your payment method on the pricing page and create an account. Choose whether you want to pay by card or through PayPal. Save the template in your preferred format. You can either print the Kansas Assignment to Living Trust form or fill it out using any online editor. There is no need to worry about making errors since your template can be used and submitted, as well as printed multiple times. Experience US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and navigate back to the form's page to save the document.

- Your saved templates are stored in My documents and are accessible at any time for future use.

- If you haven’t signed up yet, you need to register.

- Review our comprehensive instructions on how to obtain your Kansas Assignment to Living Trust template in just a few minutes.

- To receive a valid sample, verify its relevance for your state.

- Examine the template using the Preview feature (if available).

- If there's a description, read it to comprehend the details.

- Click Buy Now if you found what you are seeking.

Form popularity

FAQ

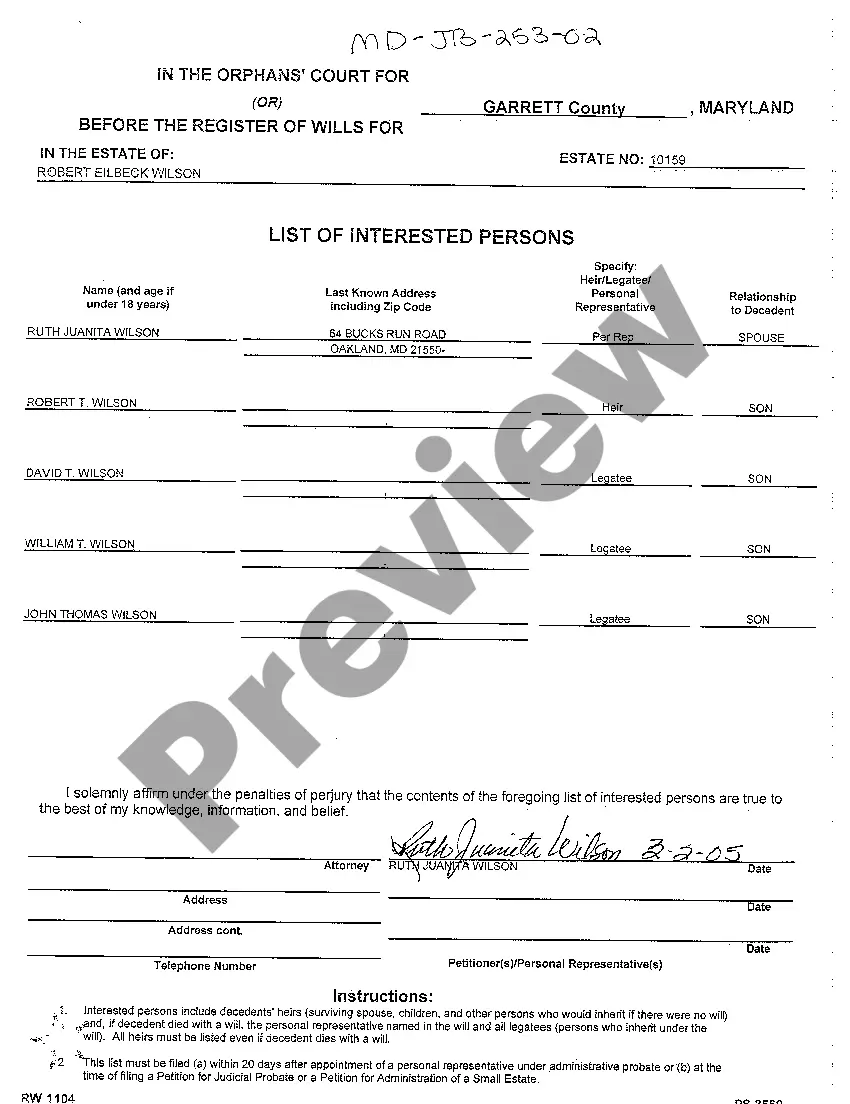

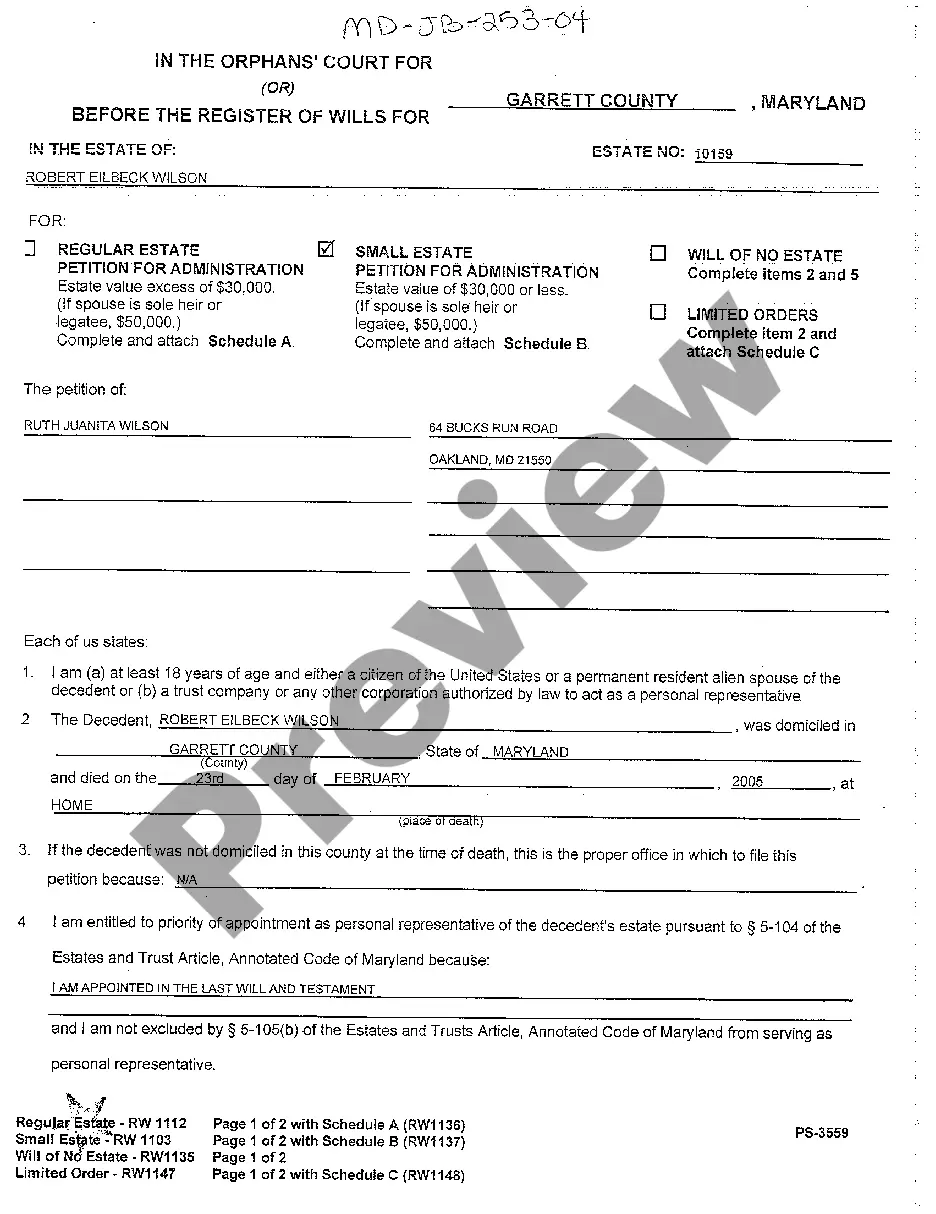

Get death certificates. find and file the will with the local probate court. notify the Social Security Administration of the death. notify the state Department of Health. identify the trust beneficiaries. notify the beneficiaries. inventory trust assets. protect trust property.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

A trust can be fairly easy to set up, so a lawyer is not always necessary. However, a person with a large or complex estate or a unique situation may want to consult with an estate planning attorney for help with setting up a trust.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

Select the type of trust that best suits your current situation. Take inventory on your property. Select your trust's trustee. Create a trust document. Sign the trust document in front of a notary public. Fund the trust by transferring property and assets into it.