This form is an official UCC which complies with all applicable Federal codes and statutes. USLF updates all Federal forms as is required by Federal statutes and law.

Indiana UCC1 Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana UCC1 Financing Statement?

Locating Indiana UCC1 Financing Statement templates and completing them can pose a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms to find the appropriate template specifically for your state with just a few clicks.

Our attorneys prepare every document, so all you need to do is complete them. It is truly effortless.

Select your plan on the pricing page and set up an account. Choose whether to pay by card or via PayPal. Save the document in your preferred file format. You can print the Indiana UCC1 Financing Statement form or complete it using any online editor. Don’t worry about typos since your template can be utilized, sent, and published as often as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your downloaded forms are stored in My documents and are available at any time for future use.

- If you haven’t registered yet, you need to sign up.

- Refer to our comprehensive instructions on obtaining the Indiana UCC1 Financing Statement form within minutes.

- To acquire a valid template, verify its eligibility for your state.

- Review the template using the Preview option (if available).

- If there's a description, read it to understand the details.

- Click on the Buy Now button if you have found what you are looking for.

Form popularity

FAQ

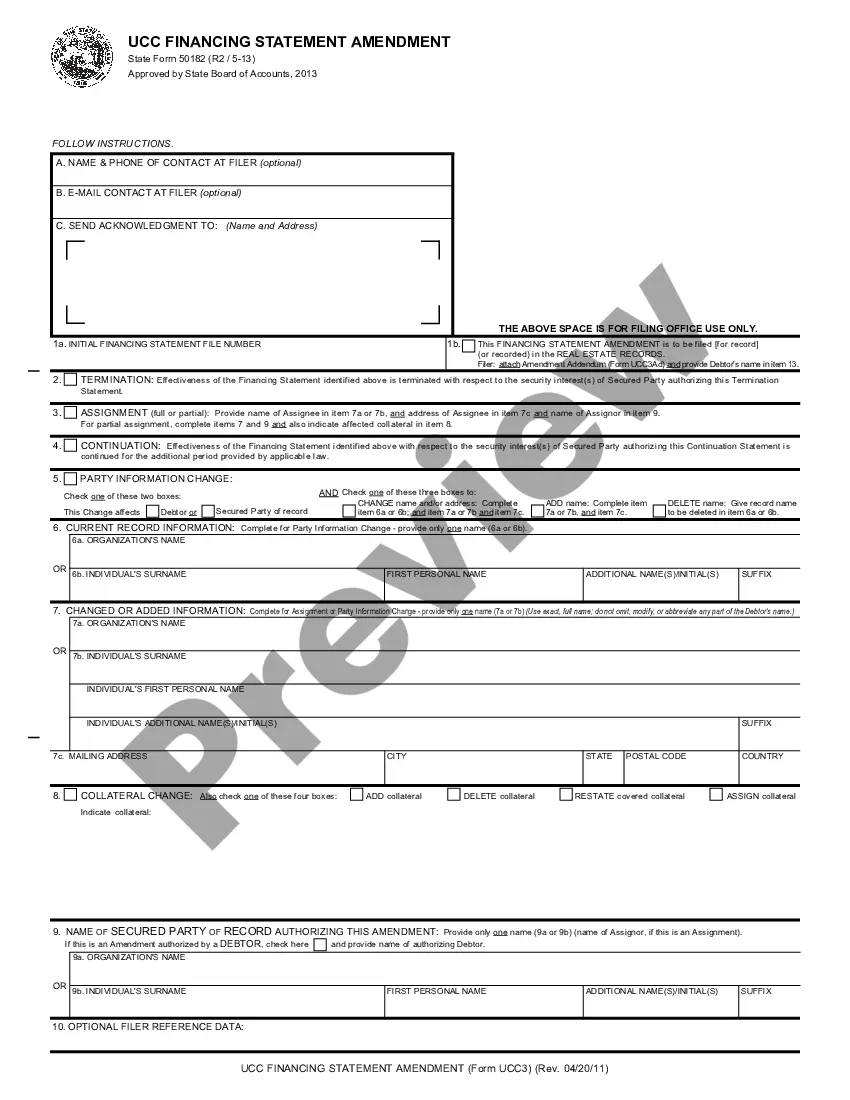

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

A UCC-Uniform Commercial Code-1 statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans.These forms must be filed with agencies located in the state where the borrower's business is incorporated.

Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

Having a UCC filed on your business credit report can have negative effects in general on your overall credit risk, scoring and other associated risk analysis, (across all three business credit bureaus) and can even kill your chances at getting financing for your business.