Every employer of workers with disabilities under special minimum wage certificates authorized by the Fair Labor Standards Act, the McNamara-O'Hara Service Contract Act, and/or the Walsh-Healey Public Contracts Act shall display a poster prescribed by the Wage and Hour Division explaining the conditions under which special minimum wages may be paid. The poster shall be posted in a conspicuous place on the employer's premises where employees and the parents or guardians of workers with disabilities can readily see it.

Indiana Notice to Workers with Disabilities Paid at Special Minimum Wages

Description

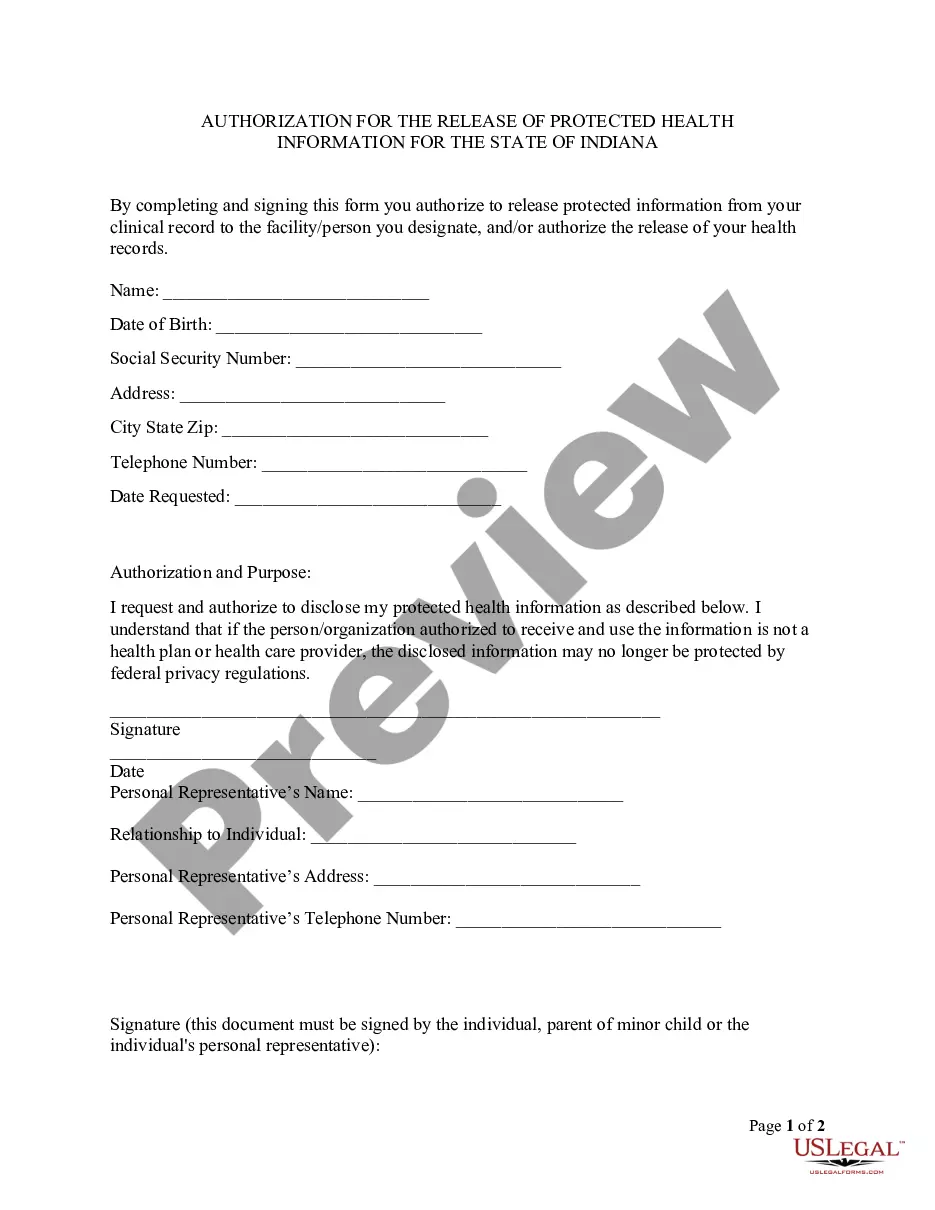

How to fill out Notice To Workers With Disabilities Paid At Special Minimum Wages?

It is feasible to invest time online trying to locate the appropriate legal document template that meets the federal and state requirements you have. US Legal Forms offers a vast collection of legal forms that are reviewed by experts.

You can easily download or print the Indiana Notice to Workers with Disabilities Paid at Special Minimum Wages from the service. If you already possess a US Legal Forms account, you can Log In and click on the Acquire button. After that, you can complete, modify, print, or sign the Indiana Notice to Workers with Disabilities Paid at Special Minimum Wages.

Every legal document template you obtain is yours indefinitely. To get another copy of a purchased form, go to the My documents tab and click on the respective button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the area/town of your preference. Review the form details to confirm you have chosen the right one. If available, use the Review button to preview the document template as well.

Utilize professional and state-specific templates to manage your business or personal needs.

- If you wish to find another version of your form, use the Search field to locate the template that suits your needs.

- Once you have found the template you want, click Buy now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

- Choose the format of your document and download it to your device.

- Make edits to your document if needed. You can complete, modify, and sign and print the Indiana Notice to Workers with Disabilities Paid at Special Minimum Wages.

- Obtain and print a vast array of document templates using the US Legal Forms website, which offers the largest selection of legal forms.

Form popularity

FAQ

To obtain a 147c letter, you need to contact the IRS directly. This letter verifies your Employer Identification Number (EIN), which is essential for compliance with the Indiana Notice to Workers with Disabilities Paid at Special Minimum Wages. You can request the letter by calling the IRS or sending a formal request through their website.

In Indiana, certain individuals are exempt from the minimum wage, particularly those with disabilities who may be paid at special minimum wage rates under Section 14(c). These exemptions are designed to encourage employment opportunities for individuals with disabilities. However, the Indiana Notice to Workers with Disabilities Paid at Special Minimum Wages plays a crucial role in informing these workers about their rights and wages.

The 14c proposed rule aims to amend the Fair Labor Standards Act to enhance protections for workers with disabilities. Specifically, this rule seeks to limit the use of special minimum wage certificates provided under Section 14(c). As part of this effort, the Indiana Notice to Workers with Disabilities Paid at Special Minimum Wages will provide clearer guidelines and ensure these workers understand their rights.

In 2023, the minimum wage rates for 25 or fewer employees will increase to $15 to match their larger counterparts, which will stay the same.

Indiana Minimum Wage for 2021, 2022. Indiana's state minimum wage rate is $7.25 per hour. This is the same as the current Federal Minimum Wage rate. The minimum wage applies to most employees in Indiana, with limited exceptions including tipped employees, some student workers, and other exempt occupations.

Indiana does not have any laws addressing when or how an employer may reduce an employee's wages or whether an employer must provide employees notice prior to instituting a wage reduction.

As of January 1, 2022, the District of Columbia had the highest minimum wage in the U.S., at 15.2 U.S. dollars per hour. This was followed by California, which had 15 U.S. dollars per hour as the state minimum wage.

Basic Wage Standards Covered, nonexempt workers are entitled to a minimum wage of $7.25 per hour effective July 24, 2009.

A worker earning 2022's NLW rate of £9.50 an hour will earn A£18,525 a year. A full research briefing is available from the Resolution Foundation on key factors behind the rate calculation and its rise this year.

It does not matter how small an employer is, they still have to pay the correct minimum wage.