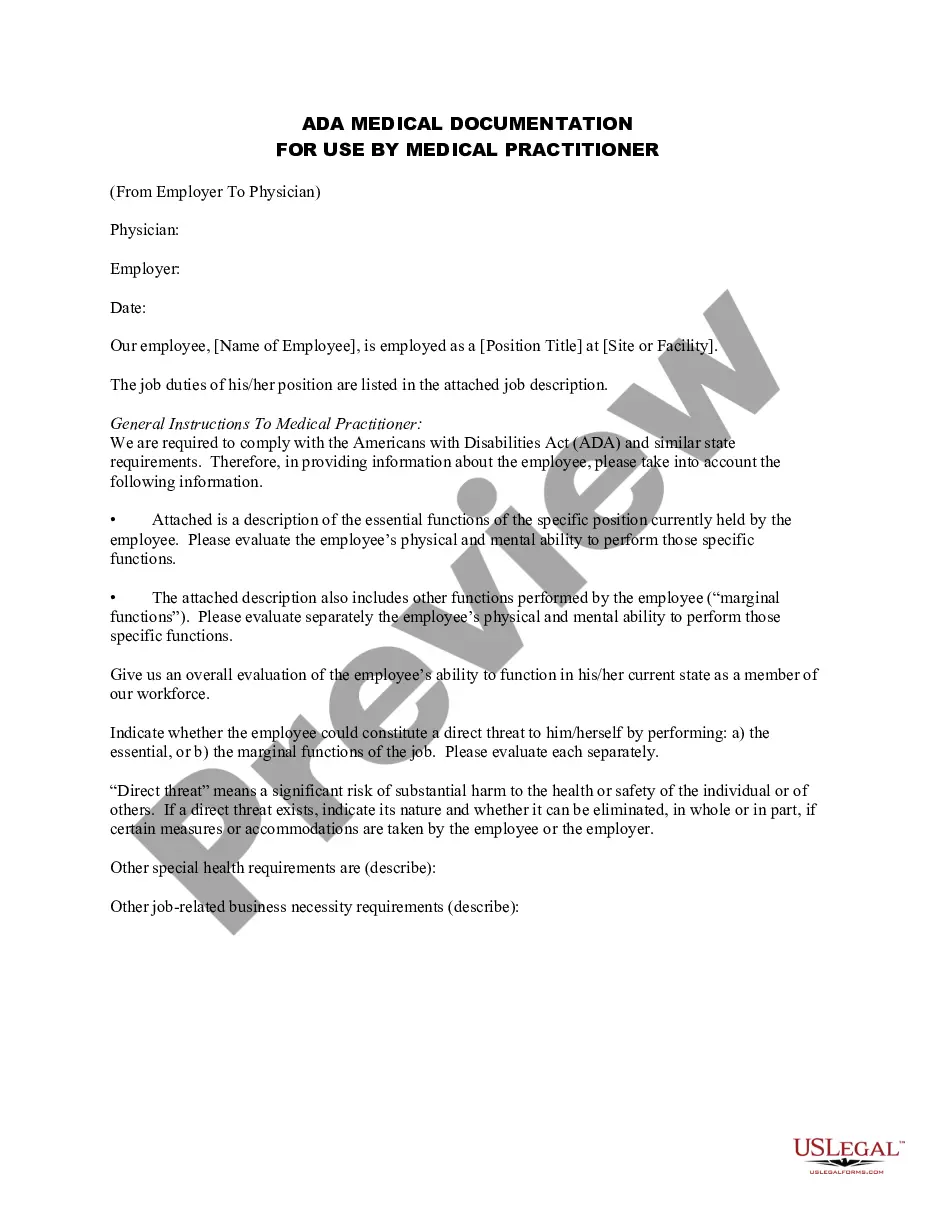

The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

Indiana Nonemployee Director Stock Option Plan

Description

How to fill out Nonemployee Director Stock Option Plan?

Choosing the best authorized papers format might be a battle. Obviously, there are a variety of themes available on the net, but how do you find the authorized kind you need? Utilize the US Legal Forms internet site. The assistance provides a huge number of themes, including the Indiana Nonemployee Director Stock Option Plan, which you can use for organization and personal requires. Every one of the types are inspected by experts and meet federal and state specifications.

If you are already signed up, log in for your profile and then click the Acquire button to have the Indiana Nonemployee Director Stock Option Plan. Make use of your profile to appear with the authorized types you may have bought in the past. Proceed to the My Forms tab of your profile and have another version from the papers you need.

If you are a brand new user of US Legal Forms, allow me to share straightforward recommendations that you can adhere to:

- Initially, make certain you have chosen the right kind for your personal city/state. You can check out the shape utilizing the Review button and look at the shape outline to ensure this is the right one for you.

- In the event the kind does not meet your preferences, take advantage of the Seach discipline to discover the correct kind.

- Once you are positive that the shape is proper, click the Acquire now button to have the kind.

- Pick the rates plan you need and enter in the essential information and facts. Design your profile and purchase the order with your PayPal profile or credit card.

- Opt for the data file format and down load the authorized papers format for your system.

- Complete, edit and print and indication the attained Indiana Nonemployee Director Stock Option Plan.

US Legal Forms may be the most significant collection of authorized types where you can see numerous papers themes. Utilize the service to down load skillfully-made documents that adhere to status specifications.

Form popularity

FAQ

Also, exercising a stock option merely means an employee is purchasing stock, and stocks themselves don't generate tax liabilities ? selling them does. So, there are ordinary income tax and capital gains taxes to take into account, too.

A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date. Learn more about how they work. Stock compensation refers to the practice of rewarding employees with stock options that will vest, or become available for purchase, at a later date.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.

The employee is under no obligation to purchase all or part of the number of shares noted in the option. The choice is theirs and they can normally purchase stock at any point during the time period between the offer and last exercise date.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

The price that you will pay for those options is set in the contract that you signed when you started. You may hear people refer to this price as the grant price, strike price or exercise price. No matter how well (or poorly) the company does, this price will not change.

Share option plans have become a popular form of employee compensation in the corporate world. These plans provide employees and directors with the opportunity to purchase company shares at a predetermined price within a specified timeframe.