This is a "Right of First Refusal and Co-Sale Agreement." It is entered into by the corporation and the purchasers of preferred stock. It gives the company and the purchasers of preferred stock certain rights of refusal and options upon the transfer of stock.

Indiana Right of First Refusal and Co-Sale Agreement

Description

How to fill out Right Of First Refusal And Co-Sale Agreement?

Are you in the position the place you need to have documents for either enterprise or specific reasons virtually every time? There are plenty of authorized record templates accessible on the Internet, but locating versions you can depend on is not easy. US Legal Forms delivers a huge number of kind templates, just like the Indiana Right of First Refusal and Co-Sale Agreement, which can be written in order to meet federal and state demands.

In case you are presently familiar with US Legal Forms web site and get your account, simply log in. After that, you are able to obtain the Indiana Right of First Refusal and Co-Sale Agreement design.

If you do not come with an bank account and would like to begin to use US Legal Forms, follow these steps:

- Get the kind you require and ensure it is for your appropriate area/region.

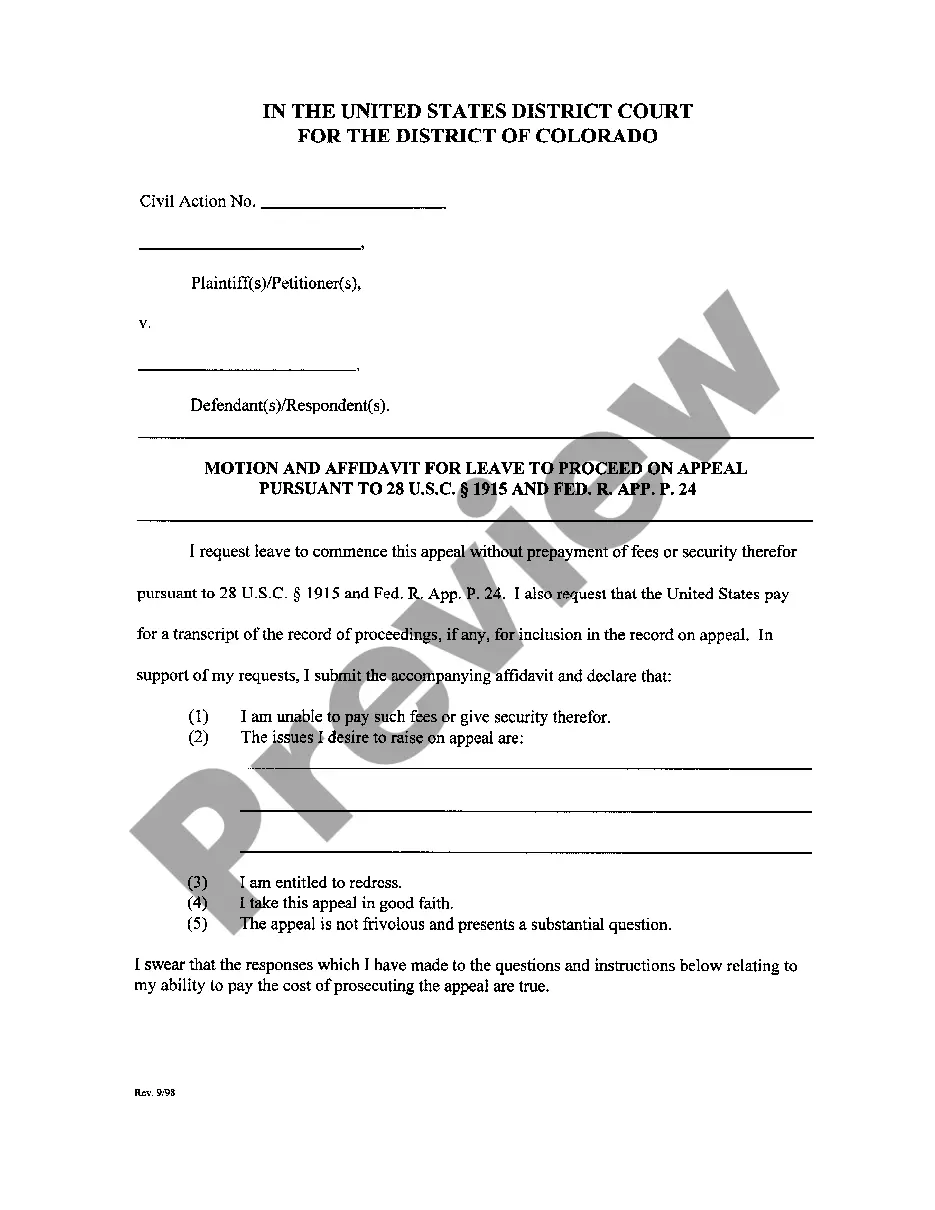

- Utilize the Review key to examine the form.

- Browse the explanation to actually have selected the right kind.

- In case the kind is not what you`re trying to find, use the Look for area to get the kind that suits you and demands.

- When you discover the appropriate kind, click Purchase now.

- Choose the pricing prepare you need, submit the required info to generate your money, and buy the order using your PayPal or charge card.

- Select a practical file structure and obtain your backup.

Find each of the record templates you have bought in the My Forms food selection. You can aquire a extra backup of Indiana Right of First Refusal and Co-Sale Agreement at any time, if needed. Just go through the needed kind to obtain or produce the record design.

Use US Legal Forms, the most comprehensive selection of authorized varieties, to save efforts and stay away from blunders. The service delivers appropriately made authorized record templates which can be used for a range of reasons. Make your account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

There are drawbacks for the buyer as well: ROFR time limits: When the seller lists the property, the potential buyer needs to be financially prepared to buy the property for the agreed price in the purchase agreement, typically within a matter of days. Prices often pre-negotiated: This can also be a con for a buyer.

Right of first refusal and co-sale agreement or ROFR for short, involves an agreement or clause that mandates a party provides notice before a transaction. Additionally, this agreement requires that an option is provided for the other party to refuse this transaction.

ROFR is a contractual obligation that binds both a prospective real estate buyer ? for example, a potential homeowner looking for an apartment, condo or single-family residence ? and a seller.

A right of first refusal?often abbreviated as ?ROFR? (pronounced ?roafer?)?gives the holder of the right ?first dibs? on any potential share sale. Also known as a ?last look? provision, ROFRs are a common feature in venture financings.

Is the right of first refusal a good idea? The right of first refusal can be a good idea in that it allows a potential buyer to have first dibs on a property, providing a sense of security and control. Sellers don't have to worry about listing the property and can save it for preferred buyers.

The Cons: For buyers, the ROFR can last only for a limited time in which they have to act. If the buyer with the right is unable to put an offer or negotiate with the seller within the time frame, they will lose this right and the seller would have the right to accept offers from other potential buyers.

Some agreements only let the holder make an offer at the end of the term, while people can use others anytime. ROFRs usually last one or two years since longer terms are riskier.

Right of first refusal is common for renters who may want the option to buy their current rental property at the end of their lease. With ROFR, they get the opportunity to make an offer on the property before the landlord starts accepting public offers.