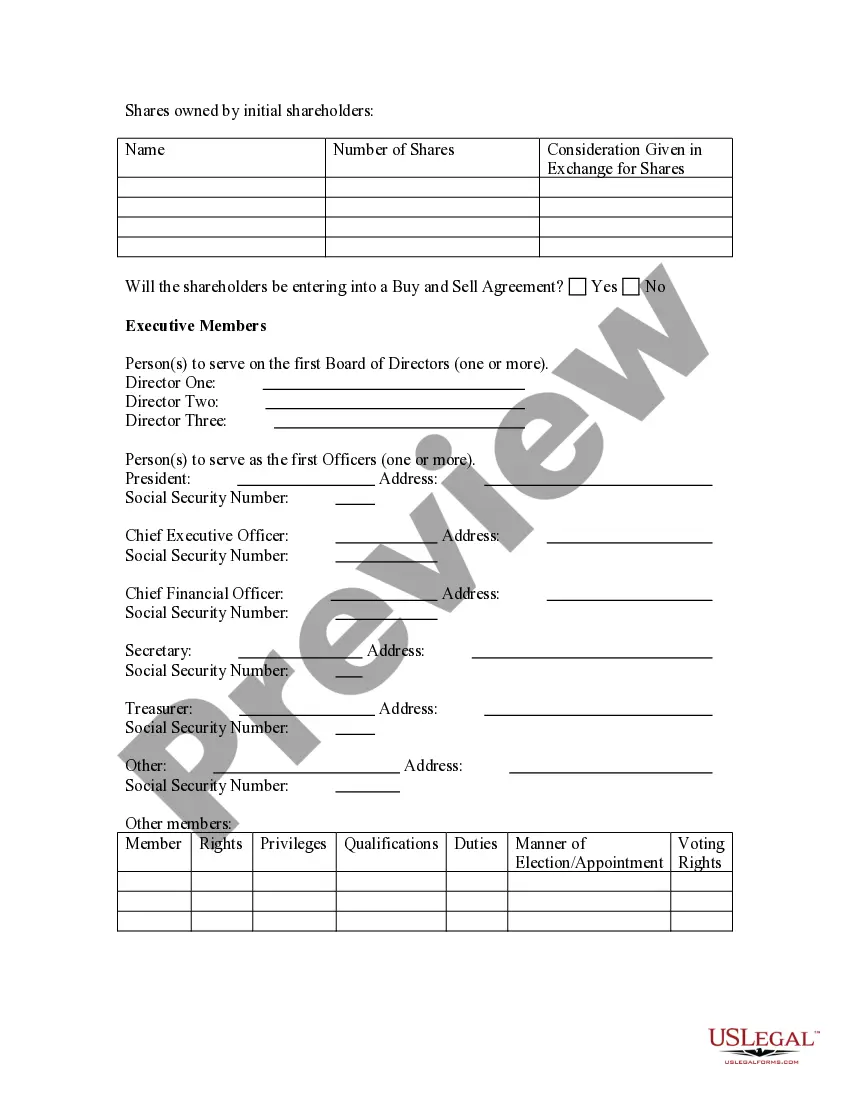

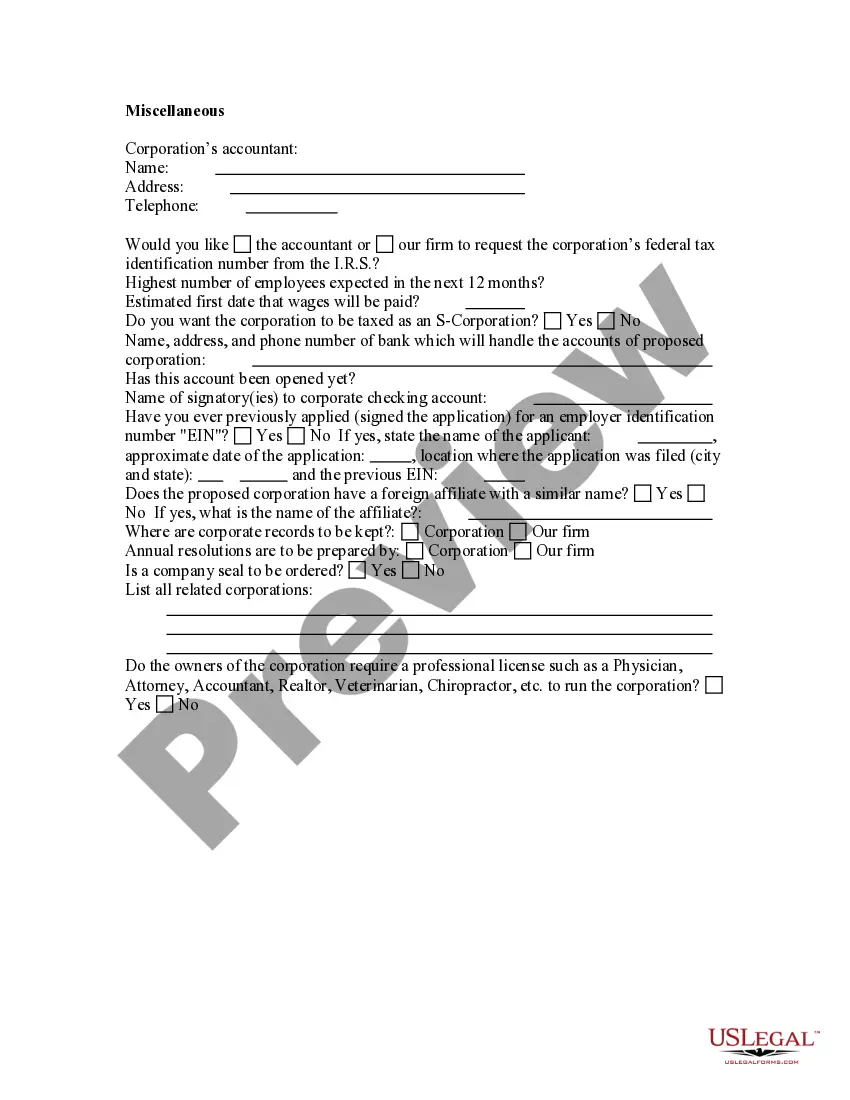

Are you currently within a position that you need to have documents for either organization or person reasons just about every working day? There are a variety of lawful file themes available on the Internet, but discovering kinds you can rely is not straightforward. US Legal Forms delivers thousands of develop themes, much like the Indiana Business Incorporation Questionnaire, that are written to meet federal and state needs.

Should you be presently acquainted with US Legal Forms site and have your account, simply log in. After that, you can down load the Indiana Business Incorporation Questionnaire format.

Unless you have an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for your appropriate metropolis/county.

- Take advantage of the Review button to examine the form.

- Browse the description to actually have chosen the correct develop.

- If the develop is not what you`re seeking, take advantage of the Research area to find the develop that fits your needs and needs.

- If you find the appropriate develop, just click Get now.

- Choose the rates prepare you would like, fill in the necessary information to generate your account, and pay for an order using your PayPal or bank card.

- Select a practical document file format and down load your copy.

Locate all of the file themes you possess purchased in the My Forms menus. You can obtain a extra copy of Indiana Business Incorporation Questionnaire anytime, if necessary. Just select the required develop to down load or print out the file format.

Use US Legal Forms, probably the most comprehensive variety of lawful types, in order to save some time and avoid blunders. The support delivers appropriately manufactured lawful file themes which you can use for an array of reasons. Produce your account on US Legal Forms and initiate creating your daily life easier.