Indiana Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

Are you within a situation in which you require files for sometimes enterprise or specific purposes virtually every working day? There are a variety of legal document layouts accessible on the Internet, but finding types you can depend on isn`t simple. US Legal Forms delivers thousands of form layouts, like the Indiana Clauses Relating to Capital Withdrawals, Interest on Capital, which are created to fulfill state and federal requirements.

When you are already familiar with US Legal Forms internet site and possess a free account, basically log in. Afterward, you can obtain the Indiana Clauses Relating to Capital Withdrawals, Interest on Capital design.

If you do not provide an bank account and want to start using US Legal Forms, adopt these measures:

- Obtain the form you need and ensure it is to the correct city/area.

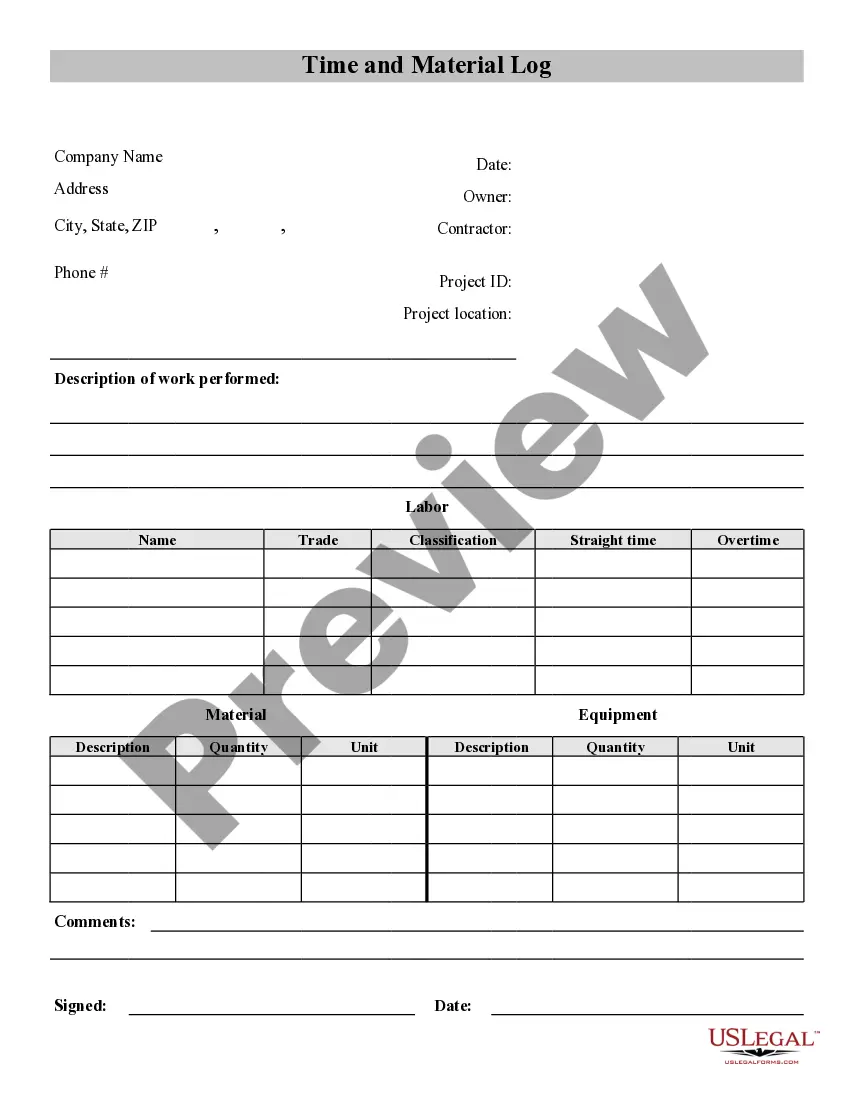

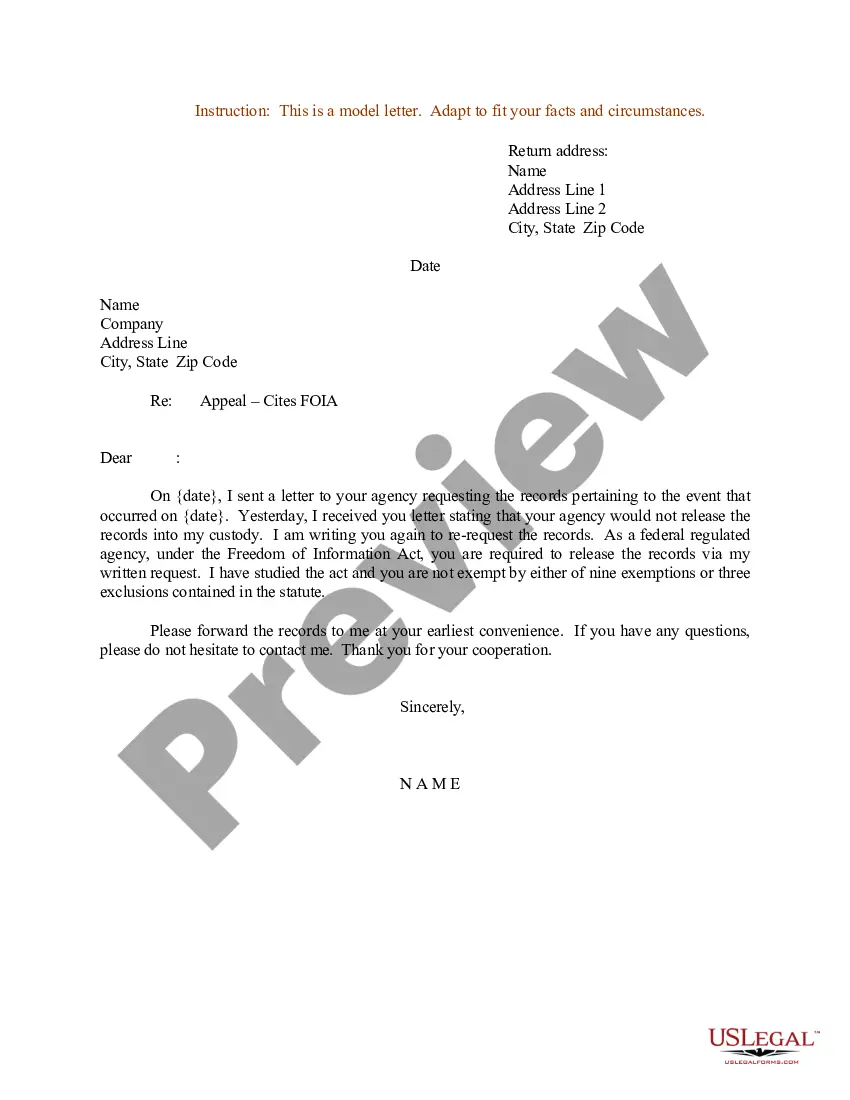

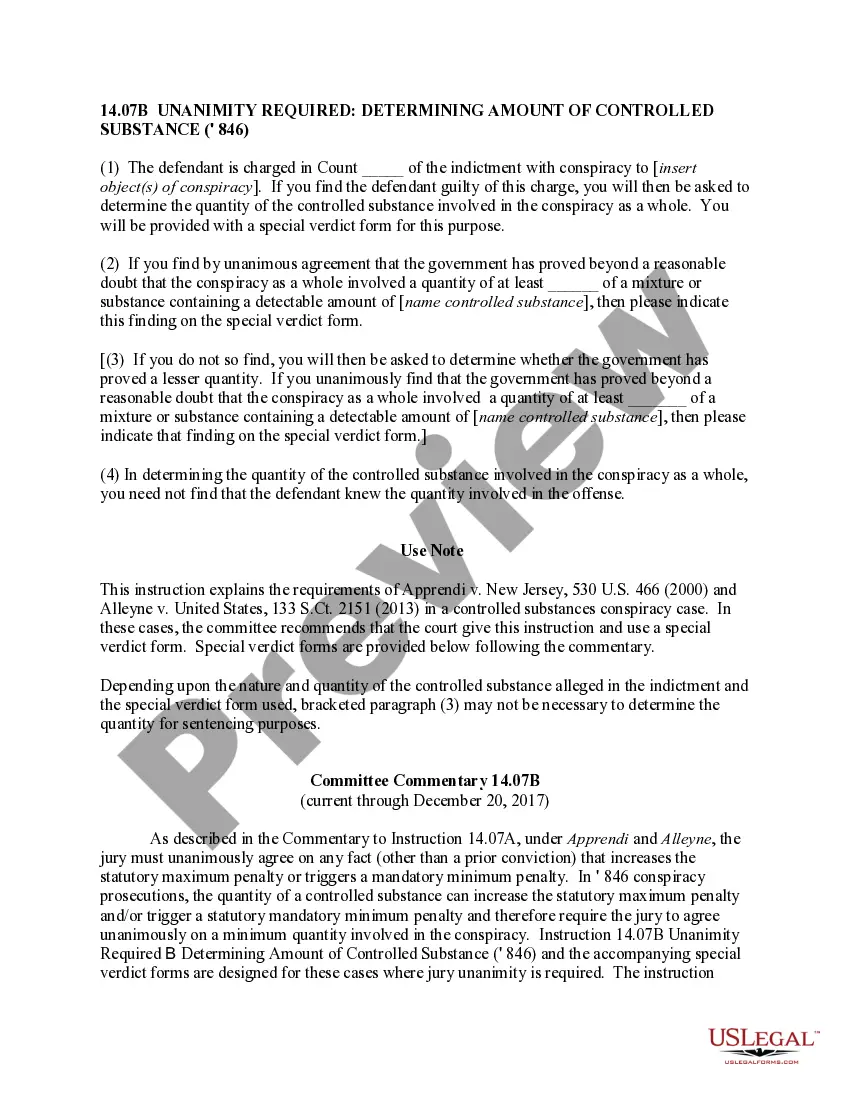

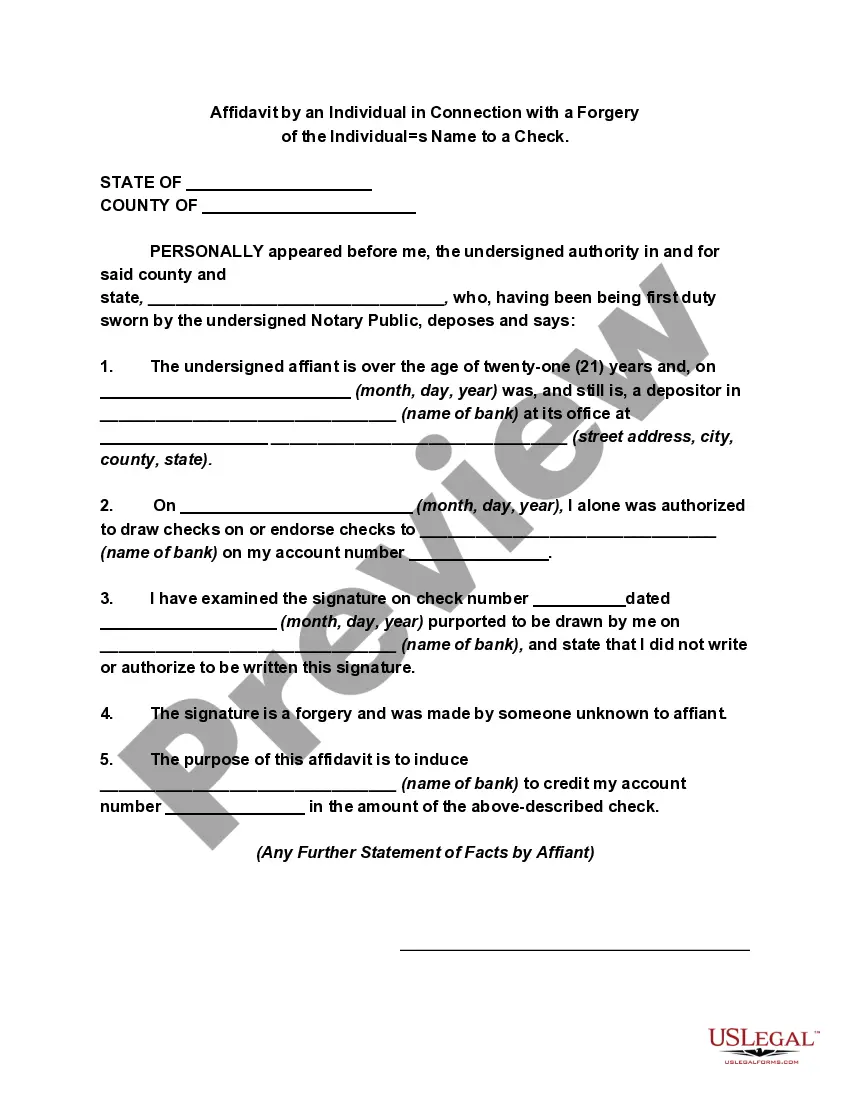

- Take advantage of the Review option to check the form.

- See the outline to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re searching for, take advantage of the Look for field to get the form that fits your needs and requirements.

- When you get the correct form, click on Get now.

- Select the costs program you desire, fill out the specified information and facts to produce your money, and purchase the order making use of your PayPal or credit card.

- Decide on a hassle-free paper format and obtain your duplicate.

Discover every one of the document layouts you possess purchased in the My Forms food list. You can aquire a extra duplicate of Indiana Clauses Relating to Capital Withdrawals, Interest on Capital any time, if possible. Just go through the necessary form to obtain or produce the document design.

Use US Legal Forms, probably the most substantial collection of legal varieties, to save efforts and stay away from errors. The support delivers expertly produced legal document layouts that you can use for a variety of purposes. Make a free account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

A new deduction (634) is available to deduct certain expenses for which a deduction is not permitted for federal income tax purposes because an employer claimed a COVID-related employee retention credit.

The partners are paid interest on the capital that remains outstanding. The maximum rate of interest that can be paid to the owners is 12% as per the Income Tax Act u/s 40(b). If a partner introduces any further capital to the business then the additional capital is also taken into account for providing interest.

Indiana Code § 23-0.5-3-1. Permitted Names; Falsely Implying Government Agency Status or Connection :: 2022 Indiana Code :: US Codes and Statutes :: US Law :: Justia.

Interest on capital will be paid to the partners if provided for in the agreement but only from profits. Interest on capital is an appropriation and not a charge against profit hence, is provided only to the extent of profits.

The tax consequences of the sale are straightforward. Pursuant to Section 741,[1] gain or loss from the sale of a partnership interest is treated as gain or loss from the sale or exchange of a capital asset, except as otherwise provided in section 751.

The tax consequences of granting, vesting and forfeiting a capital interest in a partnership is governed by IRC section 83. Under IRC section 83, the grant of a capital interest in exchange for services is taxable at the time of grant unless subject to a substantial risk of forfeiture.

Indiana Code Section 23-0.5-2-13 requires LLCs to submit a biennial business entity report to the Secretary of State every other year. You can file online for a $31 fee or by mail for a $50 fee.

Ing to Section 28, the business partner will be subject to taxation on the interest earned on capital. This means the income generated from interest will be taxable under profits and gains from business and profession.