Indiana Exhibit D to Operating Agreement Insurance - Form 2

Description

How to fill out Exhibit D To Operating Agreement Insurance - Form 2?

Choosing the best legal papers web template can be quite a battle. Naturally, there are a lot of themes available online, but how will you get the legal type you will need? Make use of the US Legal Forms website. The service provides a large number of themes, such as the Indiana Exhibit D to Operating Agreement Insurance - Form 2, which can be used for organization and private demands. All the varieties are checked out by professionals and meet state and federal requirements.

When you are already listed, log in in your account and then click the Download button to get the Indiana Exhibit D to Operating Agreement Insurance - Form 2. Utilize your account to check through the legal varieties you possess ordered earlier. Visit the My Forms tab of your own account and obtain an additional duplicate from the papers you will need.

When you are a brand new consumer of US Legal Forms, listed here are simple directions that you can follow:

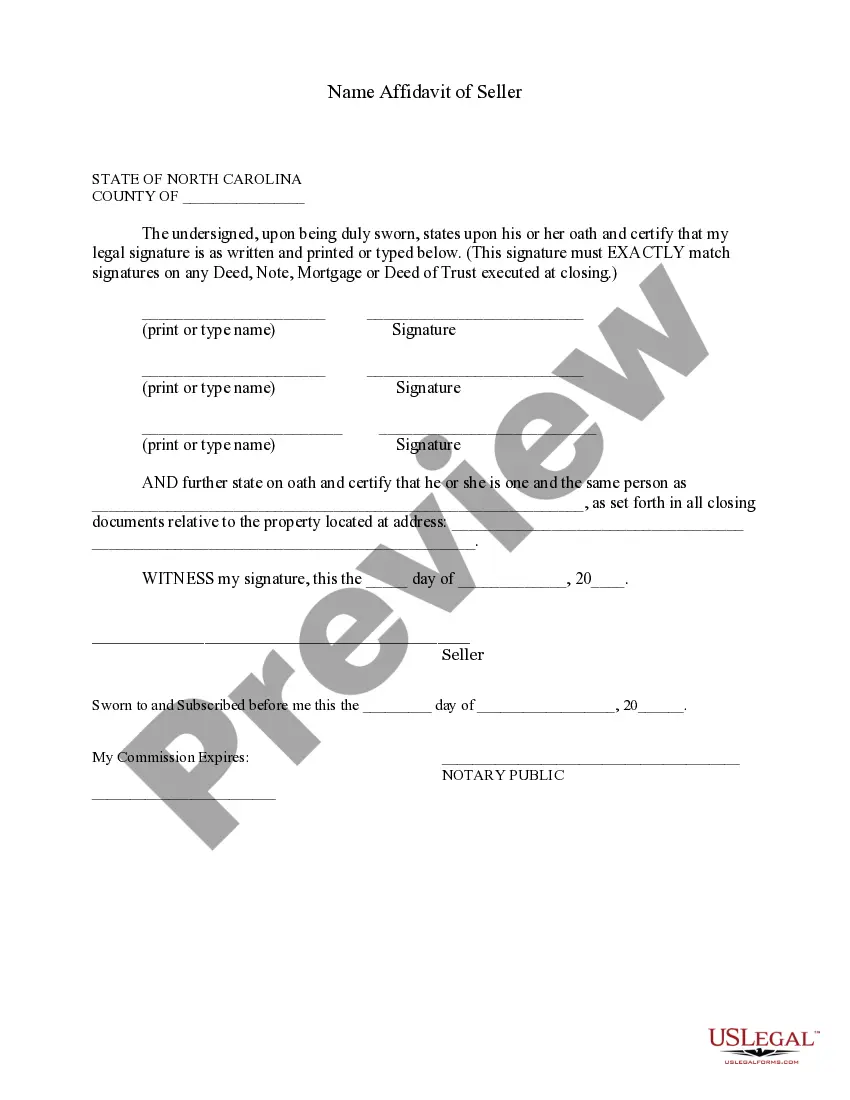

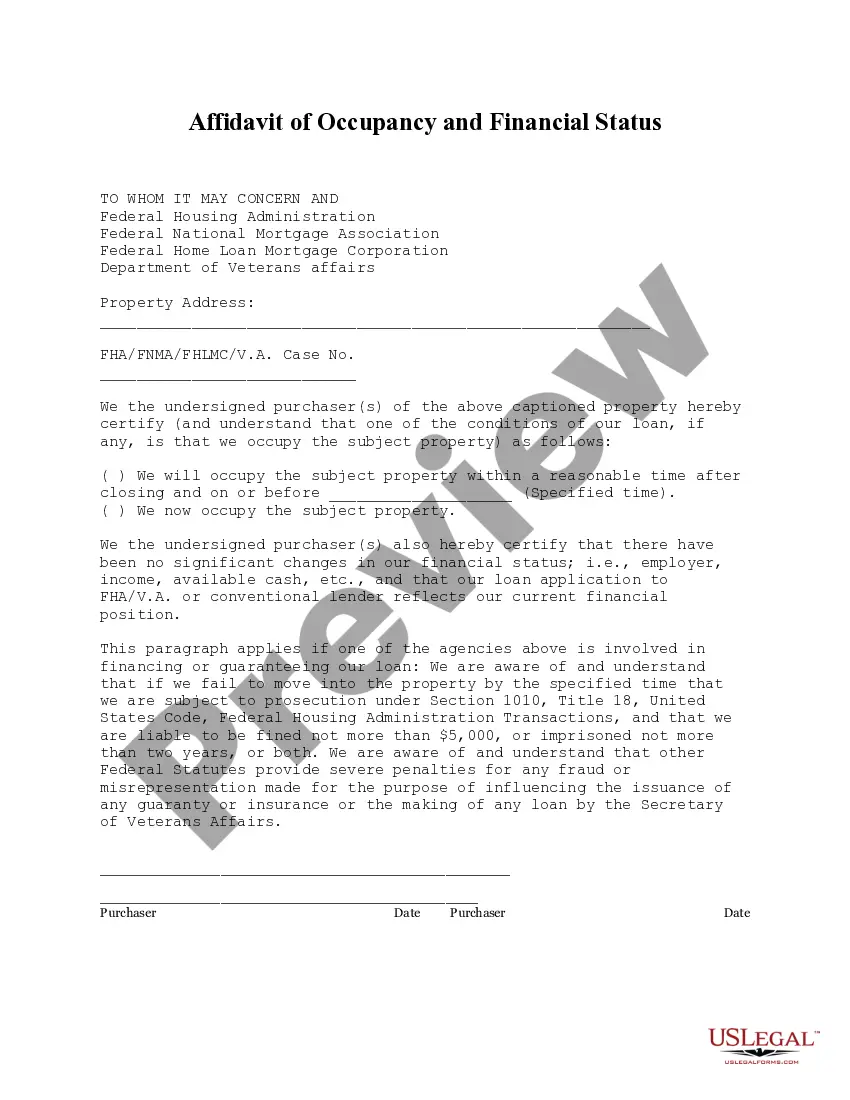

- Very first, make certain you have chosen the appropriate type to your city/area. You are able to look over the form utilizing the Preview button and study the form outline to make certain it is the right one for you.

- When the type fails to meet your expectations, use the Seach discipline to find the right type.

- When you are certain that the form would work, click on the Buy now button to get the type.

- Pick the pricing prepare you need and enter in the necessary details. Design your account and pay for the order with your PayPal account or charge card.

- Select the file formatting and obtain the legal papers web template in your gadget.

- Complete, modify and print and indicator the received Indiana Exhibit D to Operating Agreement Insurance - Form 2.

US Legal Forms may be the greatest library of legal varieties where you can see a variety of papers themes. Make use of the service to obtain appropriately-manufactured paperwork that follow status requirements.