Indiana Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands

Description

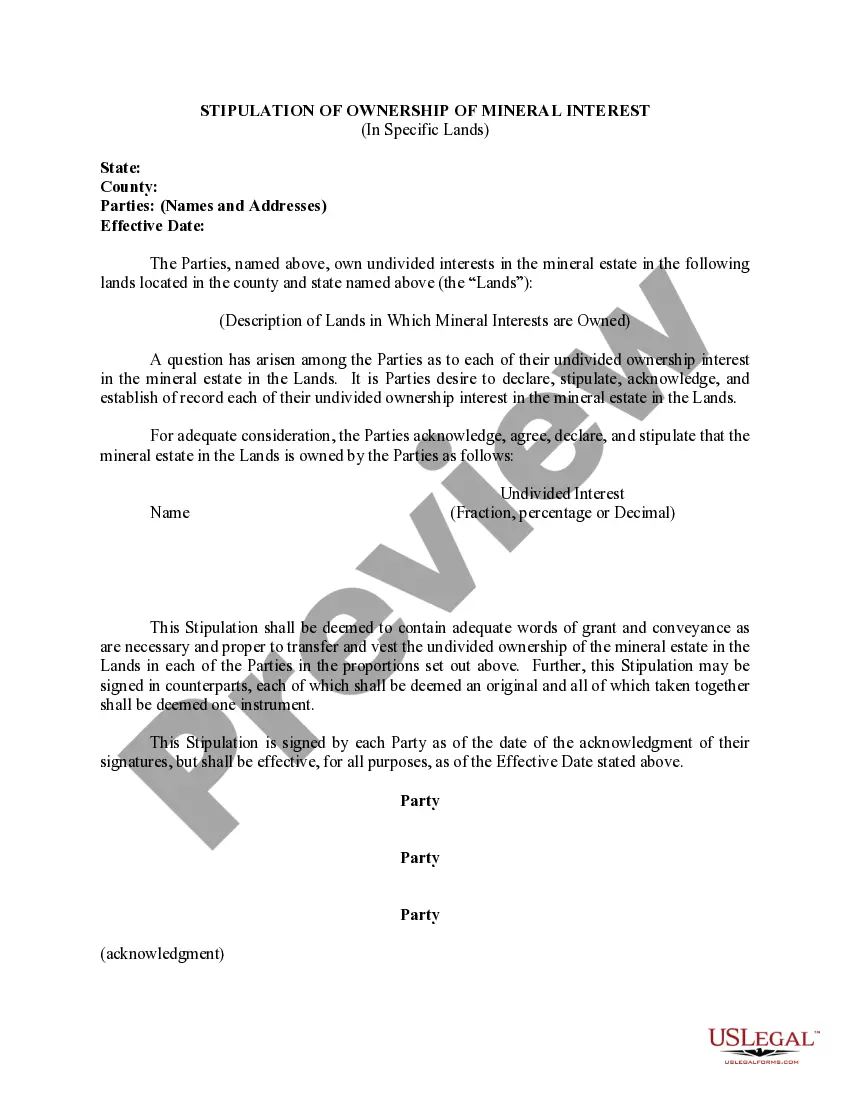

How to fill out Stipulation Of Ownership Of Mineral Interest Of Mineral Ownership In Specific Lands?

Have you been within a place in which you will need paperwork for both enterprise or personal purposes nearly every time? There are a variety of authorized file layouts available online, but getting kinds you can rely on is not simple. US Legal Forms delivers a huge number of kind layouts, just like the Indiana Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands, that happen to be written to fulfill state and federal specifications.

When you are previously acquainted with US Legal Forms site and get your account, just log in. After that, you are able to down load the Indiana Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands template.

Should you not have an bank account and would like to begin using US Legal Forms, adopt these measures:

- Get the kind you will need and ensure it is for your right metropolis/county.

- Utilize the Preview switch to check the shape.

- Look at the explanation to ensure that you have selected the correct kind.

- In the event the kind is not what you are searching for, utilize the Research industry to get the kind that fits your needs and specifications.

- Once you discover the right kind, simply click Buy now.

- Select the costs prepare you desire, fill out the necessary details to produce your bank account, and pay for your order using your PayPal or bank card.

- Choose a handy paper structure and down load your backup.

Locate every one of the file layouts you may have purchased in the My Forms menu. You may get a additional backup of Indiana Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands whenever, if needed. Just go through the needed kind to down load or print the file template.

Use US Legal Forms, probably the most extensive assortment of authorized forms, in order to save efforts and stay away from mistakes. The service delivers expertly created authorized file layouts that can be used for a range of purposes. Make your account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else. Once mineral rights have been sold, the original owner retains only the rights to the land surface, while the second party may exploit the underground resources in any way they choose.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Mineral rights are the rights to underground resources including oil, natural gas, gold, silver, copper, iron, coal, uranium, and other minerals. Sand, gravel, limestone, and subsurface water are not considered mineral rights and typically belong to the surface rights holder.

By law, in the United States, the rights to exploit and extract natural resources, such as precious minerals, oil, and natural gas, can be owned and transferred independent of the conveyance of the land. ingly, you can sell real property but retain ownership of all natural resources.

What Are Mineral Rights? Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

The Indiana Dormant Mineral Interest Act" was passed by the Indiana Legislature in 1971. The Act provides that severed mineral interests would automatically revert to the current surface owner of the land unless one of the following conditions was met: 1. Sufficient "use" of the mineral interest by the owner.

Section 32-21-7-1 - Establishing title; payment of taxes and special assessments by adverse possessor; exception for governmental entities and exempt organizations (a) Except as provided in subsection (b), in an action to establish title to real property, possession of the real property is not adverse to the owner in a ...

Surface rights and mineral rights are two distinct types of property rights. Surface rights refer to the right to own and use the surface of a piece of land, while mineral rights refer to the right to extract minerals and other resources that are found beneath the surface.