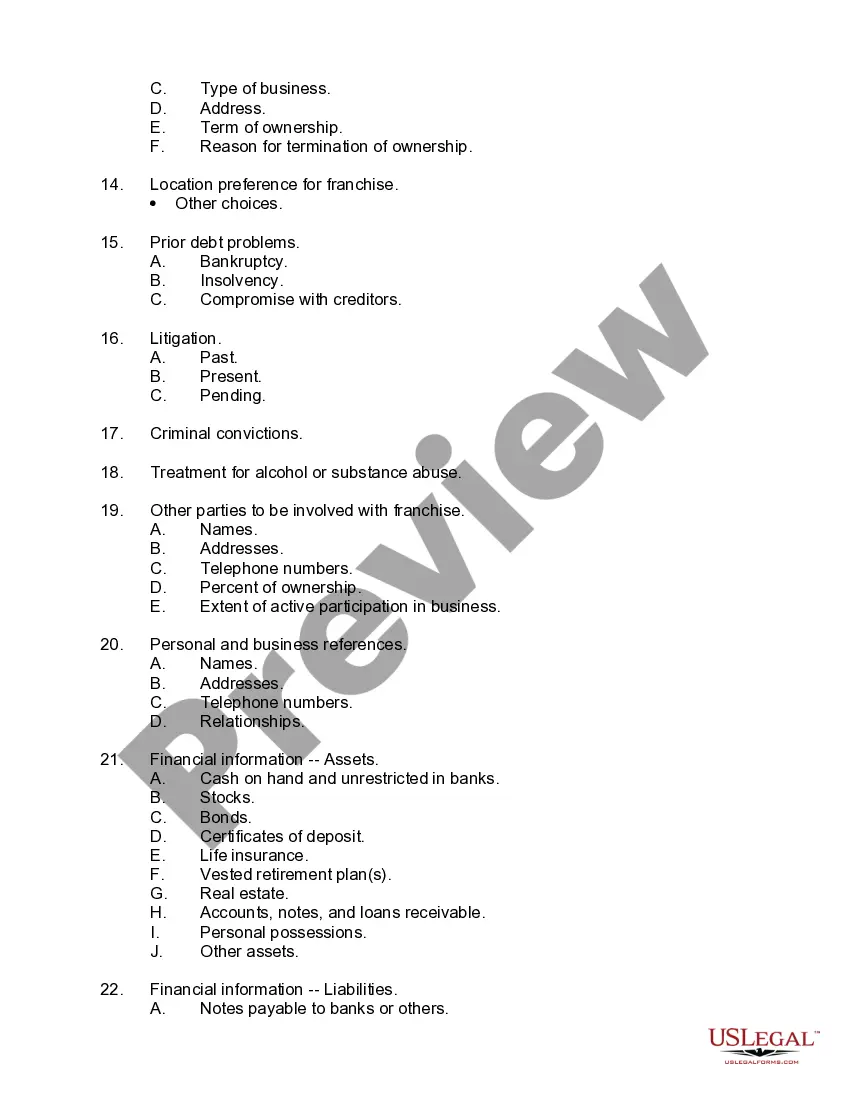

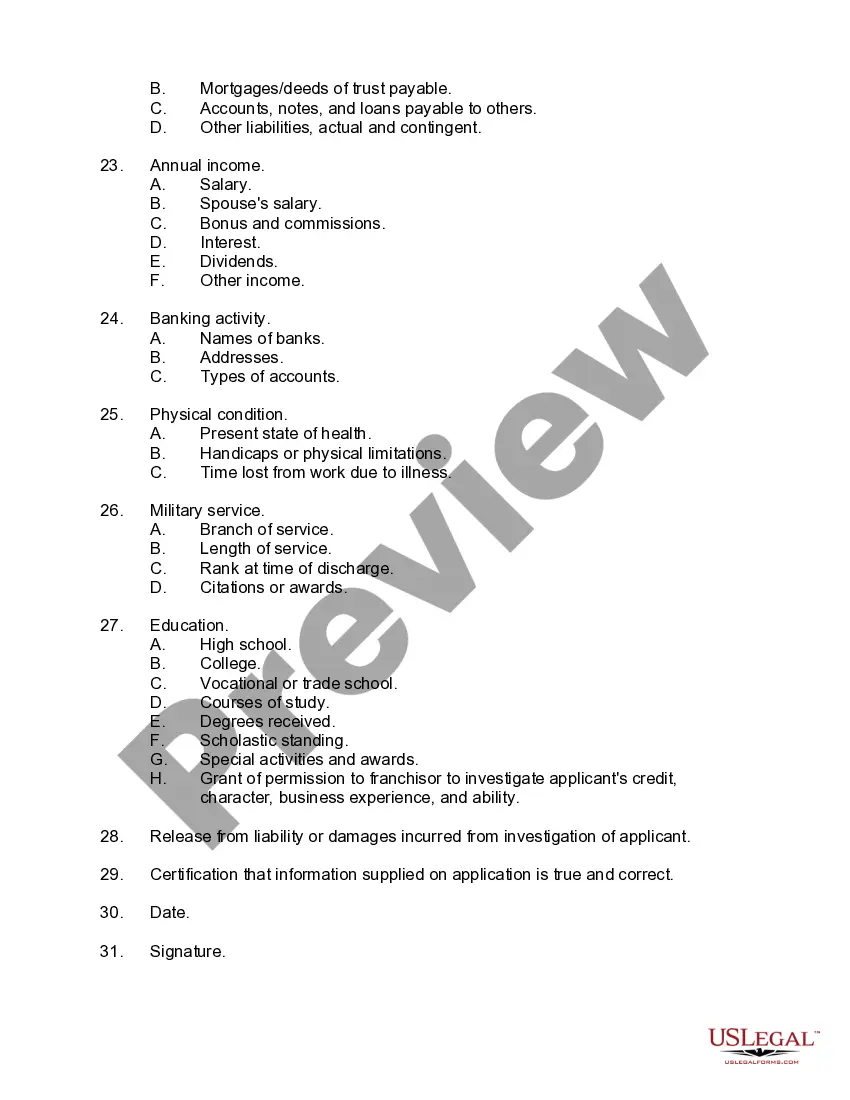

Guam Checklist for Drafting a Franchise Application

Description

How to fill out Checklist For Drafting A Franchise Application?

Selecting the optimal legal document template can be quite a challenge. Clearly, there are numerous templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The platform offers an extensive collection of templates, including the Guam Checklist for Drafting a Franchise Application, which can be utilized for both business and personal purposes. All the documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Guam Checklist for Drafting a Franchise Application. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you need.

Choose the document format and download the legal document template to your device. Fill out, modify, print, and sign the downloaded Guam Checklist for Drafting a Franchise Application. US Legal Forms is the premier repository of legal forms where you can find a variety of document templates. Use the service to obtain professionally crafted paperwork that adheres to state regulations.

- First, ensure you have chosen the correct form for your city/state.

- You can preview the form using the Review button and view the form description to verify that it is suitable for you.

- If the form does not meet your requirements, use the Search box to locate the right form.

- Once you are confident the form is appropriate, click the Acquire now button to obtain the form.

- Select the pricing plan you desire and enter the necessary details.

- Create your account and complete the order using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

One of the most important documents in owning a franchise is the Franchise Disclosure Document (FDD). This document provides essential information about the franchise, including financial obligations, operational requirements, and the franchisor's background. A comprehensive Guam Checklist for Drafting a Franchise Application will help you ensure that your FDD meets all legal standards and requirements. By utilizing the US Legal Forms platform, you can access resources that simplify this process and make your franchise journey smoother.

Guam residents do not file a standard US federal tax return; instead, they file locally with the Guam Department of Revenue and Taxation. Although Guam has its tax structure, many residents still need to comply with federal tax obligations depending on specific circumstances. Understanding these requirements is crucial as you navigate your Guam Checklist for Drafting a Franchise Application, ensuring compliance throughout your business journey.

You can absolutely submit your taxes electronically in Guam. The Guam Department of Revenue and Taxation supports electronic submissions for various tax forms. This feature makes it easier to file on time, avoiding potential penalties, especially when you are diligently following your Guam Checklist for Drafting a Franchise Application.

Yes, you can file your taxes by yourself online using various available platforms. These platforms provide user-friendly interfaces that guide you through the filing process. If you're following your Guam Checklist for Drafting a Franchise Application, ensuring that you have your financial information ready and accurate can streamline your online filing experience.

Starting a franchise typically requires several key documents, including a franchise agreement, disclosure documents, and the LLC formation papers. Additional local permits may also be necessary depending on your business type. Keeping these documents organized is vital as you follow your Guam Checklist for Drafting a Franchise Application; an efficient start sets a strong foundation for your business.

You should mail your Guam tax return to the address specified by the Guam Department of Revenue and Taxation on their official website. Ensure that you include all necessary documents and your payment if applicable. This is an important part of your financial obligations, and maintaining clear records will assist you when completing your Guam Checklist for Drafting a Franchise Application.

To apply for an LLC in Guam, start by choosing a unique name for your business that complies with Guam's naming regulations. Next, complete the Articles of Organization and submit them along with the required fees to the Guam Department of Revenue and Taxation. This process is an essential step on your Guam Checklist for Drafting a Franchise Application, ensuring you have the proper business structure in place.

Yes, you can file your Guam tax online. The Guam Department of Revenue and Taxation offers electronic filing options that simplify the process. You can conveniently submit your forms through their online portal, making tax season more manageable. For those working on their Guam Checklist for Drafting a Franchise Application, keeping financial records organized is crucial.

A franchise agreement typically includes several key components, which are essential for both parties. It outlines the rights and obligations of the franchisor and franchisee, financial arrangements, and operational guidelines. To effectively navigate these elements, consider using a Guam Checklist for Drafting a Franchise Application. This checklist can help ensure that all necessary details are included, providing clarity and protection for both sides.

Getting approved for a franchise can be straightforward if you prepare well. Following a Guam Checklist for Drafting a Franchise Application can make the process easier by ensuring you meet all necessary requirements. You should have a clear understanding of the franchise’s expectations and your financial situation. With diligence and the right tools, such as uslegalforms, you can enhance your chances of securing approval.