This document is a 44-page model partnership agreement for a law firm. It covers, among other things, duties of partners, management, operational matters, distributions, capital, changes as to partners, and dissolution.

Indiana Model Partnership Agreement

Description

How to fill out Model Partnership Agreement?

If you want to complete, down load, or produce legitimate file themes, use US Legal Forms, the largest assortment of legitimate types, that can be found on the Internet. Use the site`s easy and practical lookup to obtain the files you want. Numerous themes for company and specific reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to obtain the Indiana Model Partnership Agreement in a number of mouse clicks.

In case you are previously a US Legal Forms consumer, log in for your bank account and click the Acquire switch to have the Indiana Model Partnership Agreement. You can also access types you previously downloaded within the My Forms tab of your bank account.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape to the correct city/country.

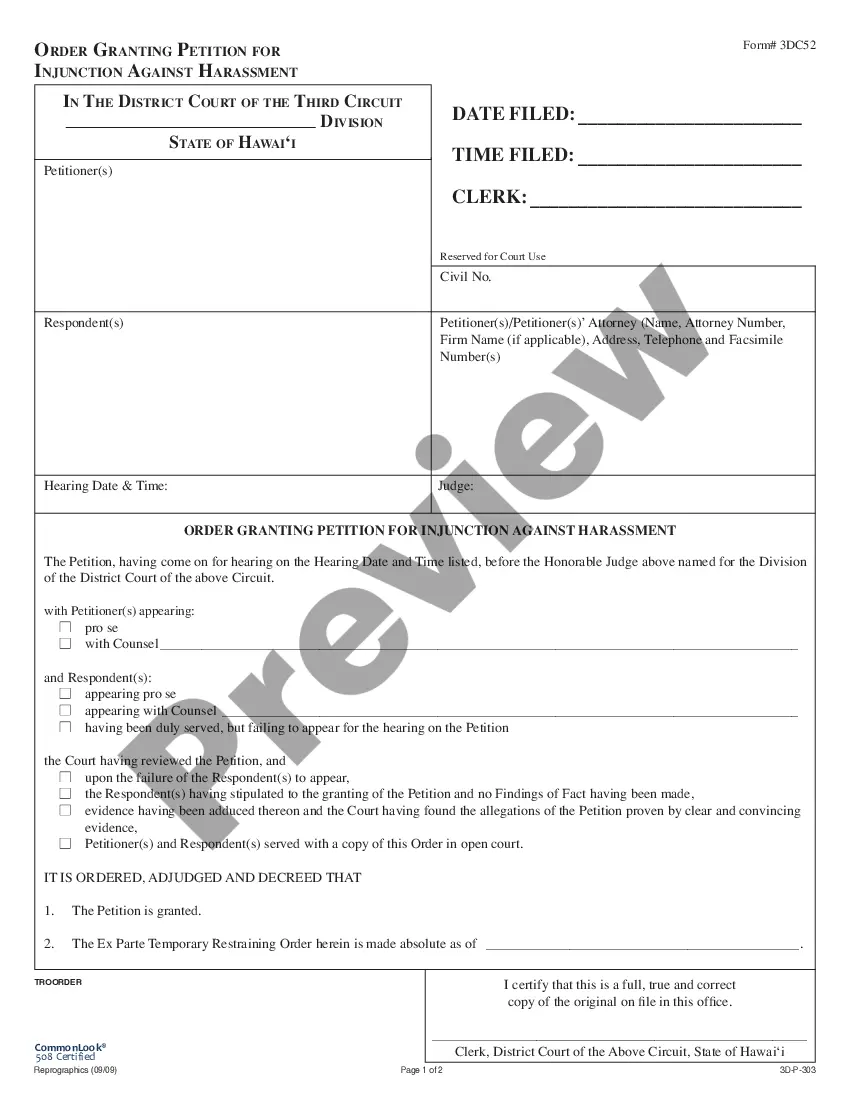

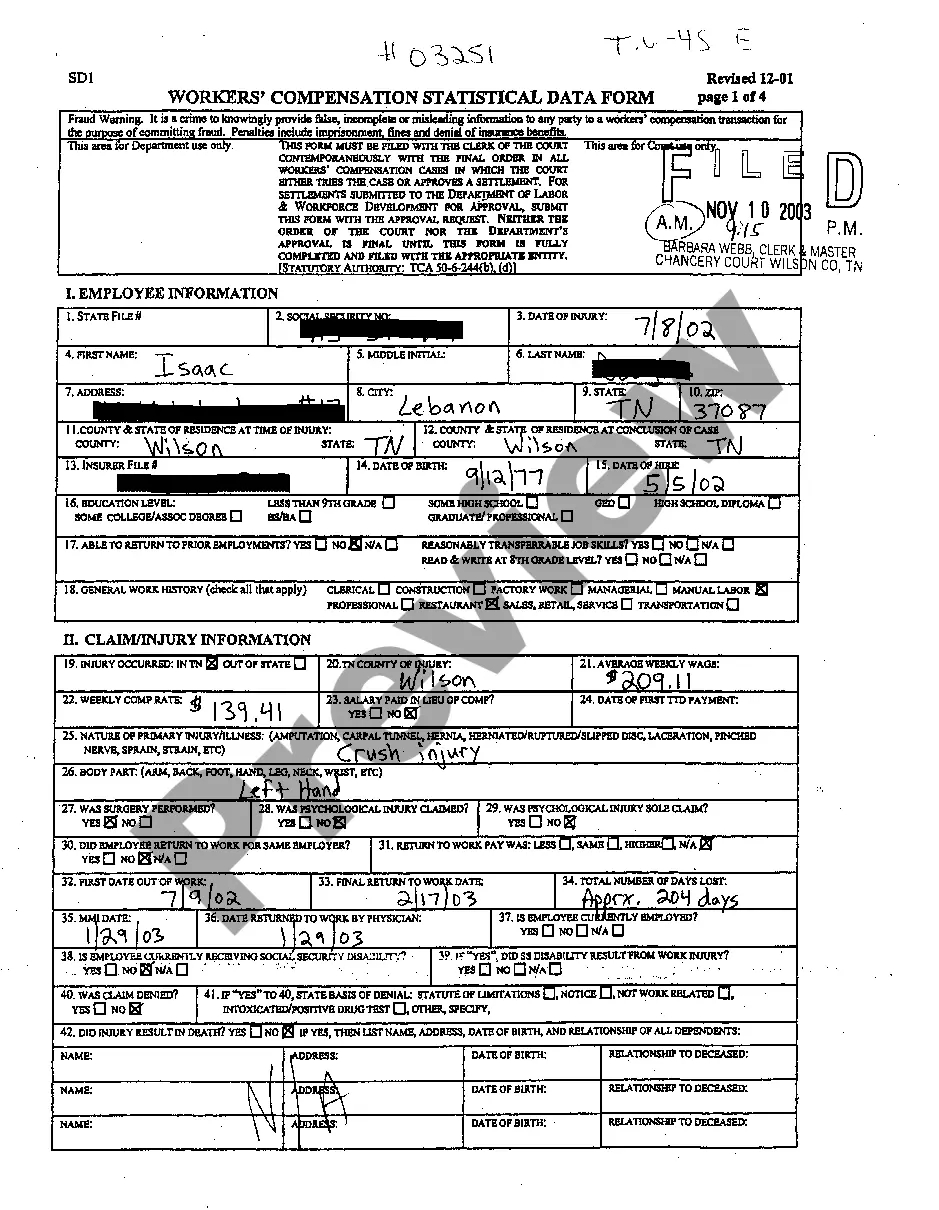

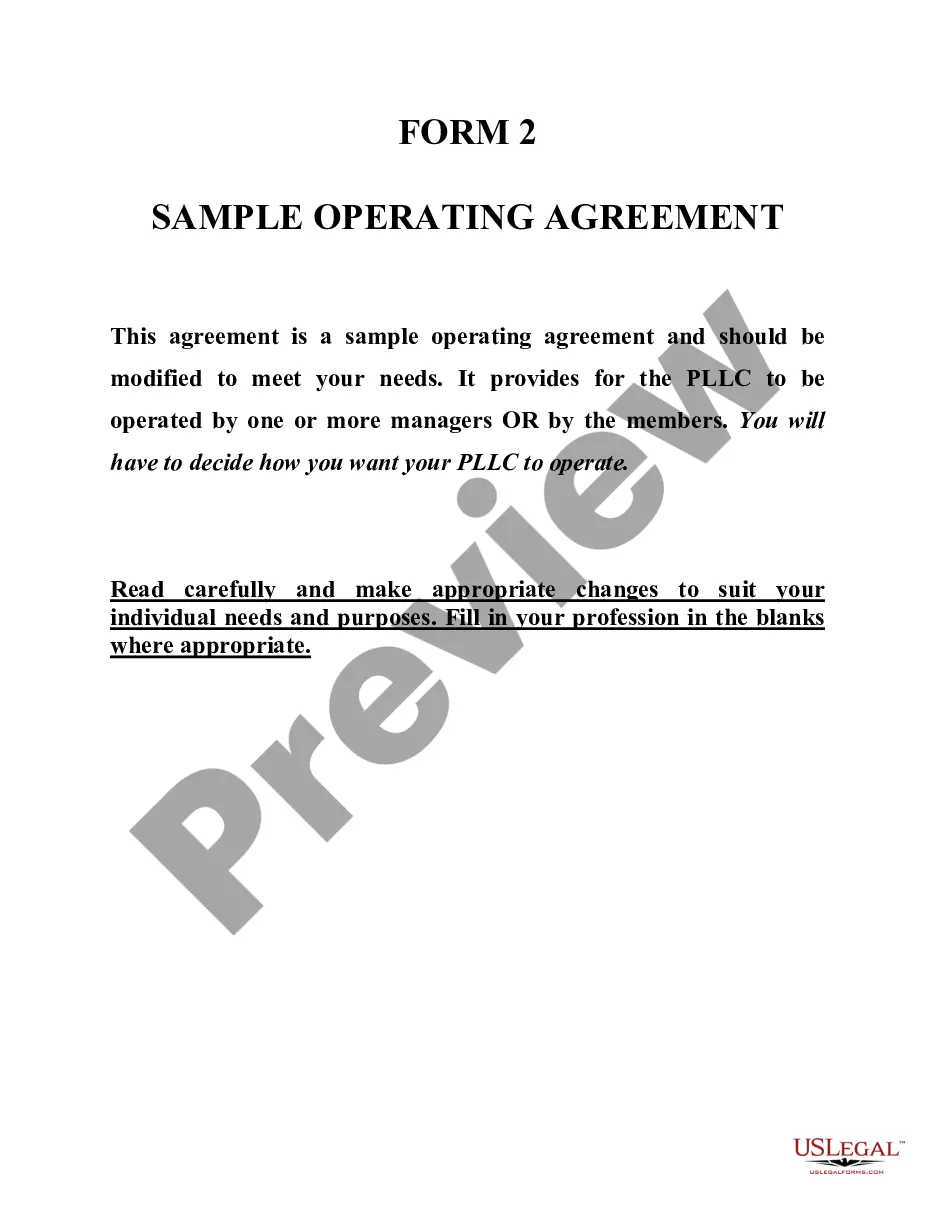

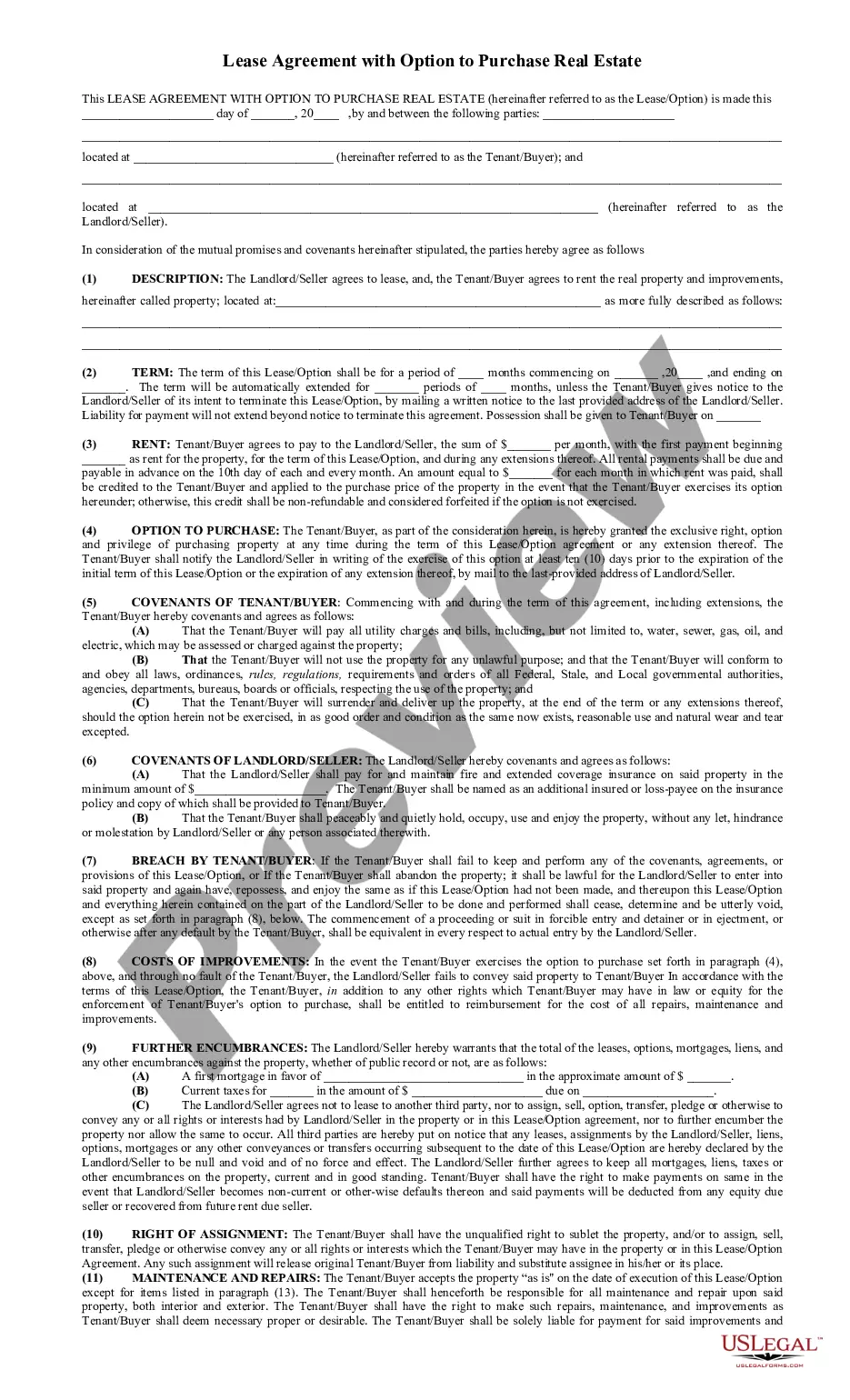

- Step 2. Use the Review method to look over the form`s content. Never forget to see the outline.

- Step 3. In case you are not happy with the form, use the Search field towards the top of the display screen to locate other types of the legitimate form design.

- Step 4. Upon having discovered the shape you want, select the Get now switch. Pick the costs strategy you prefer and include your references to sign up for the bank account.

- Step 5. Approach the transaction. You can use your Мisa or Ьastercard or PayPal bank account to finish the transaction.

- Step 6. Select the structure of the legitimate form and down load it on your system.

- Step 7. Total, change and produce or signal the Indiana Model Partnership Agreement.

Every single legitimate file design you buy is your own property for a long time. You have acces to every form you downloaded in your acccount. Click the My Forms section and decide on a form to produce or down load once more.

Compete and down load, and produce the Indiana Model Partnership Agreement with US Legal Forms. There are many expert and state-specific types you can use for your personal company or specific requires.

Form popularity

FAQ

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Indiana LLC net income must be paid just as you would with any self-employment business.

There are a number of steps to take before a partnership can be legally operated in Indiana: Step 1: Select a business name. ... Step 2: Register the business name. ... Step 3: Complete required paperwork. ... Step 4: Determine if you need an EIN, additional licenses, or tax IDs. ... Step 5: Get your day-to-day business affairs in order.

Hear this out loud PauseAny partnership doing business in Indiana or deriving gross income from sources within Indiana is required to file a return.

Hear this out loud PauseThis deed of partnership is made on [Date, Month, Year] between: [First Partner's Name], [Son/Daughter] of [Mr. Father's Name], residing at [Address Line 1, Address Line 2, City, State, Pin Code] hereinafter referred to as FIRST PARTNER. [Second Partner's Name], [Son/Daughter] of [Mr.

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

Indiana LLCs are taxed as pass-through entities by default, which means that the LLC itself doesn't pay taxes, its members (owners) do. Profits pass through the LLC and onto the tax filings of the members where they'll pay federal income tax and self-employment taxes (15.3%) on their LLC income.

If you were a full-year resident of Indiana and your gross income (the total of all your income before deductions) was more than your total exemptions claimed, then you must file an Indiana tax return.