Indiana Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

Have you ever been in a location where you need documents for either business or personal purposes almost every working day.

There is a range of legal document templates accessible online, but locating ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, including the Indiana Lab Worker Employment Contract - Self-Employed, designed to comply with state and federal requirements.

Once you find the appropriate form, click Buy now.

Choose the payment plan you prefer, fill in the required information to create your account, and complete the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Indiana Lab Worker Employment Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct jurisdiction/region.

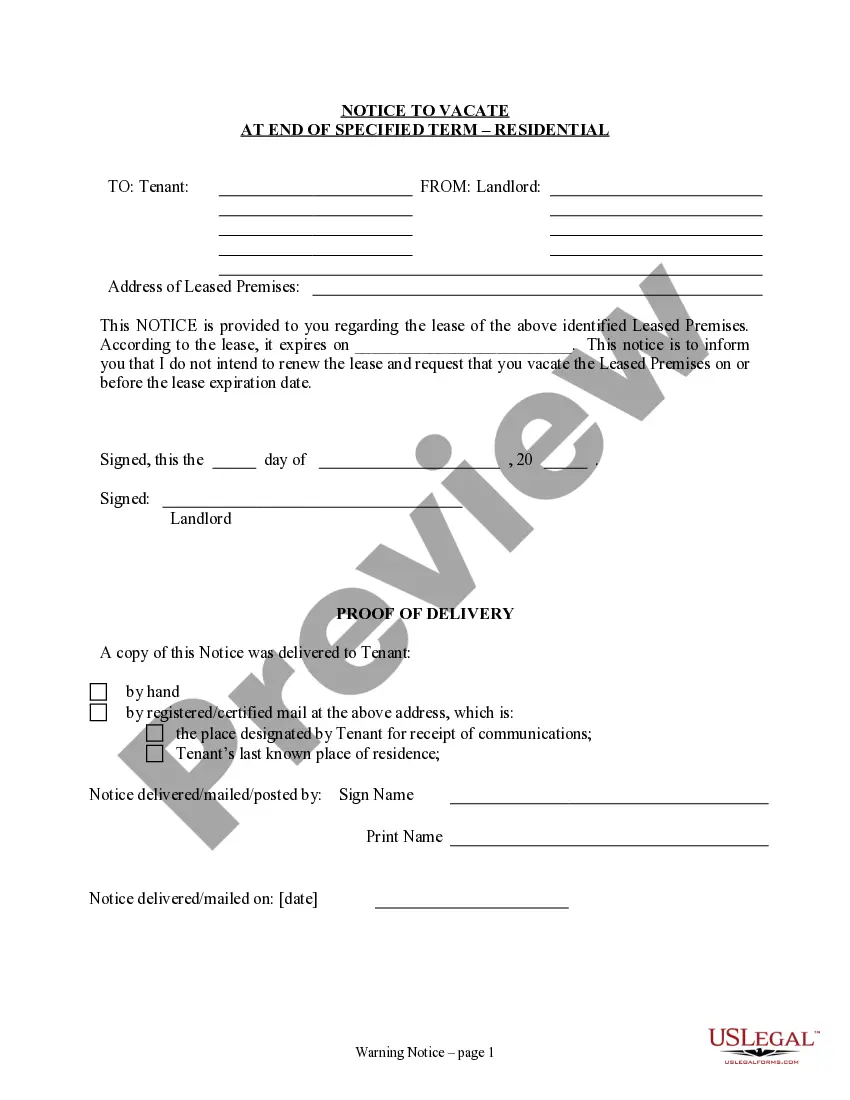

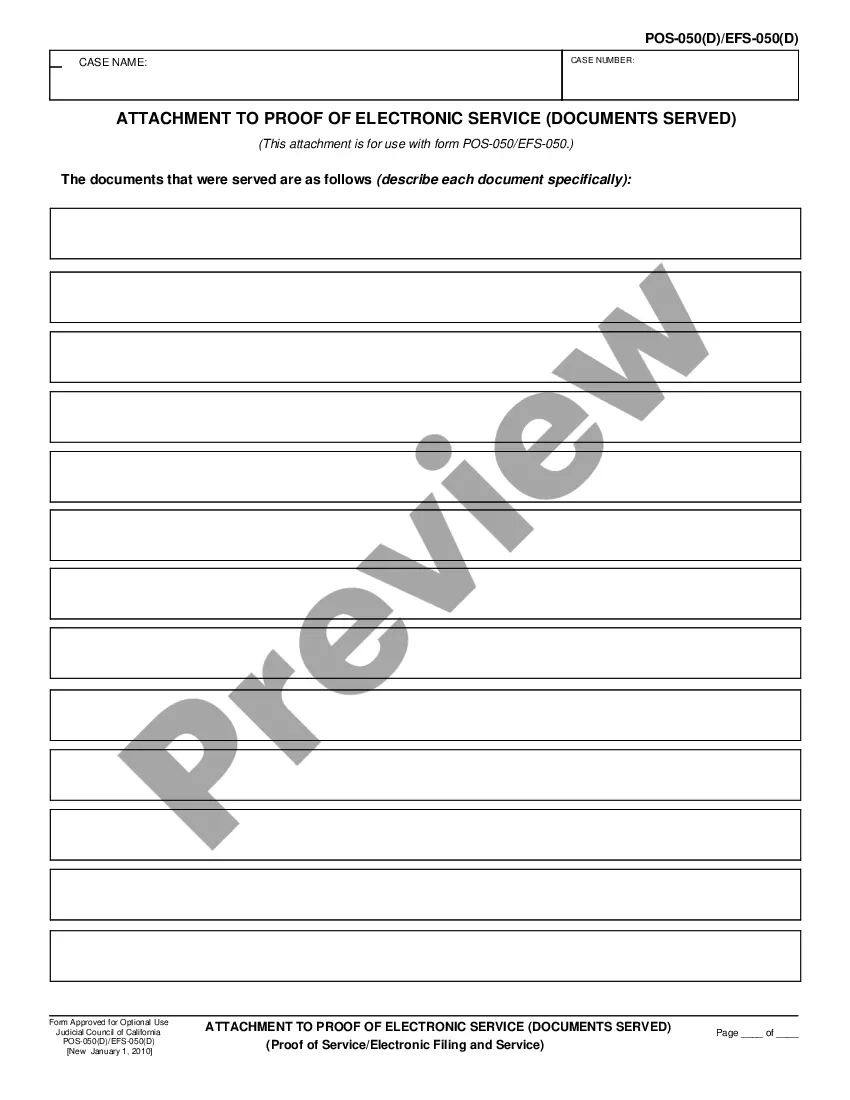

- Utilize the Preview button to view the form.

- Check the description to confirm you have chosen the correct document.

- If the document isn’t what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Yes, contract work is considered a form of employment, although it differs from traditional employment. Under an Indiana Lab Worker Employment Contract - Self-Employed, you perform specific tasks for clients or companies without being directly hired as an employee. This arrangement allows you to enjoy the benefits of flexible work while fulfilling the necessary requirements of employment.

Contract work generally falls under the umbrella of self-employment since you negotiate your own terms and manage your workload. When you engage in an Indiana Lab Worker Employment Contract - Self-Employed, you operate independently, taking on various projects as needed. This flexibility empowers you to choose the work that aligns with your skills and interests.

Yes, a 1099 employee is often viewed as self-employed because they are responsible for their own taxes and do not receive traditional employee benefits. When you work under an Indiana Lab Worker Employment Contract - Self-Employed, you may be issued a 1099 form, indicating that you are operating independently. This distinction emphasizes your role as a contractor rather than a conventional employee.

A contract is a formal agreement between two parties, while being self-employed means you work for yourself. When you enter into an Indiana Lab Worker Employment Contract - Self-Employed, you acknowledge that you are taking on a role that does not depend on a traditional employer. This arrangement allows you to maintain greater control over your work and schedule.

Yes, contract workers are considered self-employed, as they typically operate independently and are not formally employed by a single company. This means they have more control over their work and often negotiate their contracts. An Indiana Lab Worker Employment Contract - Self-Employed can help define your status, responsibilities, and relationship with clients, ensuring clarity in your self-employment journey.

Creating a private contract with yourself is somewhat unconventional but can serve specific purposes. It allows you to outline your goals and process, especially if you operate as self-employed. While it may not be legally binding in the traditional sense, it can enhance your commitment to your business objectives. Consider framing this within an Indiana Lab Worker Employment Contract - Self-Employed for a more formal touch.

New rules for self-employed individuals often focus on tax obligations and benefits. In recent years, changes have aimed to simplify the tax process and improve access to benefits like healthcare. Knowing these updates can empower you in managing your business effectively. Always consult current guidelines to stay compliant and protected in your Indiana Lab Worker Employment Contract - Self-Employed.

In Indiana, independent contractors are generally not required to have workers' compensation insurance. However, it’s crucial to assess the nature of your work and possible risks involved. Depending on your contract terms, it might still be a smart choice to carry this insurance for additional protection. Consulting the Indiana Lab Worker Employment Contract - Self-Employed can guide you on responsibilities and requirements.

Both terms are used interchangeably, but self-employed often refers to a broader category. An independent contractor typically implies working on a project basis for various clients. For your work in Indiana, you may choose either term, but be clear on the specific nature of your relationship with clients. Using an Indiana Lab Worker Employment Contract - Self-Employed helps clarify your status and expectations.

Absolutely, you can be self-employed and also have a contract in place. An Indiana Lab Worker Employment Contract - Self-Employed serves to formalize your agreements and protect both you and your clients. This contract can specify payment terms, project scope, and responsibilities, making your self-employment venture more professional and organized.