Indiana Window Contractor Agreement - Self-Employed

Description

How to fill out Window Contractor Agreement - Self-Employed?

You might invest time online looking for the appropriate legal document template that complies with the federal and state requirements you require. US Legal Forms provides a vast array of legal forms that are vetted by experts.

It's easy to obtain or print the Indiana Window Contractor Agreement - Self-Employed from their service. If you already possess a US Legal Forms account, you can Log In and click the Download button. After that, you can fill out, edit, print, or sign the Indiana Window Contractor Agreement - Self-Employed.

Every legal document template you purchase is yours indefinitely. To acquire another copy of the purchased form, visit the My documents section and click the corresponding button.

Complete the purchase. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make modifications to your document if possible. You can fill out, edit, sign, and print the Indiana Window Contractor Agreement - Self-Employed. Download and print a vast number of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for your county/region that you select.

- Review the form description to confirm that you have selected the correct template.

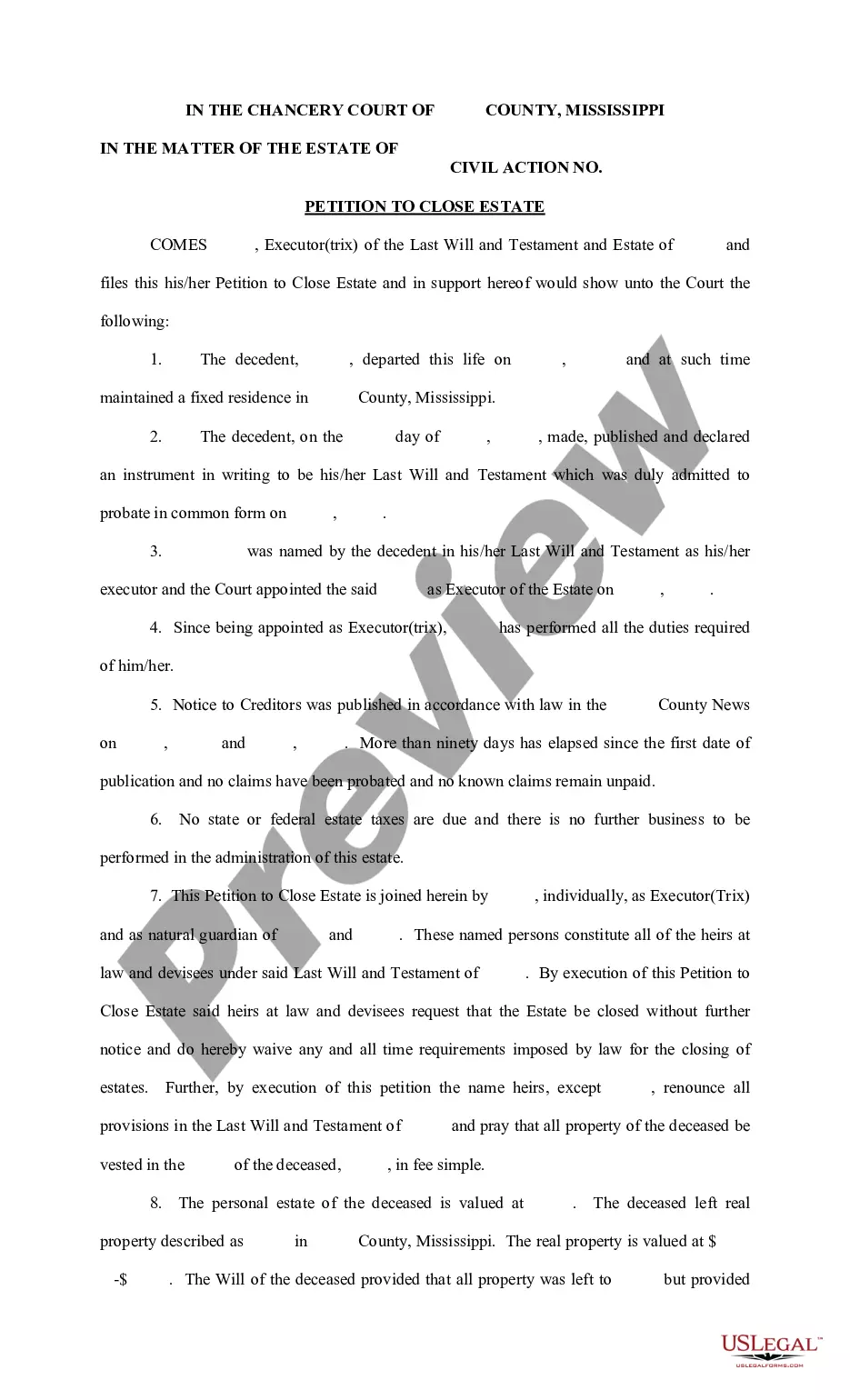

- If available, use the Review button to look through the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- Once you have found the template you need, click Get now to continue.

- Select the pricing plan you want, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

To fill out an independent contractor form, first clearly identify yourself and your work details. Enter your legal name, business information, and the specifics of the services provided as outlined in the Indiana Window Contractor Agreement - Self-Employed. Ensure all relevant sections are completed, including payment details. Using user-friendly templates from uslegalforms simplifies this process.

An independent contractor typically files taxes using a Schedule C form, reporting the income earned from contracts like the Indiana Window Contractor Agreement - Self-Employed. It is crucial to maintain records of all expenses incurred while performing these contracts to maximize tax deductions. Consulting with a tax professional can provide valuable guidance tailored to your business model.

Writing an independent contractor agreement involves outlining the key elements that define your working relationship. Begin by stating the parties involved and the services offered under the Indiana Window Contractor Agreement - Self-Employed. Include clauses about payment rates, timelines, and termination conditions to protect both parties. Ensure clarity and consider using templates from uslegalforms for streamlined formatting.

Filling out an independent contractor agreement requires clear understanding of the scope of work and terms. Start by entering your details as the contractor, along with the client’s information. Next, specify the services you will provide, payment terms, and deadlines. Finally, make sure both parties sign and date the Indiana Window Contractor Agreement - Self-Employed to validate the document.

Creating an independent contractor agreement involves several key steps. Start by outlining the scope of work, payment terms, and deadlines. When drafting your Indiana Window Contractor Agreement - Self-Employed, ensure you include clauses on confidentiality and ownership of work. You can simplify the process by using platforms like uslegalforms, which provide customizable templates tailored to your specific needs, making it easier to establish a clear and effective agreement.

In Indiana, independent contractors generally do not need to carry workers' compensation insurance, but it is beneficial to do so. When working under the Indiana Window Contractor Agreement - Self-Employed, you should assess your potential risks. While being self-employed offers flexibility, you remain responsible for your own safety and wellbeing. Consider obtaining coverage to protect yourself from unforeseen incidents that may arise during your contracting work.

An independent contractor usually needs to fill out a few key documents to ensure compliance and clear agreements. The Indiana Window Contractor Agreement - Self-Employed is essential, as it outlines the terms of the working relationship, payment details, and project specifications. Additionally, contractors may need to provide tax forms, such as the W-9, and any necessary licensing documents required for window installation in Indiana. Utilizing the uslegalforms platform can streamline this process by offering templates and guidance for your specific needs.