Indiana Pipeline Service Contract - Self-Employed

Description

How to fill out Pipeline Service Contract - Self-Employed?

Selecting the optimal legal document template can be challenging. Clearly, there are numerous designs available on the web, but how do you locate the legal template you need? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Indiana Pipeline Service Contract - Self-Employed, that you can utilize for business and personal needs. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Indiana Pipeline Service Contract - Self-Employed. Use your account to search through the legal forms you have purchased previously. Visit the My documents tab of your account to download another copy of the document you require.

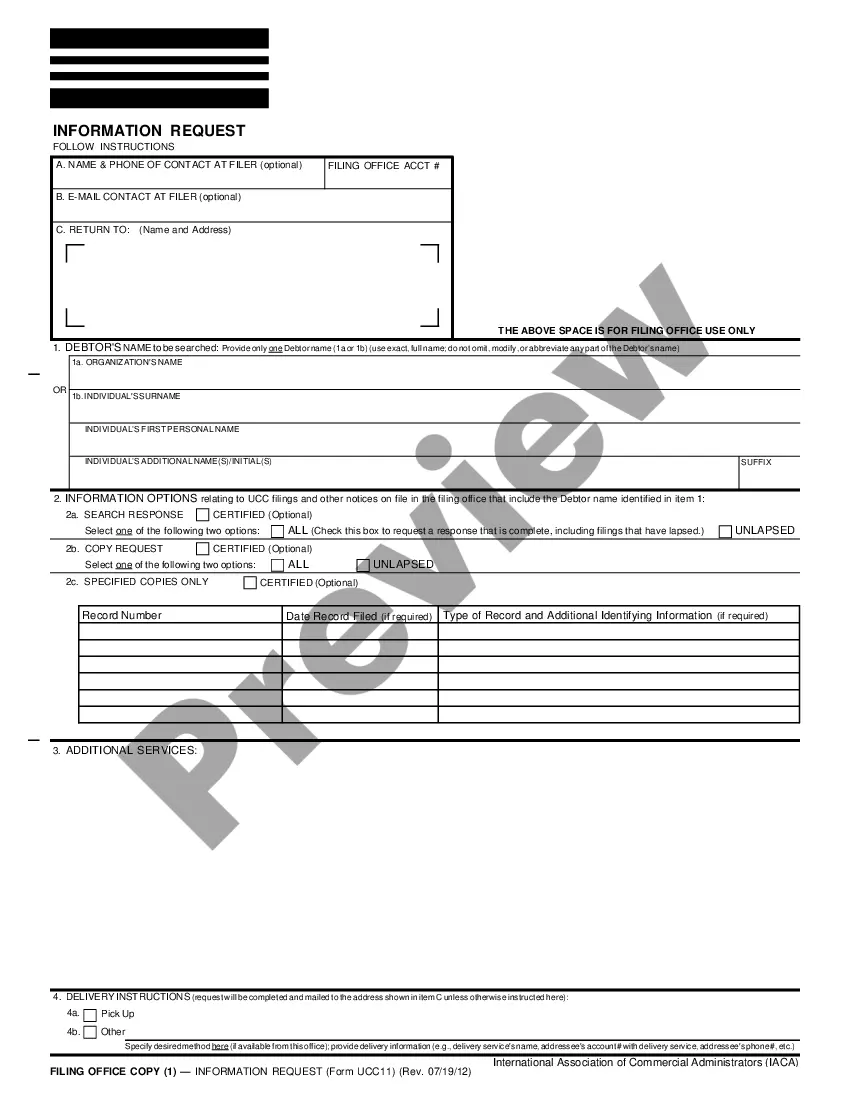

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct form for your city/state. You can browse the form using the Preview button and read the form summary to confirm it is appropriate for you. If the form does not meet your needs, use the Search field to find the right form.

US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to download professionally-crafted documents that meet state regulations.

- Once you are confident the form is suitable, click on the Buy now button to acquire the form.

- Select the pricing plan you prefer and enter the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, edit, print, and sign the acquired Indiana Pipeline Service Contract - Self-Employed.

Form popularity

FAQ

When working under an Indiana Pipeline Service Contract - Self-Employed, independent contractors must follow specific rules established by both state and federal laws. These rules define your responsibilities, tax obligations, and rights, emphasizing the importance of documentation and compliance. It is essential to maintain clear contracts that outline your services and payment terms, ensuring protection for both you and your clients. Understanding these regulations can help you navigate your role as a self-employed individual successfully.

Yes, you can write an agreement without a lawyer, which includes the Indiana Pipeline Service Contract - Self-Employed. However, it is crucial to understand the laws that apply to your agreement to ensure its validity. If you need help or want peace of mind, consider using platforms like USLegalForms, which offer templates and guidance for creating legally sound contracts.

You can absolutely write your own service agreement, including for the Indiana Pipeline Service Contract - Self-Employed. Just ensure you understand the essential components and legal implications involved. There are many resources available online, including templates, that can make the process easier and more efficient.

Self-written contracts are legal as long as they meet specific requirements, such as mutual consent and a clear description of services. In the context of the Indiana Pipeline Service Contract - Self-Employed, ensure your contract complies with state regulations to avoid any legal challenges. Always keep a copy for your records to serve as proof of the agreement.

An effective self-employed contract, like the Indiana Pipeline Service Contract - Self-Employed, should include the scope of work, payment terms, and timelines. Additionally, specify confidentiality agreements and dispute resolution mechanisms to protect both parties. Including these elements ensures that everyone is on the same page and can help prevent misunderstandings.

Yes, you can definitely write your own service contract. For an Indiana Pipeline Service Contract - Self-Employed, ensure you understand the legal requirements and include all necessary clauses to protect yourself. Using a simple template can guide you through the process and ensure you cover all relevant aspects in your contract.

To write a simple service contract for the Indiana Pipeline Service Contract - Self-Employed, start by clearly stating the names of the parties involved and the services being offered. Include important details such as payment terms, deadlines, and conditions for termination. Remember, clarity is key; ensure all parties understand their obligations to avoid conflicts later.

You can freelance without a contract, but it is risky. Working without an agreement, like an Indiana Pipeline Service Contract - Self-Employed, can lead to misunderstandings about your work and payment terms. A contract not only protects you but also establishes professionalism and trust with your clients.

Most independent contractors in Indiana do need a business license to legally operate. The licensing requirements can vary based on your type of service and local regulations. It's a good idea to check your local government rules and possibly consider an Indiana Pipeline Service Contract - Self-Employed, which may outline specific licensing needs related to your field.

Being self-employed means you operate your own business and offer services directly to clients. Contracted work, on the other hand, usually involves an agreement to provide services to a specific client or company. An Indiana Pipeline Service Contract - Self-Employed formalizes this relationship, highlighting the scope of work and payment terms, making it essential for clarity.