Indiana Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a vast selection of legal form templates that you can download or create.

By utilizing the website, you can access countless forms for both business and personal uses, categorized by type, state, or keywords. You can retrieve the latest versions of forms such as the Indiana Guaranty of Payment of Open Account in just moments.

If you have a subscription, Log In and obtain the Indiana Guaranty of Payment of Open Account from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the transaction using your credit card or PayPal account.

Select the format and download the form to your device. Edit, complete, print, and sign the downloaded Indiana Guaranty of Payment of Open Account. Every form you add to your account does not have an expiration date and belongs to you indefinitely. Thus, if you want to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Indiana Guaranty of Payment of Open Account with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure to select the correct form for your jurisdiction/state.

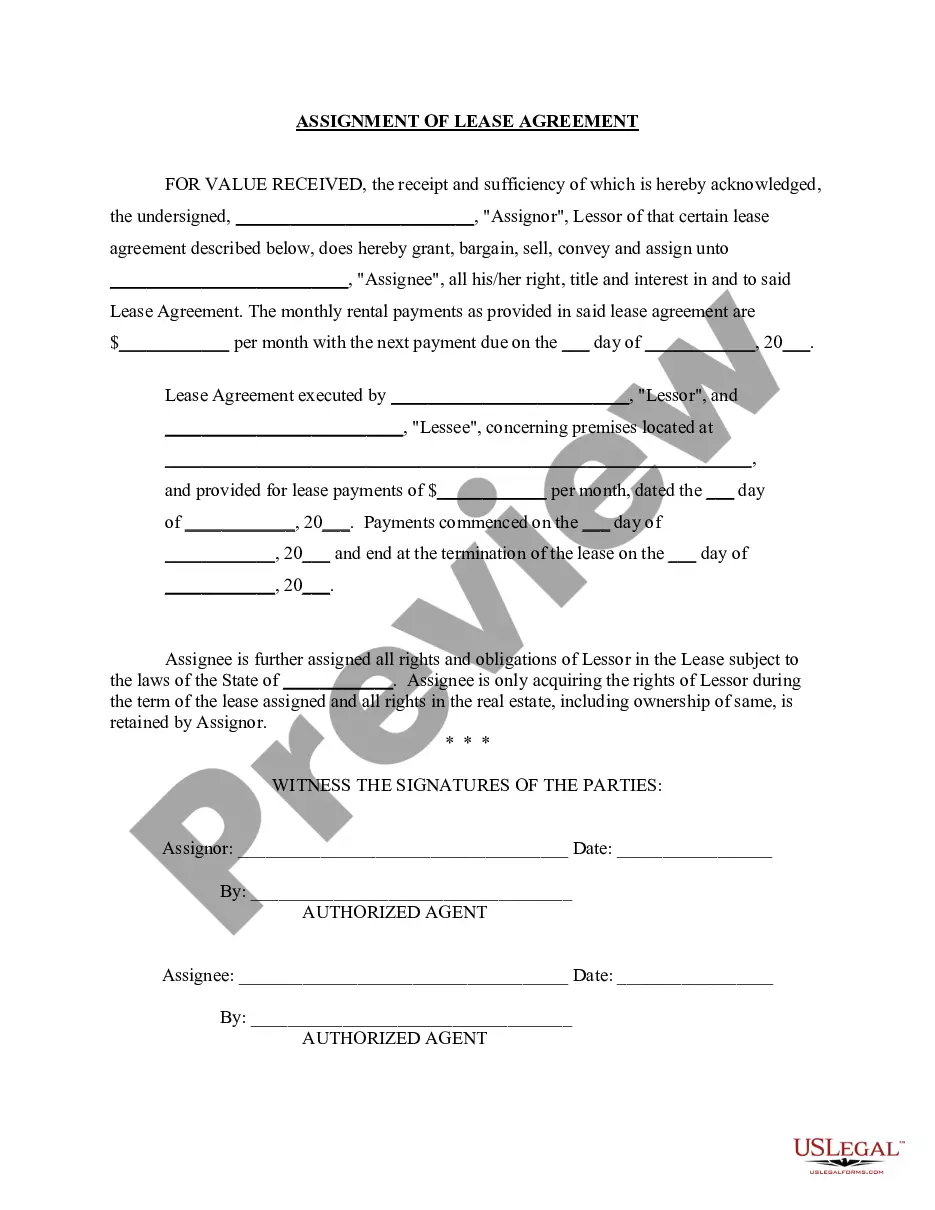

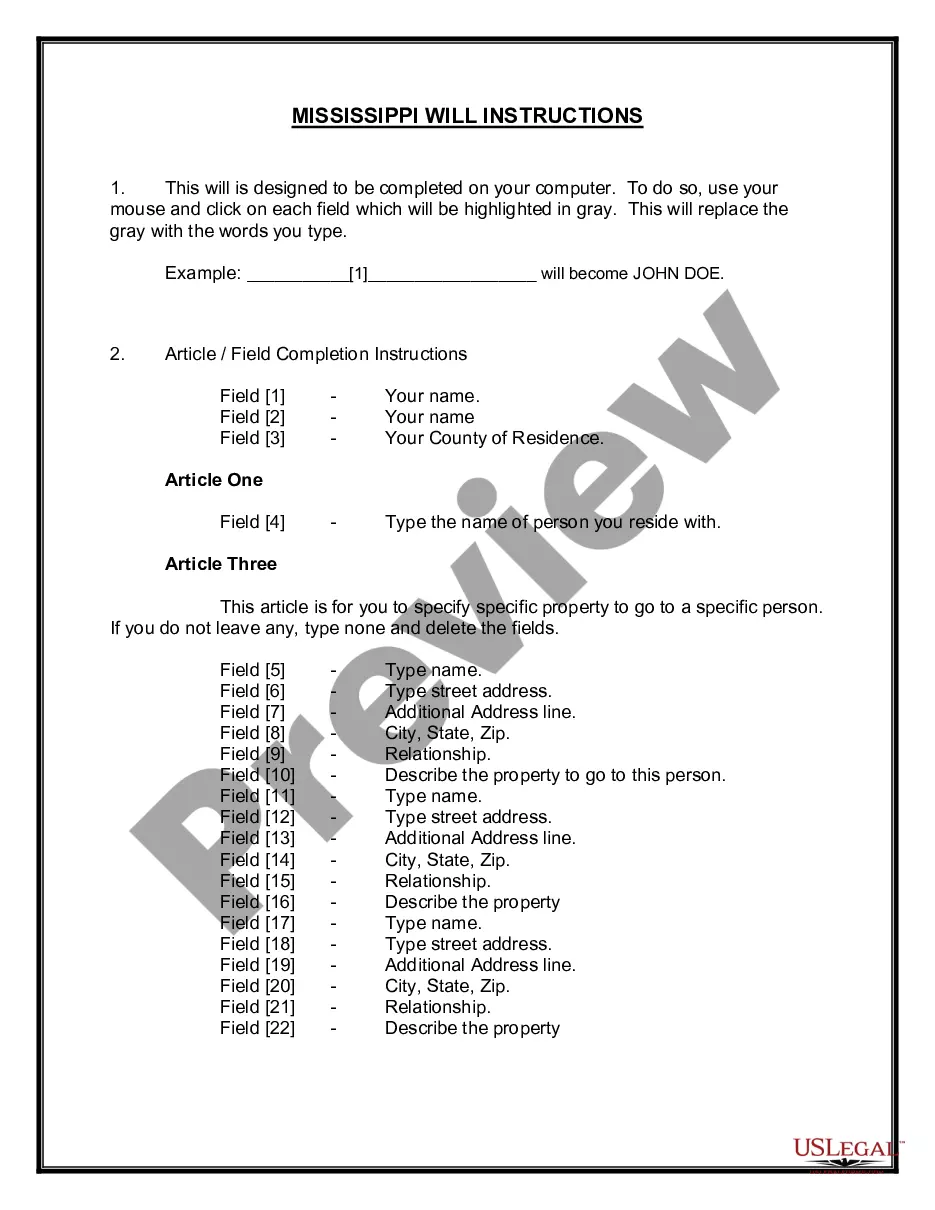

- Click the Preview button to review the form's details.

- Check the form description to ensure you've selected the appropriate form.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy Now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

When you fill out a guaranty form, start by listing your details and the specifics of the obligation you're guaranteeing. Clearly state the amount related to the Indiana Guaranty of Payment of Open Account, and define the responsibilities of all parties involved. Finally, ensure the form is signed and dated to validate your guarantee.

An example of a guarantor clause could state that 'The Guarantor hereby guarantees full payment of the obligations of the Borrower for the Indiana Guaranty of Payment of Open Account.' This clause clearly outlines the roles of both the guarantor and the borrower, ensuring that all parties understand their responsibilities. Including such a clause strengthens the legal enforceability of the agreement.

A guaranty of payment is a legal commitment by one party to take responsibility for another party's debt if they fail to fulfill their obligation. In the context of the Indiana Guaranty of Payment of Open Account, it ensures that the creditor receives payment, even if the primary debtor defaults. This type of agreement provides security to creditors and peace of mind for those extending credit.

To properly fill out a guarantee form, you should start by clearly writing your name and the relationship to the debtor. Indicate the amount that you are guaranteeing under the Indiana Guaranty of Payment of Open Account. Make sure to read any instructions provided with the form, and double-check for any errors before finalizing it.

Filling out a guarantee form requires careful attention to detail. Begin by entering your personal information, such as your name, address, and contact details. Next, provide the specifics of the Indiana Guaranty of Payment of Open Account, including the amount guaranteed and the parties involved. Always review the form for accuracy before submitting.

The Indiana Life and Health Insurance Guarantee Association exists to protect consumers in case their insurance provider fails. This association ensures that individuals will continue to receive coverage for their health or life insurance policies, maintaining stability in uncertain times. By offering this safety net, the association reinforces the trust that policyholders place in their insurance arrangements. Knowing about the Indiana Guaranty of Payment of Open Account can help you feel more secure in the choices you make regarding your financial safety.

The Indiana life and health insurance Guaranty Association Quizlet serves as an educational tool to help individuals better understand the benefits and functions of this association. By using this platform, users can learn key concepts related to insurance guarantees, policyholder rights, and the safeguards offered by the association. This interactive learning approach can empower individuals to make informed decisions about their insurance choices. Thus, exploring the Indiana Guaranty of Payment of Open Account enhances your knowledge and prepares you for real-world situations.

Indiana life and health insurance products serve to protect individuals and their families against unexpected health-related expenses and provide financial security. These insurance plans cover a wide range of medical conditions and circumstances, ensuring policyholders can access necessary care without financial burden. By offering coverage options tailored to different needs, the plans enhance the overall health and wellbeing of the community. It is crucial to consider the Indiana Guaranty of Payment of Open Account when choosing a provider to ensure you are safeguarded against unforeseen insolvencies.

The Indiana Life and Health Insurance Guaranty Association provides protection to policyholders in the event that an insurance company becomes insolvent. This association ensures that individuals receive benefits owed to them under their life and health insurance policies, thus maintaining the integrity of financial commitments. It essentially acts as a safety net, delivering peace of mind to policyholders amidst financial turmoil in the insurance sector. Understanding the role of the Indiana Guaranty of Payment of Open Account can help you appreciate the value of these protections.

Indiana Code 4 15 2.2 24 discusses financial matters related to state-funded entities and their payment obligations. This code reinforces the standards associated with financial transparency and accountability. For individuals and organizations involved in state contracts, familiarity with this code is important. US Legal Forms can aid you in accessing the relevant legal documents related to the Indiana Guaranty of Payment of Open Account, ensuring you stay informed.