Indiana IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

Have you ever been in a situation where you require documents for various companies or particular reasons almost daily.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast range of form templates, such as the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status, that are designed to satisfy federal and state regulations.

Once you find the right form, click Buy now.

Choose the pricing plan you desire, fill out the required information to create your account, and complete your purchase using PayPal or credit card. Select a convenient file format and download your copy. You can view all the document templates you have purchased in the My documents section. You may obtain an additional copy of the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status anytime if needed. Simply click the desired form to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and confirm it is for your specific city/state.

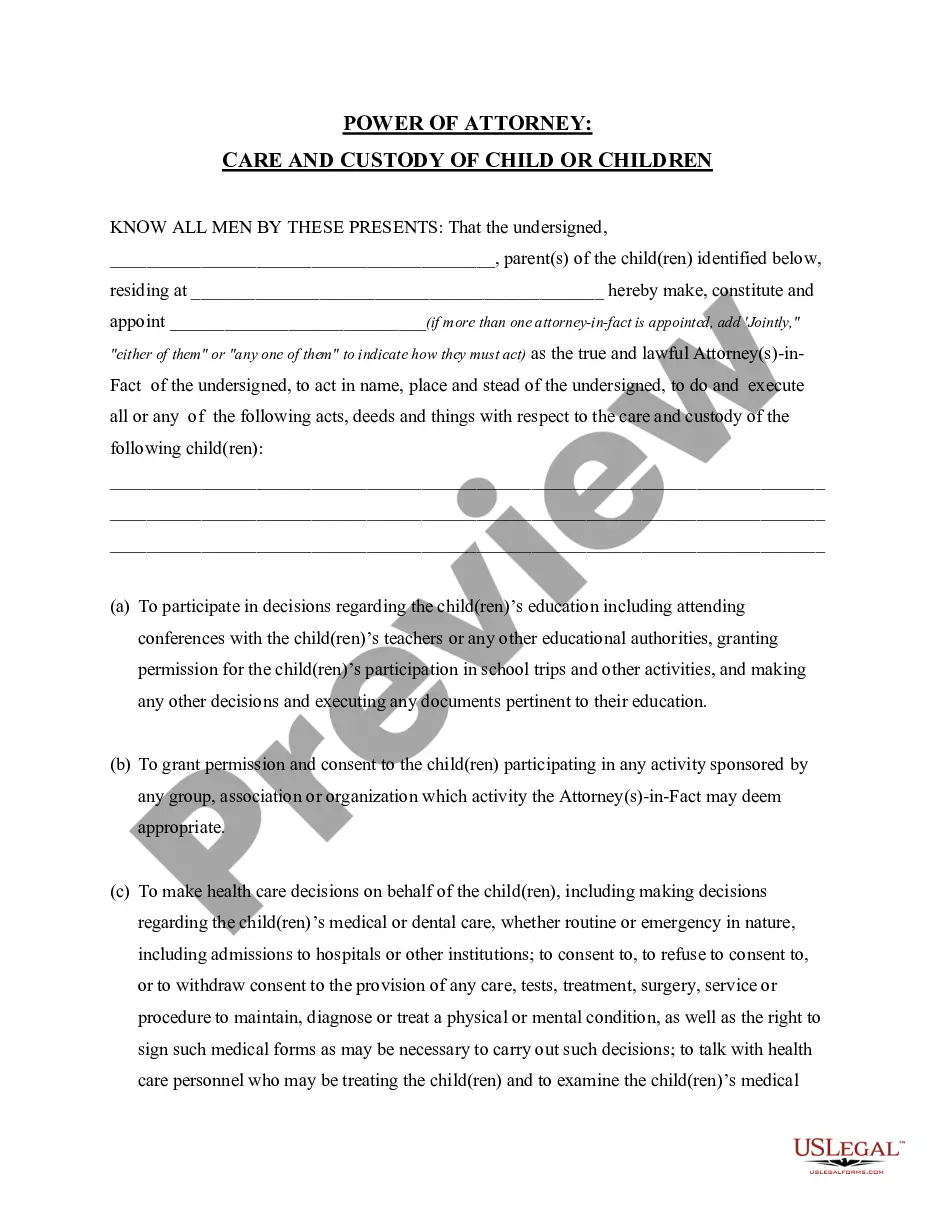

- Utilize the Preview button to view the form.

- Review the information to ensure you have selected the correct form.

- If the form is not what you require, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The IRS looks at several factors to determine if a person is an independent contractor, including the level of control the employer has over the work, the worker's independence, and the relationship's nature. You can take the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status to assess these factors effectively. This quiz helps clarify whether you should classify a worker as an independent contractor or an employee. Understanding this distinction can protect you from potential legal issues and financial penalties.

To decide whether someone is an employee or an independent contractor, factors such as behavioral and financial control, along with the relationship's nature, play a vital role. Often, the presence of specific contractual agreements or the provision of benefits will indicate classification. Utilizing the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status can assist in clarifying these distinctions effectively.

To assess independent contractor status, consider asking about the level of control the employer has over the worker, how payments are made, and whether the worker provides their tools. Additionally, inquire about the type of relationship and contract terms. These questions can be critical, and leveraging the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status can help streamline this evaluation.

Identifying whether a person is classified as a W-2 employee or a 1099 independent contractor depends on the nature of their work relationship. W-2 employees typically have a defined work schedule, receive benefits, and are subject to more control from their employer. In contrast, 1099 contractors enjoy greater freedom in how they complete their tasks. The Indiana IRS 20 Quiz to Determine 1099 vs Employee Status can provide additional clarity on this topic.

The IRS uses three primary tests: the behavioral control test, the financial control test, and the relationship test. Each test assesses different aspects of the work arrangement, focusing on the level of independence and the nature of the working relationship. For those seeking a systematic approach, the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status serves as a helpful tool for navigating these tests.

To determine a person's status as an employee or independent contractor, consider the degree of control the employer has over the worker, along with their financial relationship. Evaluating how much supervision is involved and the way payments are structured can provide insight into the correct classification. For more clarity, the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status offers a structured approach to understanding these classifications.

The IRS assesses independence through several criteria, mainly focusing on behavioral control, financial control, and the relationship's nature. Behavioral control pertains to how much direction the employer gives the worker, while financial control evaluates how the worker is compensated. By understanding these factors, you can use the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status for clearer guidance.

The distinction between an employee and an independent contractor hinges on various factors, including the level of control an employer has over the worker, the nature of the work relationship, and the financial arrangement. In short, the IRS evaluates how much direction and supervision the employer exercises over the worker's tasks. By utilizing the Indiana IRS 20 Quiz to Determine 1099 vs Employee Status, individuals can better understand these differences.