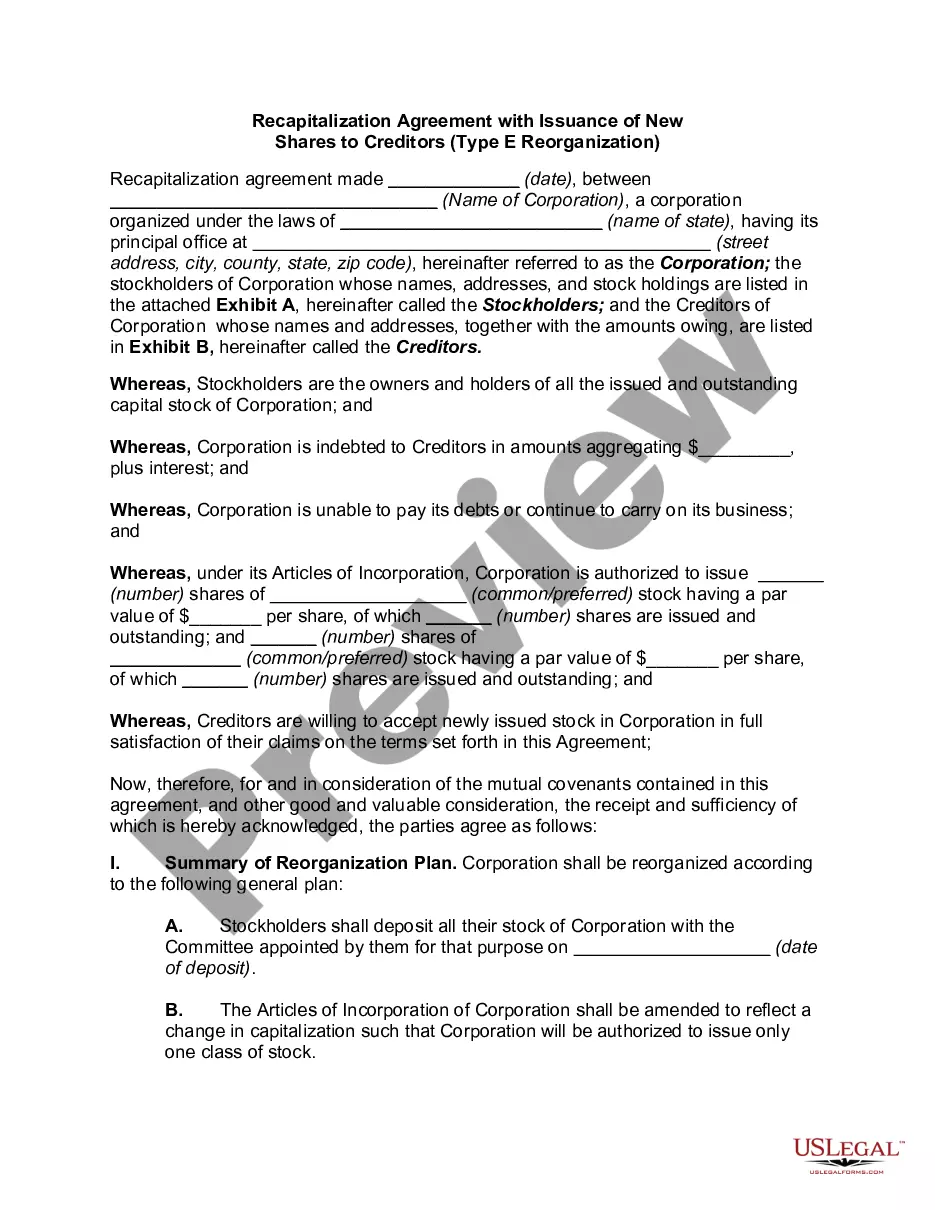

Indiana Recapitalization Agreement

Description

How to fill out Recapitalization Agreement?

US Legal Forms - one of the most significant libraries of legal kinds in the United States - delivers a wide range of legal papers templates you are able to acquire or print out. Making use of the site, you can find 1000s of kinds for company and individual purposes, sorted by classes, claims, or search phrases.You can find the most up-to-date types of kinds like the Indiana Recapitalization Agreement within minutes.

If you already possess a subscription, log in and acquire Indiana Recapitalization Agreement from the US Legal Forms local library. The Obtain switch can look on each and every develop you look at. You have access to all in the past saved kinds in the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, allow me to share straightforward instructions to help you started off:

- Be sure you have picked the right develop for the town/state. Click the Review switch to review the form`s information. Read the develop outline to actually have chosen the proper develop.

- When the develop doesn`t satisfy your needs, utilize the Lookup discipline at the top of the display screen to discover the one which does.

- Should you be content with the shape, validate your option by clicking the Buy now switch. Then, select the costs prepare you want and give your accreditations to register for the bank account.

- Process the purchase. Make use of your credit card or PayPal bank account to complete the purchase.

- Find the format and acquire the shape on your own product.

- Make alterations. Fill up, revise and print out and sign the saved Indiana Recapitalization Agreement.

Every single web template you added to your money does not have an expiry particular date and is also your own property permanently. So, in order to acquire or print out yet another duplicate, just go to the My Forms section and then click about the develop you will need.

Obtain access to the Indiana Recapitalization Agreement with US Legal Forms, the most considerable local library of legal papers templates. Use 1000s of skilled and state-specific templates that satisfy your business or individual demands and needs.

Form popularity

FAQ

Leveraged recapitalizations have a similar structure to that employed in leveraged buyouts (LBO), to the extent that they significantly increase financial leverage. But unlike LBOs, they may remain publicly traded.

Leveraged Recapitalization In this case, the company may issue debt securities to fund buying back its outstanding shares in the market. By reducing the number of outstanding shares, the company expects to increase the earnings per share, as well as increase the share price.

Leveraged recapitalization, leveraged buyouts, nationalization, and equity recapitalization are various types of recapitalization. One may also use this process as an opening route in private equity.

Recapitalization occurs when a company adjusts its capital structure, often with the goal of shifting its D/E ratio closer to its optimal capital structure. Such measures are taken by companies to reach their ?optimal capital structure? ? either to: Maximize Shareholder Value (or) Fix an Unsustainable Capital Structure.

Recapitalization is the restructuring of a company's debt and equity ratio. The purpose of recapitalization is to stabilize a company's capital structure. Some of the reasons a company may consider recapitalization include a drop in its share price, to defend against a hostile takeover, or bankruptcy.

Recapitalization can refer to the creation of common and preferred stock. Preferred stock has dividend and liquidation priority over common stock. In other words, the owner of preferred stock has a greater degree of security than the owner of common stock.