Indiana Agreement and Plan of Conversion -

Description

How to fill out Agreement And Plan Of Conversion -?

If you have to full, down load, or produce lawful record web templates, use US Legal Forms, the largest variety of lawful kinds, which can be found on the web. Utilize the site`s easy and practical look for to obtain the documents you want. Various web templates for business and person functions are sorted by classes and states, or keywords. Use US Legal Forms to obtain the Indiana Agreement and Plan of Conversion - within a number of mouse clicks.

When you are previously a US Legal Forms consumer, log in to your account and click on the Obtain key to have the Indiana Agreement and Plan of Conversion -. Also you can gain access to kinds you previously saved within the My Forms tab of the account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape to the appropriate metropolis/nation.

- Step 2. Take advantage of the Preview method to look through the form`s content. Never neglect to read through the outline.

- Step 3. When you are not satisfied together with the develop, utilize the Search discipline towards the top of the display to discover other versions of your lawful develop format.

- Step 4. Once you have discovered the shape you want, click on the Acquire now key. Opt for the pricing program you like and add your credentials to register to have an account.

- Step 5. Method the purchase. You can utilize your charge card or PayPal account to finish the purchase.

- Step 6. Choose the format of your lawful develop and down load it on your own system.

- Step 7. Complete, revise and produce or indicator the Indiana Agreement and Plan of Conversion -.

Every single lawful record format you purchase is your own forever. You might have acces to every develop you saved in your acccount. Click on the My Forms section and select a develop to produce or down load once again.

Contend and down load, and produce the Indiana Agreement and Plan of Conversion - with US Legal Forms. There are thousands of specialist and express-specific kinds you can use for your personal business or person requires.

Form popularity

FAQ

Please visit our office on the web at .sos.IN.gov 4. Make check or money order payable to the Secretary of State. 5. Submit original completed paperwork and payment to: 302 West Washington Street, Room E-018, Indianapolis, IN 46204.

Once your LLC or corporation formation is approved by Indiana, you need to file Form 2553, Election by a Small Business Corporation, with the IRS to get S corp status.

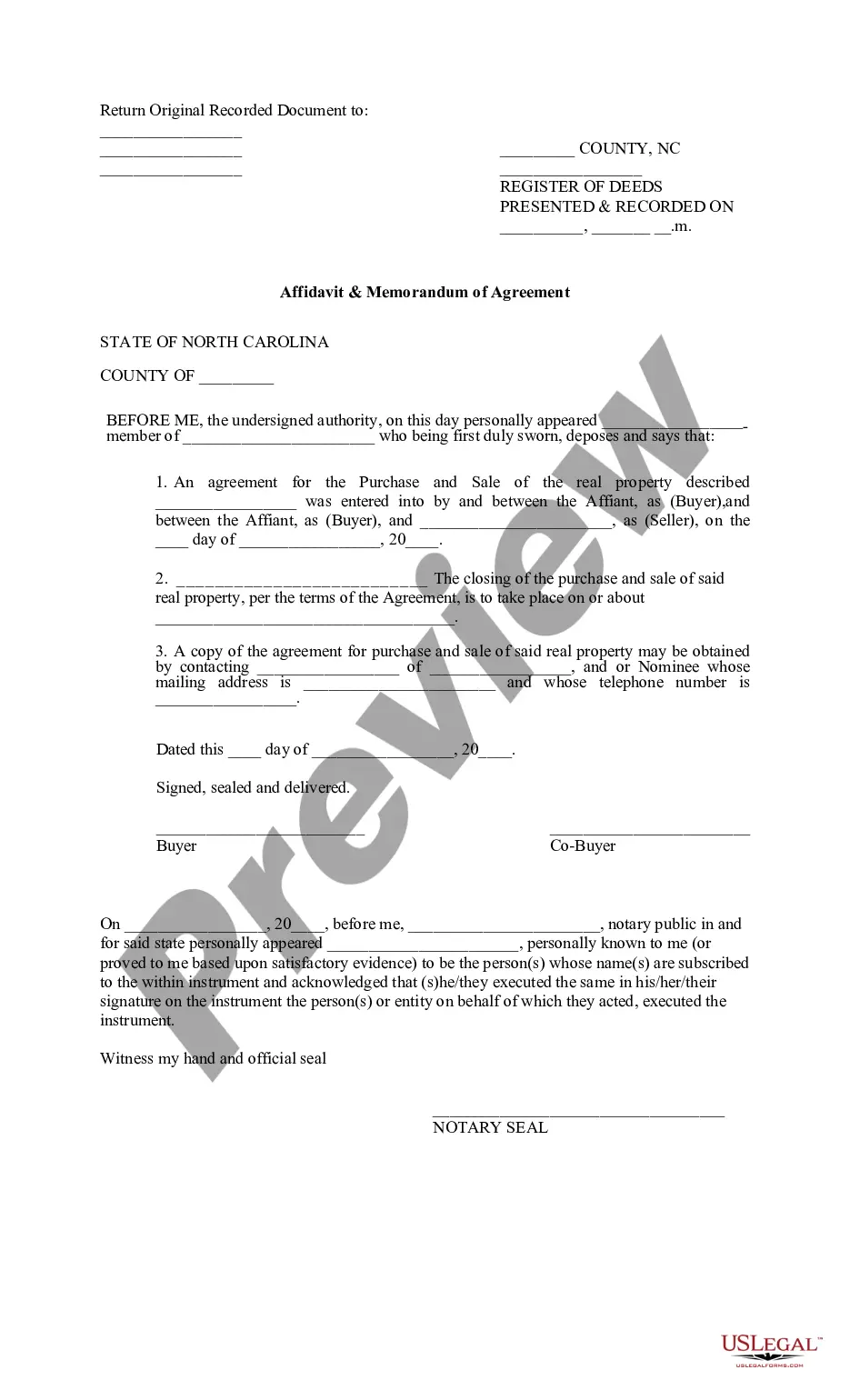

The Certificate of Conversion, also known as the Articles or Statement of Conversion, is the document that officially puts your business entity conversion into effect. This conversion document includes basic information about both your converting and converted entities.

Company Domestication in Indiana Step 1: Your entity needs to authorize domestication as required by the laws of the foreign jurisdiction. Step 2: The foreign entity is then converted into an Indiana entity by filing Articles of Domestication with Indiana Secretary of State.

The articles of organization document contains all the information needed to establish your LLC in Indiana. Including: The name of your LLC. The street address of your LLC's registered office and the name of the registered agent at that office.

The document required to form an LLC in Indiana is called the Articles of Organization. The information required in the formation document varies by state. Indiana's requirements include: Registered agent.

To register a foreign corporation in Indiana, you must file an Indiana Application for Certificate of Authority of a Foreign Corporation with the Indiana Secretary of State, Corporations Division.