Indiana Expense Limitation Agreement

Description

How to fill out Expense Limitation Agreement?

Are you in a situation where you require files for both company or individual functions virtually every time? There are tons of lawful document themes available on the net, but finding ones you can trust is not easy. US Legal Forms gives 1000s of develop themes, like the Indiana Expense Limitation Agreement, that happen to be created to meet state and federal requirements.

When you are previously acquainted with US Legal Forms internet site and possess your account, merely log in. Afterward, you can down load the Indiana Expense Limitation Agreement template.

If you do not have an account and would like to start using US Legal Forms, abide by these steps:

- Discover the develop you need and ensure it is to the correct town/county.

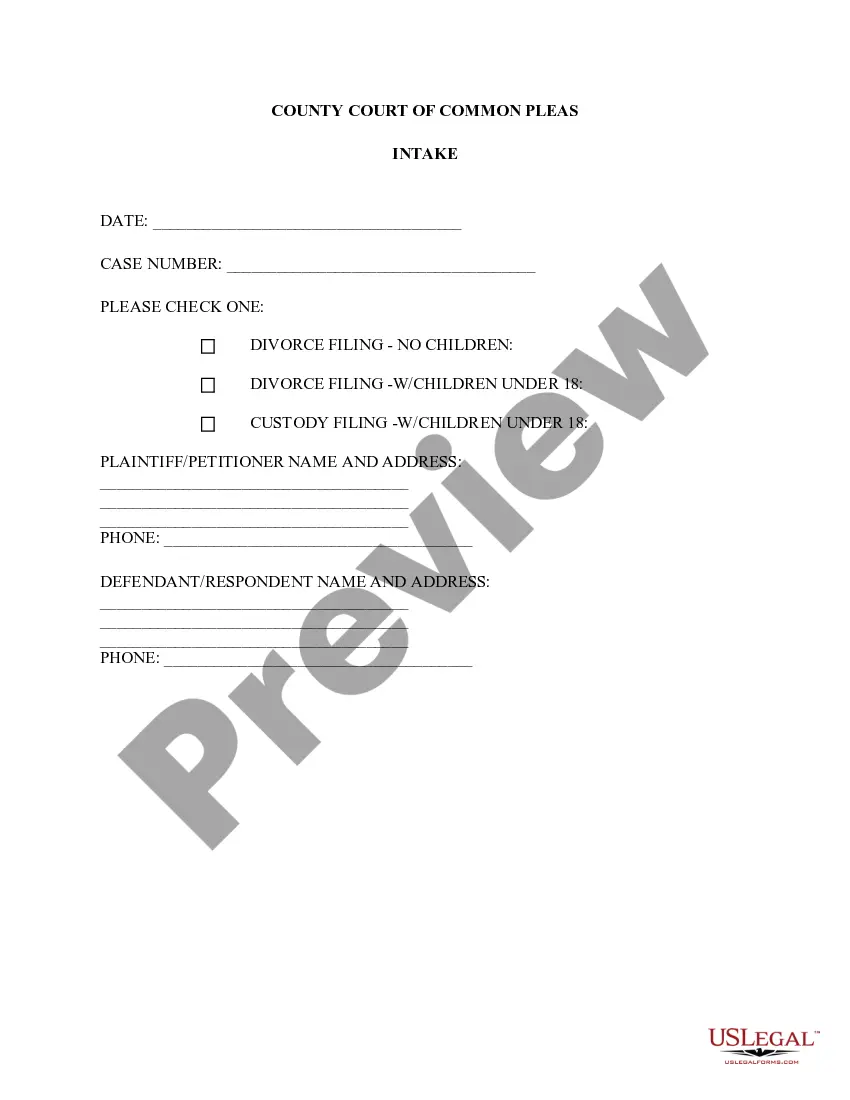

- Take advantage of the Review switch to analyze the shape.

- See the outline to actually have chosen the appropriate develop.

- In case the develop is not what you`re trying to find, make use of the Look for industry to get the develop that fits your needs and requirements.

- Once you get the correct develop, click on Acquire now.

- Pick the pricing strategy you need, fill out the desired information and facts to produce your money, and buy the order utilizing your PayPal or bank card.

- Pick a convenient document formatting and down load your backup.

Discover all the document themes you have purchased in the My Forms food selection. You can obtain a further backup of Indiana Expense Limitation Agreement any time, if necessary. Just click on the necessary develop to down load or printing the document template.

Use US Legal Forms, by far the most extensive variety of lawful varieties, in order to save time as well as stay away from mistakes. The services gives skillfully made lawful document themes that can be used for a range of functions. Make your account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

You may obtain the Indiana CC-40 tax form along with all requirements and instructions online here from the State of Indiana's website. This form is for computing credit for contributions to colleges and universities located in Indiana.

To be eligible for a tax warrant expungement, all outstanding tax liabilities must be paid in full or otherwise resolved and the taxpayer must be current on all tax filings for the previous five years.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Indiana has adopted the Internal Revenue Code as in effect March 31, 2021, thus incorporating the federal changes into Indiana law. However, in 2018, Indiana decoupled from the provisions of IRC § 163(j), allowing the full amount of the deduction. The allowance of the full deduction will continue to be allowed.

Indiana Form IT-40 ? Personal Income Tax for Residents. Indiana Form IT-40PNR ? Personal Income Tax for Nonresidents. Indiana Form IT-2440 ? Disability Retirement Deduction. Indiana Schedule 1 ? Add-Backs. Indiana Schedule 2 ? Deductions.

Indiana LLCs are taxed as pass-through entities by default, which means that the LLC itself doesn't pay taxes, its members (owners) do. Profits pass through the LLC and onto the tax filings of the members where they'll pay federal income tax and self-employment taxes (15.3%) on their LLC income.

Form WH-47, Certificate of Residence, should be completed by residents of these states working for Indiana employers. This certificate is an affidavit showing the employee's state of legal residence and provides proof that no withholding of Indiana state income tax is required.

What Credit is Available? A taxpayer may be eligible for a credit on qualified research expenses incurred in Indiana. The potential value of the credit is equal to the taxpayer's qualified research expense for the taxable year, minus the base period amount up to $1 million, multiplied by 15 percent.