Indiana Tenant Improvement Lease

Description

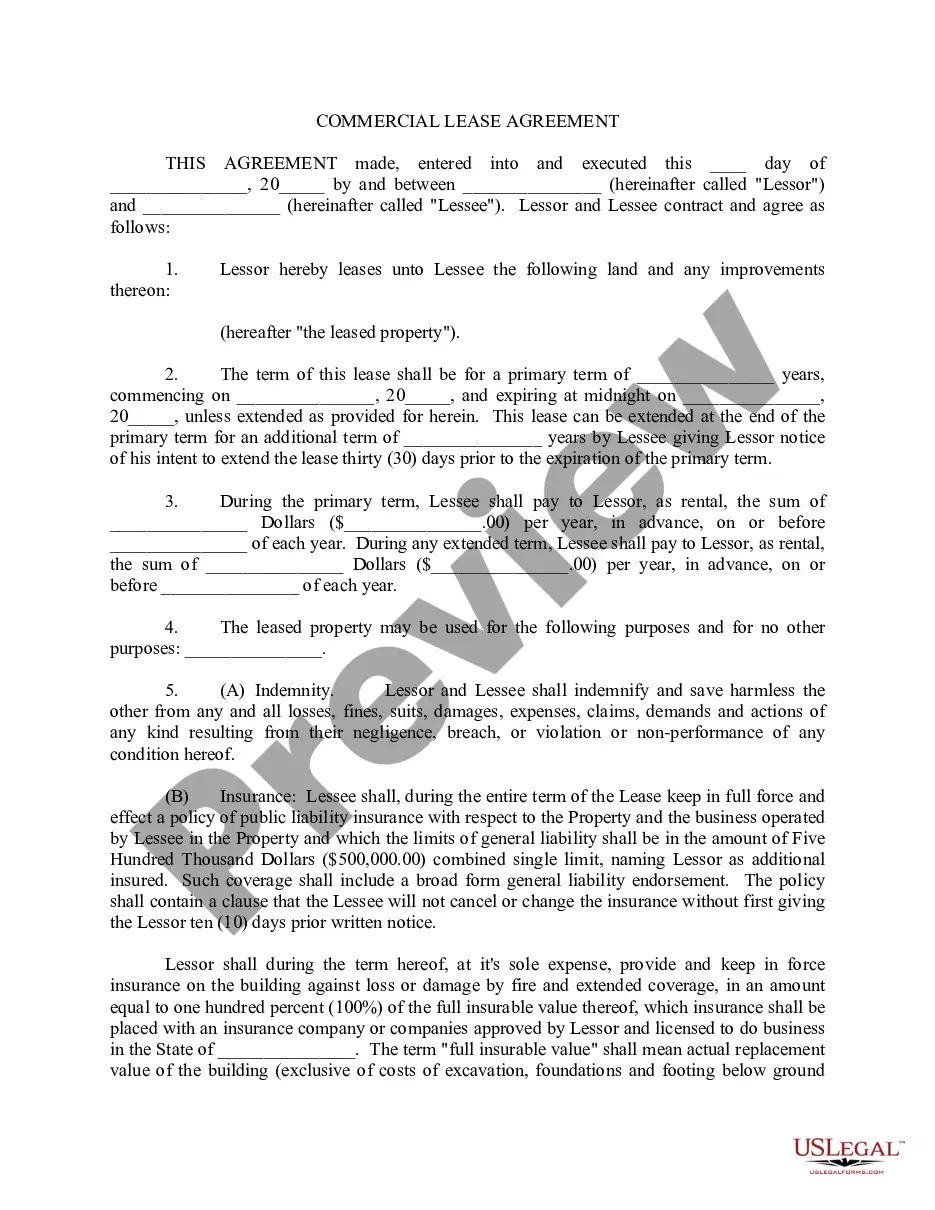

How to fill out Tenant Improvement Lease?

Have you been within a place where you need papers for possibly enterprise or specific reasons nearly every time? There are tons of legitimate document web templates available on the net, but locating types you can trust isn`t easy. US Legal Forms gives a huge number of kind web templates, like the Indiana Tenant Improvement Lease, which are created in order to meet state and federal needs.

Should you be presently knowledgeable about US Legal Forms site and possess your account, just log in. Afterward, you may obtain the Indiana Tenant Improvement Lease template.

Unless you provide an profile and want to start using US Legal Forms, adopt these measures:

- Discover the kind you want and ensure it is to the right city/county.

- Utilize the Review option to examine the form.

- Browse the information to ensure that you have selected the right kind.

- When the kind isn`t what you`re looking for, make use of the Research area to obtain the kind that meets your needs and needs.

- If you obtain the right kind, click Get now.

- Opt for the costs prepare you would like, submit the desired information to create your money, and buy the transaction using your PayPal or charge card.

- Decide on a hassle-free document file format and obtain your copy.

Find all the document web templates you may have purchased in the My Forms menus. You can obtain a further copy of Indiana Tenant Improvement Lease whenever, if possible. Just click the necessary kind to obtain or print the document template.

Use US Legal Forms, the most considerable selection of legitimate kinds, to save time and avoid blunders. The support gives professionally produced legitimate document web templates that can be used for a selection of reasons. Make your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

What are some examples of TI's? Every business has specific needs and TI's enable them to customize a lease space to meet specific needs. Some examples of TI's include adding walled offices, a break room or kitchen, an additional bathroom, conference rooms, drop ceilings and painting.

If the lessee owns the improvements, then the lessee initially records the allowance as an incentive (which is a deferred credit), and amortizes it over the lesser of either the term of the lease or the useful life of the improvements, with no residual value.

From an accounting standpoint, leasehold improvements must be capitalized on the balance sheet, meaning the cost of the improvements is spread out over time in line with the company's use of space.

If the improvement allowance is paid after the lease's commencement date, the payments will be factored into both the lease liability and ROU asset measurement. The lease liability is calculated as the present value of all future payments, including those received for the allowance. Tenant Improvement Allowance Accounting for ASC 842 ... LeaseQuery ? blog ? tenant-improvement-al... LeaseQuery ? blog ? tenant-improvement-al...

For purposes of accounting, the costs of leasehold improvements are capitalized as a fixed asset and then amortized rather than depreciated, as the prior section mentioned. Leasehold Improvements (LI) | Definition + Examples wallstreetprep.com ? knowledge ? leasehold... wallstreetprep.com ? knowledge ? leasehold...

The lessor records the expenditure as a fixed asset and depreciates it over the useful life of the asset. Accounting for a tenant improvement allowance AccountingTools ? articles ? accounti... AccountingTools ? articles ? accounti...

Expense tenant improvements with depreciation. They are tangible assets that the landlord owns. They have a useful life and a salvage value. The landlord records them as an asset on the balance sheet and then expenses them over time as depreciation on income statements. 4 Ways to Account for Tenant Improvements - wikiHow wikihow.com ? Account-for-Tenant-Improv... wikihow.com ? Account-for-Tenant-Improv...

Per-Square-Foot Basis: Many leases calculate TIAs based on a per-square-foot basis. This involves multiplying the agreed-upon per-square-foot allowance by the total square footage of the leased space. For example, if the TIA is $10 per square foot, and your space is 2,000 square feet, your TIA would be $20,000.