Indiana Commercial Lease - Long Form

Description

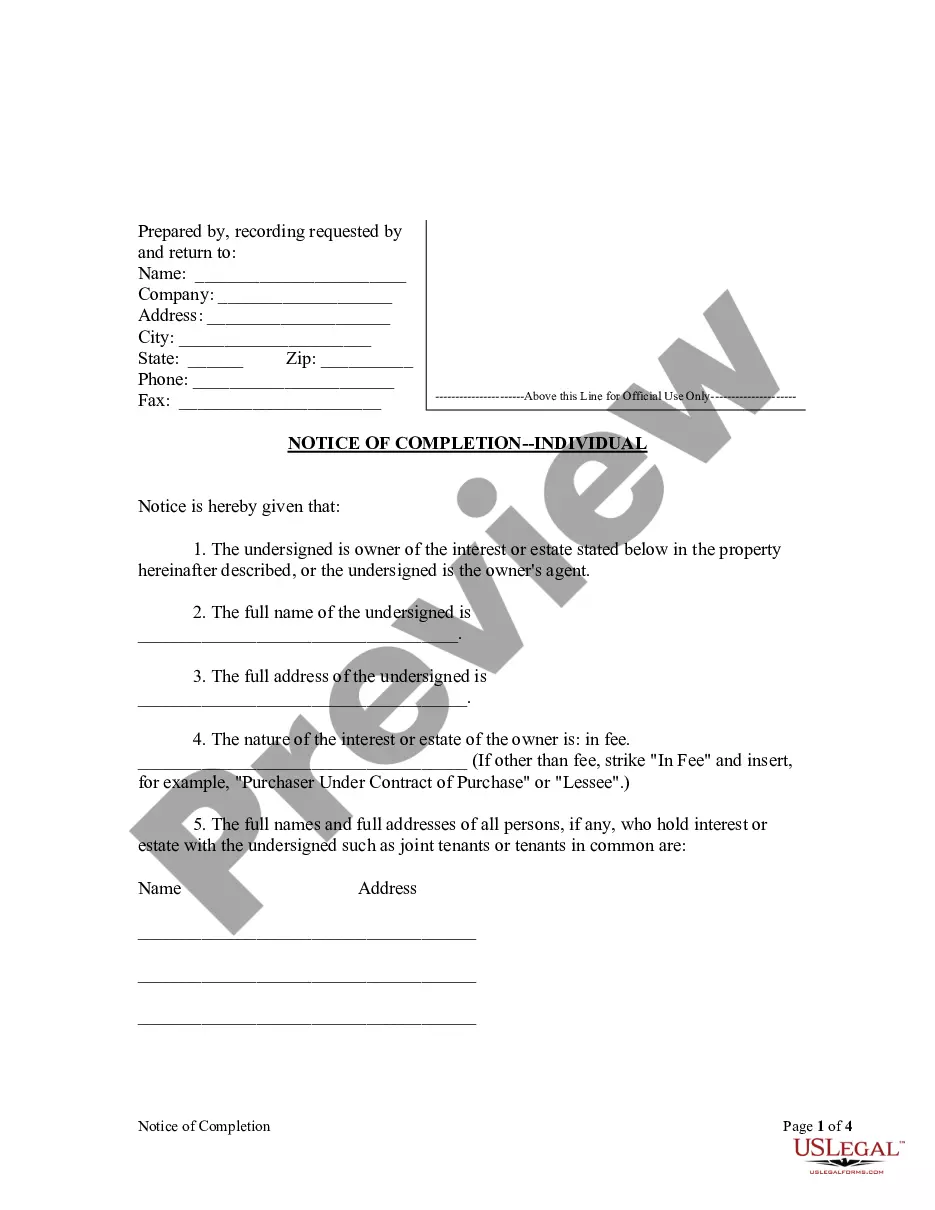

How to fill out Commercial Lease - Long Form?

Are you presently in a position where you require documents for possible business or particular purposes nearly every day? There is a plethora of legitimate document templates available online, but finding forms you can trust isn’t simple.

US Legal Forms offers a vast selection of form templates, including the Indiana Commercial Lease - Long Form, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, just Log In. After that, you can download the Indiana Commercial Lease - Long Form template.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Indiana Commercial Lease - Long Form at any time if needed. Click on the required form to download or print the document template.

Utilize US Legal Forms, the largest repository of legal forms, to save time and prevent mistakes. The service provides well-structured legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the right form.

- If the form isn’t what you are searching for, use the Search section to find the form that meets your needs.

- If you find the correct form, simply click Buy now.

- Choose the pricing plan you desire, fill out the necessary information to create your account, and make a purchase using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Getting approved for a lease with a 600 credit score is possible, but it may require additional steps. Some landlords may seek extra security, such as higher deposits or a co-signer. Presenting a well-prepared proposal with an Indiana Commercial Lease - Long Form can demonstrate your commitment and make you a more appealing candidate.

Assigning a commercial lease typically involves obtaining the landlord’s consent. First, review your lease agreement to check for any restrictions. Once you secure approval, you can draft an assignment agreement that outlines the terms of the transition. Using an Indiana Commercial Lease - Long Form ensures that all parties understand their responsibilities and rights clearly.

The required down payment for a commercial property can vary widely, often ranging from 10% to 30%. Factors influencing this include the property type, lease length, and your financial profile. An Indiana Commercial Lease - Long Form can clearly outline your payment obligations and help you budget effectively. Be mindful of additional costs that may arise during the leasing process.

Most landlords usually accept a minimum credit score of 620 for an Indiana Commercial Lease - Long Form. While some may accept lower scores, it's essential to emphasize your business’s financial strengths in such cases. Providing additional documentation can enhance your chances. If you’re uncertain, consult with leasing professionals for tailored advice.

The minimum credit score for a commercial lease often starts at around 600. However, landlords may prefer higher scores to ensure reliability in rental payments. If your score falls below this benchmark, consider discussing your situation with potential landlords or seeking partnerships to strengthen your application. Utilizing an Indiana Commercial Lease - Long Form can help you present a structured and thorough agreement.

The best lease type for commercial property depends on your business needs. For many business owners, a long-term lease provides stability, while a flexible lease may suit startups better. An Indiana Commercial Lease - Long Form often includes clear terms and conditions, making it a popular choice for both landlords and tenants when they seek comprehensive agreements.

To rent a commercial property under an Indiana Commercial Lease - Long Form, most landlords typically look for a credit score of at least 650. However, this requirement can vary based on the property type and the landlord’s own criteria. A higher credit score can lead to better leasing terms. Make sure to check with individual landlords to understand their specific demands.

The three primary types of commercial property leases are the Gross Lease, the Net Lease, and the Percentage Lease. A Gross Lease typically involves the landlord covering all property expenses, while a Net Lease shifts some costs to the tenant; the Percentage Lease ties rent to a percentage of sales, benefiting both parties in profitable situations. In Indiana, understanding these lease types can help you determine which best fits your business model and financial strategy. Utilizing resources like the Indiana Commercial Lease - Long Form will simplify this decision-making process.

A long commercial lease is a rental agreement that typically extends beyond five years and provides businesses with stability and predictability. In Indiana, a long commercial lease can help you secure a favorable location for your business and establish a strong relationship with your landlord. This type of lease often includes terms that grant rights and responsibilities to both parties, ensuring clarity and reducing potential conflicts. By using Indiana Commercial Lease - Long Form, you can customize your lease to meet your business needs effectively.

You should mail Indiana Form 104 to the appropriate address based on your specific situation. Generally, if you are expecting a refund, you can send it to the Indiana Department of Revenue at P.O. Box 40, Indianapolis, IN 46206-0040. If you owe taxes, you should send it to the address listed in the instructions for the Indiana Commercial Lease - Long Form. Make sure to double-check all mailing details to ensure your documents reach the correct destination promptly.