Indiana Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

How to fill out Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

Are you currently within a placement in which you will need files for either organization or specific purposes virtually every day? There are plenty of authorized papers web templates available on the Internet, but locating versions you can rely is not effortless. US Legal Forms delivers 1000s of form web templates, such as the Indiana Master Agreement between Credit Suisse Financial Products and Bank One National Association, which can be composed to fulfill federal and state needs.

In case you are previously acquainted with US Legal Forms internet site and possess a merchant account, merely log in. Following that, it is possible to obtain the Indiana Master Agreement between Credit Suisse Financial Products and Bank One National Association template.

Should you not provide an account and need to start using US Legal Forms, adopt these measures:

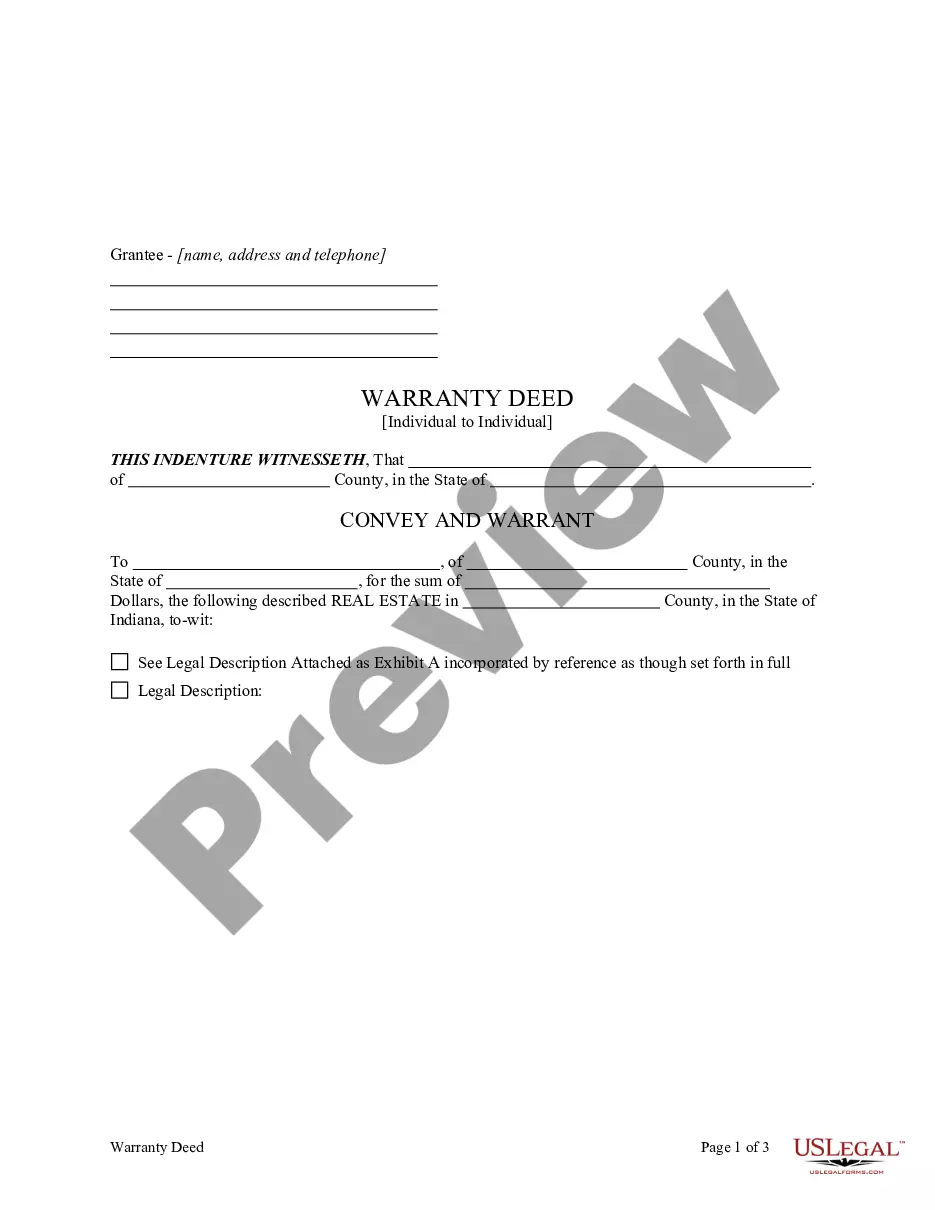

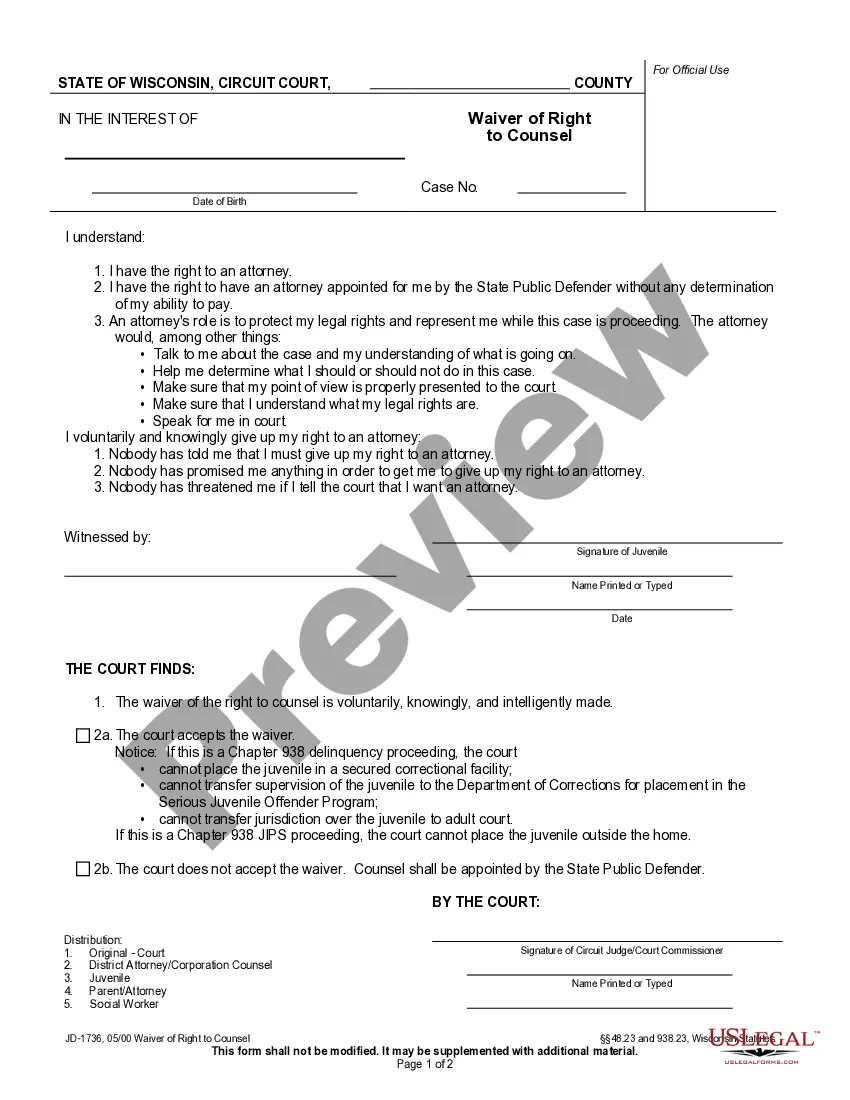

- Find the form you require and ensure it is to the right city/county.

- Use the Preview option to examine the shape.

- Browse the outline to ensure that you have chosen the appropriate form.

- In case the form is not what you are seeking, use the Look for discipline to find the form that meets your requirements and needs.

- Once you obtain the right form, just click Purchase now.

- Select the pricing strategy you desire, fill in the required details to generate your account, and buy the order with your PayPal or bank card.

- Pick a handy file format and obtain your version.

Locate all the papers web templates you possess purchased in the My Forms food selection. You can obtain a further version of Indiana Master Agreement between Credit Suisse Financial Products and Bank One National Association any time, if necessary. Just click on the needed form to obtain or print out the papers template.

Use US Legal Forms, by far the most extensive selection of authorized forms, in order to save efforts and stay away from mistakes. The service delivers skillfully created authorized papers web templates which you can use for a variety of purposes. Create a merchant account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

One Bank Collaboration (OBC) is all about having an established network of colleagues who have the trust in each other to execute and deliver the right solutions to the bank's clients. Through this strategy, Credit Suisse generates creative solutions and enables stronger client relationships.

On 19 March 2023, Swiss bank UBS Group AG agreed to buy Credit Suisse for CHF 3 billion (US$3.2 billion) in an all-stock deal brokered by the government of Switzerland and the Swiss Financial Market Supervisory Authority.

The strategic update suggests that UBS has started to look beyond the integration of its former competitor, which was rescued from collapse by government support in March. The acquisition of some of Credit Suisse's business territories in Asia and Latin America has given UBS an immediate scale boost.

Credit Suisse Group AG has been merged into UBS Group AG and the combined entity will operate as a consolidated banking group.

The combined group will oversee $5 trillion of assets, giving UBS a leading position in key markets it would otherwise have needed years to grow in size and reach. The merger also ends Credit Suisse's 167-years of independence.

Each Credit Suisse shareholder will receive cash in lieu of any fractional UBS Group AG Shares that such stockholder would otherwise receive in the transaction. Note that if you hold Credit Suisse ADSs, the Credit Suisse Depositary may charge you certain fees in connection with the transaction.