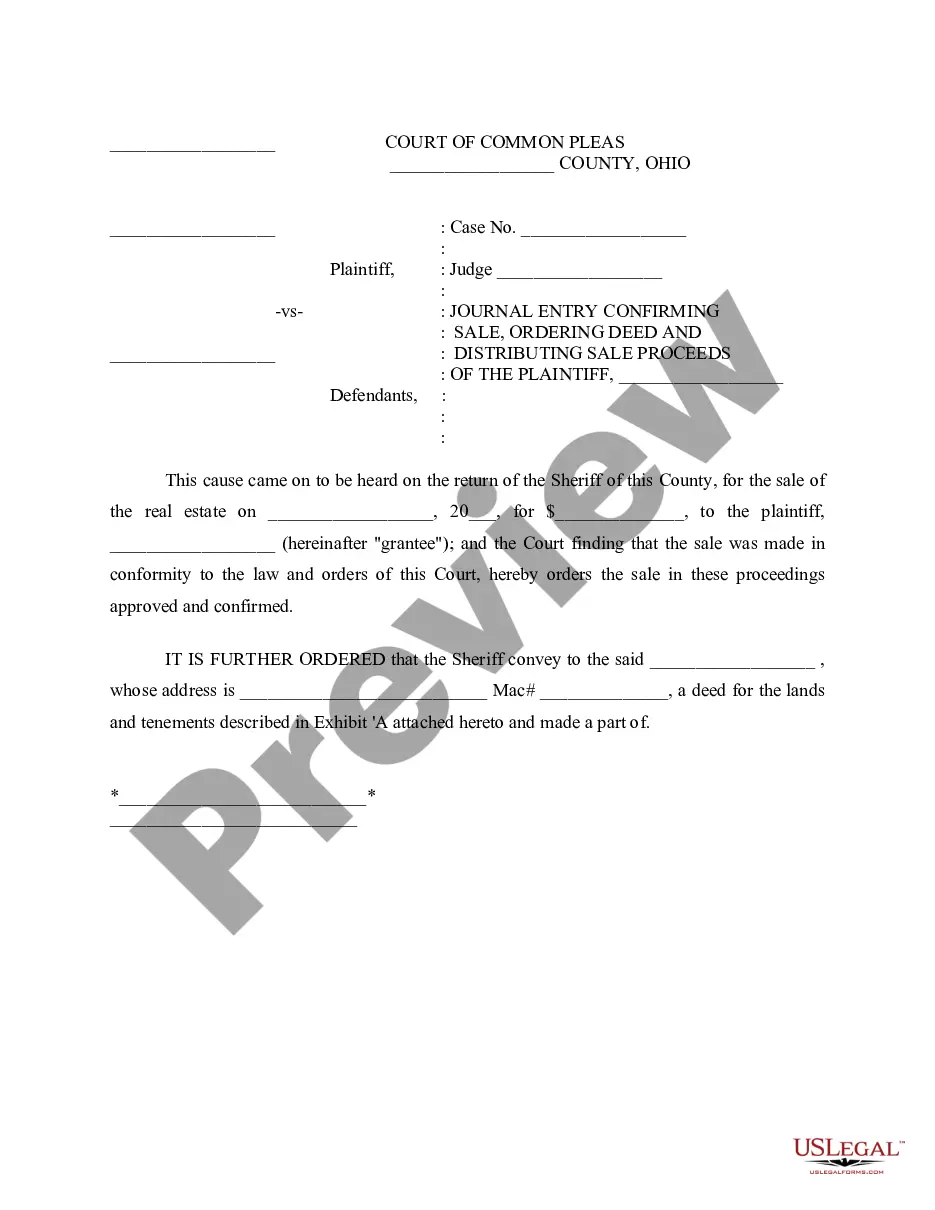

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Indiana Fee Interest Workform

Description

How to fill out Fee Interest Workform?

Selecting the appropriate legal document template can be a challenge.

Naturally, there are numerous templates accessible online, but how will you obtain the legal form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview option and review the form details to confirm this is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Indiana Fee Interest Workform. US Legal Forms is the largest collection of legal documents from which you can discover various document templates. Leverage the service to acquire properly crafted documents that adhere to state regulations.

- The service offers a wide range of templates, including the Indiana Fee Interest Workform, which can be used for both business and personal needs.

- All of the documents are verified by experts and comply with federal and state standards.

- If you are currently registered, Log In to your account and click on the Download button to acquire the Indiana Fee Interest Workform.

- Use your account to review the legal documents you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

Form popularity

FAQ

ST103 is another name for the ST-103 form used in Indiana for sales tax exemptions. This form is essential for buyers who qualify for the exemption and wish to avoid sales tax on purchases. Familiarizing yourself with the ST103 and the Indiana Fee Interest Workform can simplify your tax processes. Make sure to keep accurate records to support your claims and avoid potential legal issues.

Delayed tax payments in Indiana accrue interest, which can significantly affect the total amount owed. The state sets the interest rate, which is calculated on the unpaid tax amount. Understanding how this interest accumulates can help you avoid unexpected expenses in your financial planning. Utilizing the Indiana Fee Interest Workform can assist you in managing your tax obligations more efficiently.

In Indiana, various entities qualify for sales tax exemption, including government agencies, non-profits, and specific businesses. To obtain an exemption, these entities must complete the appropriate forms, such as the ST-103, and provide valid reasons for their exemption status. Knowing the Indiana Fee Interest Workform and requirements can help you navigate this process effectively. If you're unsure, consider seeking guidance from reputable platforms like uslegalforms.

St. 103, often referred to as the ST-103 form, serves as an exemption certificate for sales tax in Indiana. This document allows eligible buyers to avoid paying sales tax on specific purchases that qualify for exemption. It is crucial to have a clear understanding of the Indiana Fee Interest Workform to ensure proper handling of your exemptions. Failure to use the correct forms may lead to unnecessary tax costs.

The ST-103 form is used in Indiana to claim a sales tax exemption for certain purchases. It provides a declaration that the buyer is not responsible for sales tax on qualifying items. This form is important for businesses and individuals seeking to minimize their tax liabilities. Understanding the Indiana Fee Interest Workform and related tax documents can streamline your financial processes.

The interest rate on tax penalties varies based on the current state regulations outlined in the Indiana Fee Interest Workform. Typically, this rate is established to encourage timely tax payments and discourage delays. By understanding this interest rate, you can better manage your tax liabilities. Utilizing the right resources, such as uslegalforms, can provide clarity on how to calculate these penalties effectively.

The Indiana form 6WTH is a specific document used to report the Indiana Fee Interest Workform. This form is essential for taxpayers who need to calculate their fee interest on any outstanding tax obligations. By accurately completing this form, you can ensure compliance with Indiana tax laws. It's important to stay on top of your tax responsibilities to avoid unnecessary penalties.

To calculate your Indiana state income tax, start by totaling your gross income and then subtracting any allowable deductions. You can follow the tax rates outlined by the Indiana Department of Revenue or consult with a tax professional for personalized advice. Utilizing the Indiana Fee Interest Workform efficiently will ensure that you report your income accurately and comply with state tax regulations.

The amount you should withhold for Indiana state taxes depends on your income level and filing status. Generally, you can use the Indiana withholding tables provided on the Department of Revenue's website to determine the appropriate amount. Using the Indiana Fee Interest Workform will help you correctly calculate the necessary withholdings based on your specific situation.

To fill out an Indiana withholding form, start by entering your personal details, including your name and Social Security number. Then, indicate your filing status and any allowances you wish to claim. Ensure you follow the instructions carefully, as correct completion of the Indiana Fee Interest Workform is essential for accurate tax withholding and reporting.