Indiana Agreement to Reimburse for Insurance Premium

Description

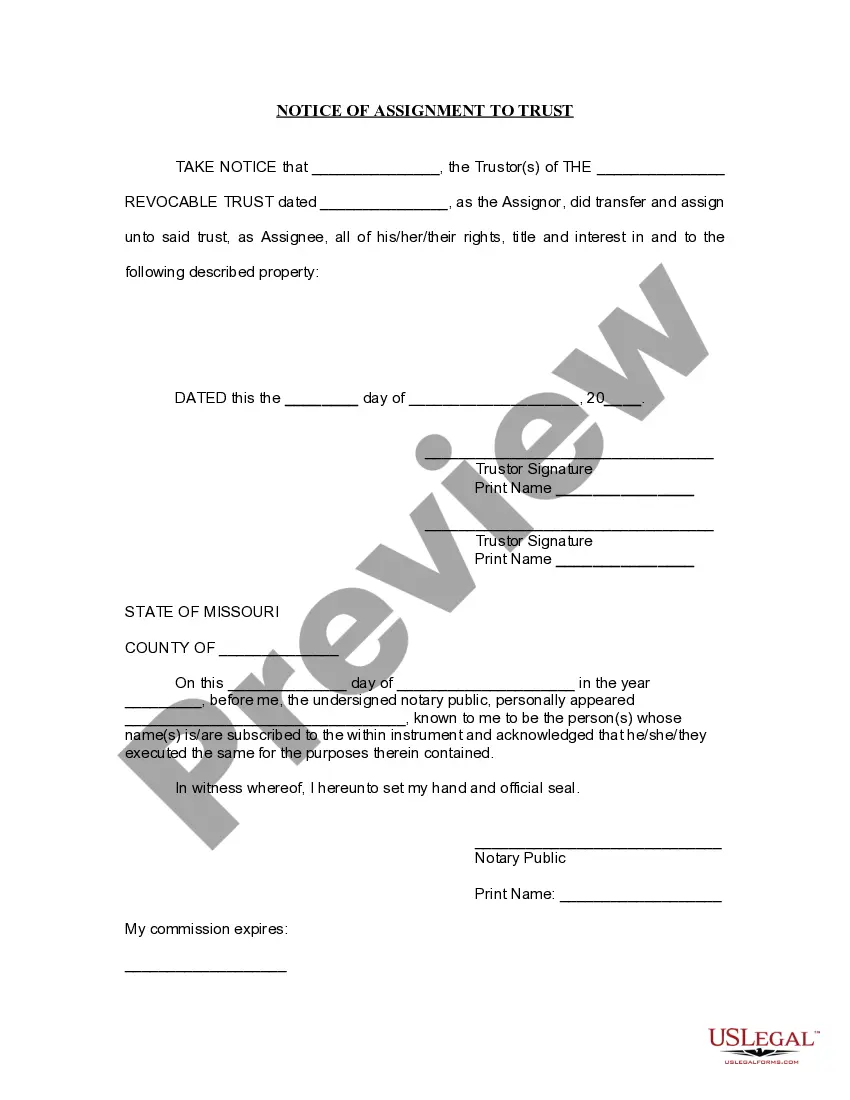

How to fill out Agreement To Reimburse For Insurance Premium?

US Legal Forms - one of the largest collections of legal templates in the country - provides an extensive selection of legal document styles that you can download or create.

By utilizing the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords.

You can access the latest versions of documents such as the Indiana Agreement to Reimburse for Insurance Premium in just minutes.

Read the form details to confirm that you have selected the correct form.

If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you already possess a subscription, sign in to acquire the Indiana Agreement to Reimburse for Insurance Premium from the US Legal Forms library.

- The Download button is visible on every form displayed.

- You can view all previously saved documents in the My documents section of your account.

- To get started with US Legal Forms for the first time, follow these simple instructions.

- Ensure that you have selected the appropriate form for your specific city/county.

- Click the Preview button to review the form’s content.

Form popularity

FAQ

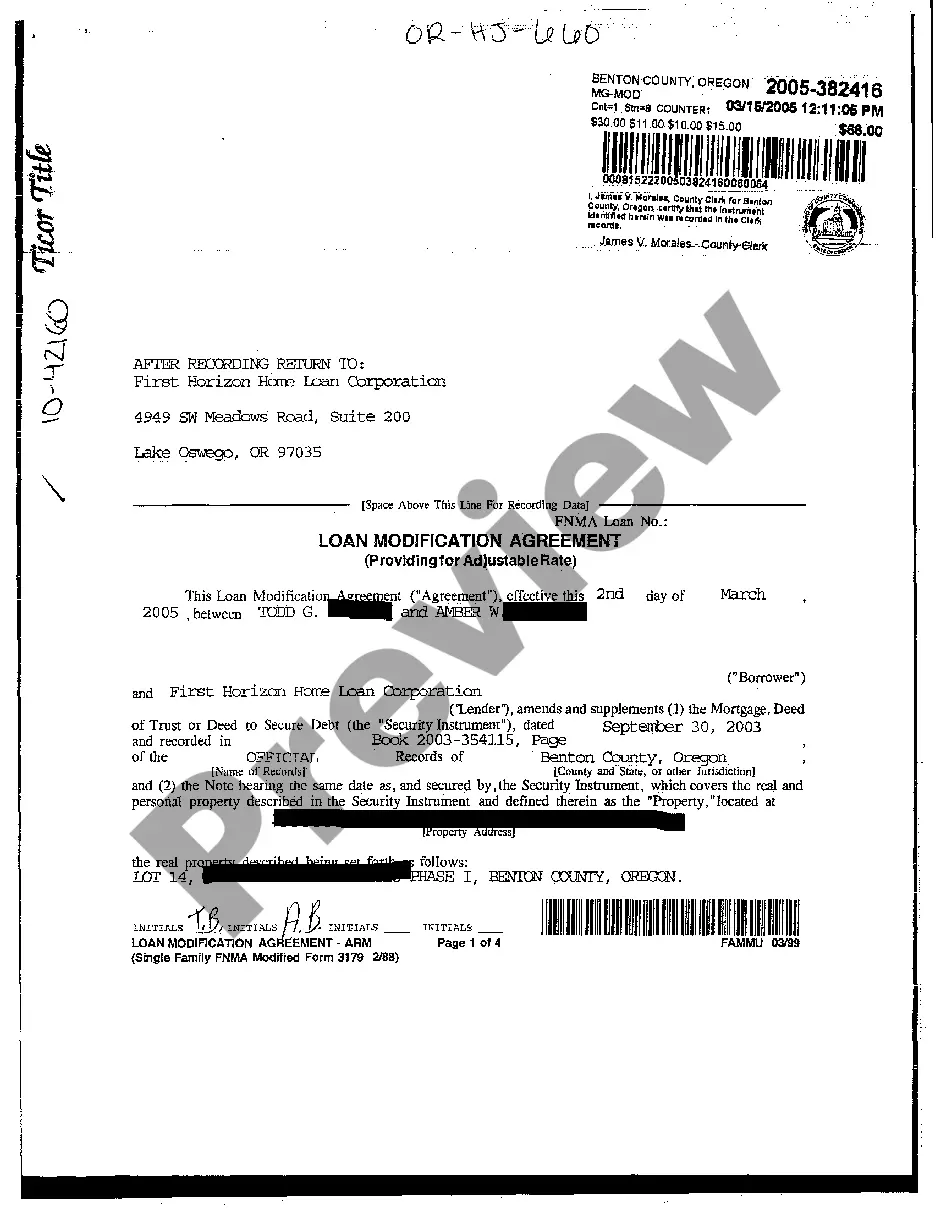

An insurance contract is a legally binding agreement between an insurer and the insured. This contract outlines the coverage details, terms, and conditions associated with the policy. Understanding the Indiana Agreement to Reimburse for Insurance Premium is important, as it specifies how reimbursements will be handled in the event of a claim.

Health insurance premiums are deductible on federal taxes, in some cases, as these monthly payments are classified as medical expenses. Generally, if you pay for medical insurance on your own, you can deduct the amount from your taxes.

To better understand these terms, think of it like owning a car. A premium is like your monthly car payment. You must make regular payments to keep your car, just as you must pay your premium to keep your health care plan active. A deductible is the amount you pay for coverage services before your health plan kicks in.

Your insurance premium and deductible have an inverse relationship. As one increases, the other decreases so a policy with a lower monthly premium will typically have a higher deductible, and a policy with a lower deductible will typically have a higher premium.

If you buy health insurance through the federal insurance marketplace or your state marketplace, any premiums you pay out of pocket are tax-deductible. If you are self-employed, you can deduct the amount you paid for health insurance and qualified long-term care insurance premiums directly from your income.

Your deductible exceeds the cost of the damages, so you'll have to pay it all out of pocket.

According to the insurers' financial reports reviewed by CFA and CEJ, between 2016 and 2019, auto insurers paid 67.4 cents of every premium dollar for claims. The remaining 32.6 cents plus investment income earned from holding policyholders' money covered insurer expenses and profit.

Deduction Available under Section 80D of the Income Tax ActUnder Section 80D, you are allowed to claim a tax deduction of up to Rs 25,000 per financial year on medical insurance premiums. This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children.

In order to keep your benefits active and the plan in force, you'll need to pay your premium on time every month. A deductible is a set amount you have to pay every year toward your medical bills before your insurance company starts paying. It varies by plan and some plans don't have a deductible.

After you pay your deductible, you usually pay only a copayment or coinsurance for covered services. Your insurance company pays the rest. Many plans pay for certain services, like a checkup or disease management programs, before you've met your deductible. Check your plan details.